Up to Date Supplