Top Pick Tax consequences of transferring ownership of a life insurance policy Everything You Need To Know

Home » Health Insurance » Top Pick Tax consequences of transferring ownership of a life insurance policy Everything You Need To KnowYour Tax consequences of transferring ownership of a life insurance policy india are available in this site. Tax consequences of transferring ownership of a life insurance policy are a business that is most popular and liked by everyone today. You can Find and Download the Tax consequences of transferring ownership of a life insurance policy files here. Find and Download all royalty-free investment.

If you’re looking for tax consequences of transferring ownership of a life insurance policy pictures information connected with to the tax consequences of transferring ownership of a life insurance policy keyword, you have visit the ideal blog. Our site frequently provides you with suggestions for refferencing the highest quality video and picture content, please kindly hunt and locate more enlightening video content and images that match your interests.

Tax Consequences Of Transferring Ownership Of A Life Insurance Policy. So it’s important to understand what it means to be a policyowner and the various forms of policy ownership. In most cases, the transfer will trigger a taxable policy gain. If you transfer a life insurance policy to the beneficiary and it�s worth more than $15,000 in 2018 and 2019, then it�s considered a reportable. Essentially, if ownership of the policy is transferred within three years of your death, the proceeds revert to your taxable estate.

Life Insurance Proceeds and Taxes From thecommonexecutor.com

Life Insurance Proceeds and Taxes From thecommonexecutor.com

If you surrender a cash value life insurance policy, the only penalty is that you may have to pay a surrender fee. Transferring ownership of a life insurance policy can come with tax consequences. However, there are potential tax consequences which are important to keep in mind. This gain is fully taxable as ordinary income. In some cases, divorce courts have required one spouse to transfer a life insurance policy to the other as part of the property settlement while continuing to pay the premiums. Typically, when ownership of a life insurance policy changes, the original owner reports a fully taxable policy gain equal to the excess of the proceeds of disposition over the owner’s adjusted cost.

Once that policy is transferred, you no longer have control over the beneficiaries or coverage limit and the new owner is now responsible for the premium payments.

However, there are potential tax consequences which are important to keep in mind. Having a spouse own your policy: The general summary does not constitute legal or tax advice. If you wait too long, your intentions may be defeated. If you transfer the ownership of your life insurance policy and the cash value exceeds the annual exclusion limit, it’s considered a taxable gift. Generally, the proceeds of your life insurance policy are included in your taxable estate.

Source: mcdlawyers.net

Source: mcdlawyers.net

The existing owner realizes tax on the policy’s gain in the year of the transfer. Transferring ownership of a life insurance policy can come with tax consequences. Having a spouse own your policy: A portion of the money you receive. The resulting tax consequences depend on many factors, including whether the shareholder is an individual or a corporation, the tax attributes of the policy, whether the shareholder paid anything for the policy or if it was.

Source: dhjjfinancial.com

Source: dhjjfinancial.com

If you transfer a life insurance policy to the beneficiary and it�s worth more than $15,000 in 2018 and 2019, then it�s considered a reportable. You can remove them by transferring ownership of the policy, but there’s a catch: The resulting tax consequences depend on many factors, including whether the shareholder is an individual or a corporation, the tax attributes of the policy, whether the shareholder paid anything for the policy or if it was. There should be no income tax consequences as a result of this transfer. Here are some typical life insurance ownership changes and transfer situations involving life insurance:

Source: weqmra.com

Source: weqmra.com

The policy gain is equal to the proceeds of disposition minus the adjusted cost basis (acb) of the interest in the life insurance policy. A transfer from the insured to his/her children or to an irrevocable life insurance trust (ilit) for their benefit. Having a spouse own your policy: There should be no income tax consequences as a result of this transfer. Surrendering a policy ends the life insurance coverage.

Source: fdocuments.us

Source: fdocuments.us

Once that policy is transferred, you no longer have control over the beneficiaries or coverage limit and the new owner is now responsible for the premium payments. If you transfer the ownership of your life insurance policy and the cash value exceeds the annual exclusion limit, it’s considered a taxable gift. The resulting tax consequences depend on many factors, including whether the shareholder is an individual or a corporation, the tax attributes of the policy, whether the shareholder paid anything for the policy or if it was. Insurers can get around this obstacle by cancelling your current policy and. You can remove them by transferring ownership of the policy, but there’s a catch:

Source: slideshare.net

Source: slideshare.net

If you transfer a life insurance policy to the beneficiary and it�s worth more than $15,000 in 2018 and 2019, then it�s considered a reportable. If you transfer a life insurance policy to a beneficiary, tax authorities regard the transaction as a gift. If you transfer the ownership of your life insurance policy and the cash value exceeds the annual exclusion limit, it’s considered a taxable gift. A portion of the money you receive. Income and gift tax consequences of each transfer must be examined independently for each ownership transfer.

Source: mykeymaninsurance.com

Source: mykeymaninsurance.com

Surrendering a policy ends the life insurance coverage. Insurers can get around this obstacle by cancelling your current policy and. The policy gain is equal to the proceeds of disposition minus the adjusted cost basis (acb) of the interest in the life insurance policy. Income and gift tax consequences of each transfer must be examined independently for each ownership transfer. What to consider before transferring ownership.

![[INFOGRAPHIC] 2016 Canadian Federal Budget Analysis and [INFOGRAPHIC] 2016 Canadian Federal Budget Analysis and](https://safepacific.com/wp-content/uploads/2017/04/Safe-Pacific-Federal-Budget-622x1024.jpg) Source: safepacific.com

Source: safepacific.com

Tax in respect of a disposition. Once that policy is transferred, you no longer have control over the beneficiaries or coverage limit and the new owner is now responsible for the premium payments. A better plan may be to use an irrevocable life insurance trust to bifurcate the ownership of the policy so that it will not be included in your estate for estate tax purposes. If you transfer a life insurance policy to a beneficiary, tax authorities regard the transaction as a gift. A life insurance policy transfer may trigger a policy gain, which is taxable in the ha nds of the transferor.

Source: newyorkcityvoices.org

Source: newyorkcityvoices.org

If you transfer a life insurance policy to the beneficiary and it�s worth more than $15,000 in 2018 and 2019, then it�s considered a reportable. Transferring ownership of a life insurance policy can come with tax consequences. The life insurance company will deduct the surrender fee when it sends you the money. Check your policy to find out the fee, or ask your life insurance agent. If the new owner of the policy is required to pay ongoing premiums to maintain it, you can still gift them up to $14,000 to cover the cost without a penalty.

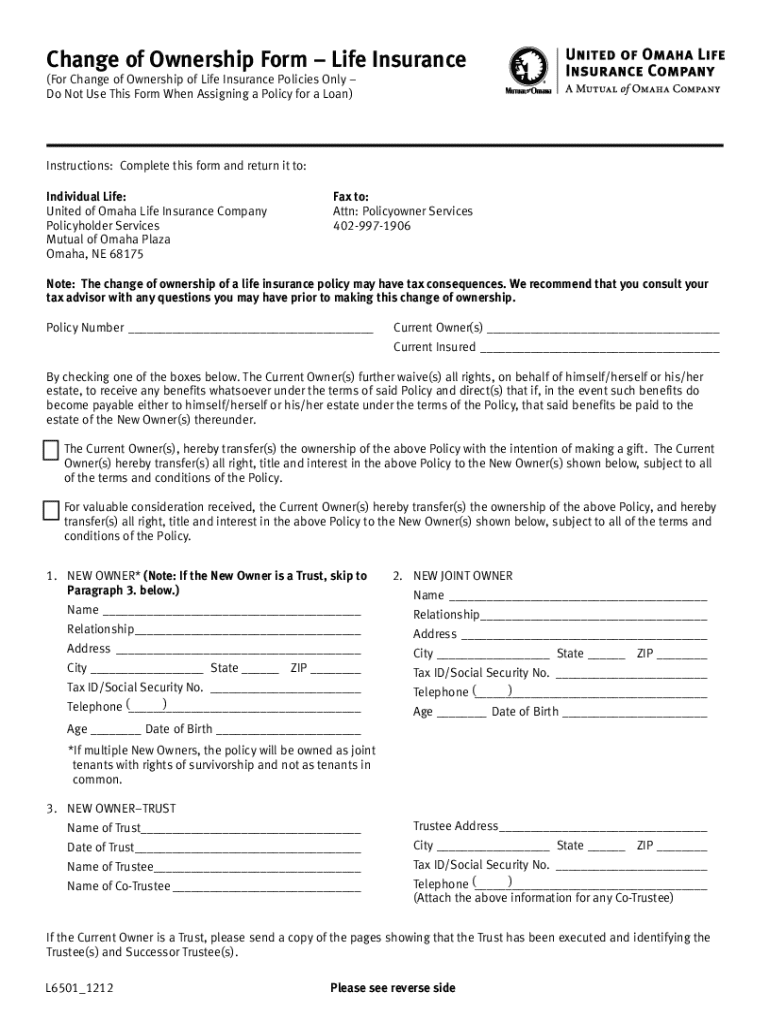

Source: pdffiller.com

Source: pdffiller.com

Surrendering a policy ends the life insurance coverage. Essentially, if ownership of the policy is transferred within three years of your death, the proceeds revert to your taxable estate. A better plan may be to use an irrevocable life insurance trust to bifurcate the ownership of the policy so that it will not be included in your estate for estate tax purposes. In some cases, divorce courts have required one spouse to transfer a life insurance policy to the other as part of the property settlement while continuing to pay the premiums. If you transfer a life insurance policy to the beneficiary and it�s worth more than $15,000 in 2018 and 2019, then it�s considered a reportable.

Source: signnow.com

Source: signnow.com

What are the tax consequences of transferring ownership of a life insurance policy? In some cases, divorce courts have required one spouse to transfer a life insurance policy to the other as part of the property settlement while continuing to pay the premiums. If you transfer a cash value life insurance policy to someone and it’s worth more than the exclusion limit, it’s considered a taxable gift. Once that policy is transferred, you no longer have control over the beneficiaries or coverage limit and the new owner is now responsible for the premium payments. A better plan may be to use an irrevocable life insurance trust to bifurcate the ownership of the policy so that it will not be included in your estate for estate tax purposes.

Source: mmkr.com

Source: mmkr.com

Generally, the proceeds of your life insurance policy are included in your taxable estate. The existing owner realizes tax on the policy’s gain in the year of the transfer. Generally, the proceeds of your life insurance policy are included in your taxable estate. Probably the most important tax trap is making a transfer for value of a life insurance policy. The way that you structure the ownership of your life insurance policy can have possible estate tax consequences.

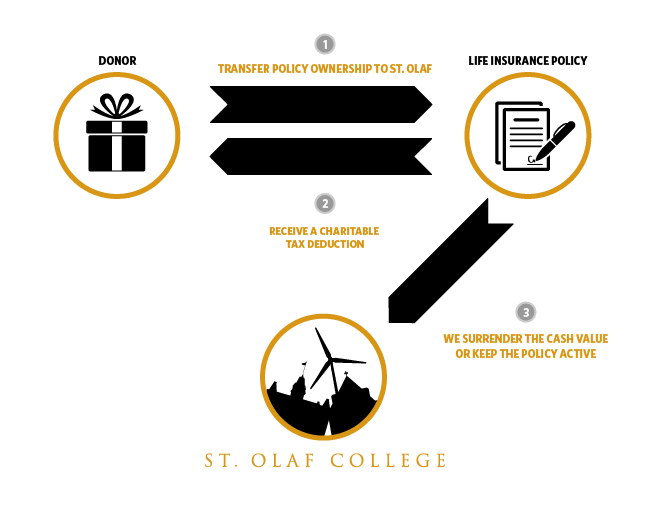

Source: wp.stolaf.edu

Source: wp.stolaf.edu

If you transfer the ownership of your life insurance policy and the cash value exceeds the annual exclusion limit, it’s considered a taxable gift. When a corporation transfers a life insurance policy to a shareholder, there are tax consequences to both the corporation and shareholder. Essentially, if ownership of the policy is transferred within three years of your death, the proceeds revert to your taxable estate. Under current gift tax rules, if you transfer a policy with a present value of more than $16,000 to another person, gift taxes will be assessed. The resulting tax consequences depend on many factors, including whether the shareholder is an individual or a corporation, the tax attributes of the policy, whether the shareholder paid anything for the policy or if it was.

Source: fdocuments.us

Source: fdocuments.us

When that happens, people may need to move a life insurance policy from one person or entity to another. Income and gift tax consequences of each transfer must be examined independently for each ownership transfer. Essentially, if ownership of the policy is transferred within three years of your death, the proceeds revert to your taxable estate. If the new owner of the policy is required to pay ongoing premiums to maintain it, you can still gift them up to $14,000 to cover the cost without a penalty. If you transfer a cash value life insurance policy to someone and it’s worth more than the exclusion limit, it’s considered a taxable gift.

Source: sapling.com

Source: sapling.com

Policy owners should consult with their own legal and tax advisors before transferring ownership of any policy. If you transfer a life insurance policy to a beneficiary, tax authorities regard the transaction as a gift. Check your policy to find out the fee, or ask your life insurance agent. Typically, when ownership of a life insurance policy changes, the original owner reports a fully taxable policy gain equal to the excess of the proceeds of disposition over the owner’s adjusted cost. If you wait too long, your intentions may be defeated.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

Since nearly half of all marriages today end in divorce, adverse tax consequences could result if one spouse owns life insurance on the other. This gain is fully taxable as ordinary income. If you transfer the ownership of your life insurance policy and the cash value exceeds the annual exclusion limit, it’s considered a taxable gift. If you transfer a life insurance policy to a beneficiary, tax authorities regard the transaction as a gift. In some cases, divorce courts have required one spouse to transfer a life insurance policy to the other as part of the property settlement while continuing to pay the premiums.

Source: weqmra.com

Source: weqmra.com

However, there are potential tax consequences which are important to keep in mind. There can be tax implications when transferring ownership of a life policy to someone who is not related to you. Income and gift tax consequences of each transfer must be examined independently for each ownership transfer. Under current gift tax rules, if you transfer a policy with a present value of more than $16,000 to another person, gift taxes will be assessed. Generally, the proceeds of your life insurance policy are included in your taxable estate.

Source: pdffiller.com

Source: pdffiller.com

A better plan may be to use an irrevocable life insurance trust to bifurcate the ownership of the policy so that it will not be included in your estate for estate tax purposes. Check your policy to find out the fee, or ask your life insurance agent. Surrendering a policy ends the life insurance coverage. Essentially, if ownership of the policy is transferred within three years of your death, the proceeds revert to your taxable estate. Here are some typical life insurance ownership changes and transfer situations involving life insurance:

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title tax consequences of transferring ownership of a life insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.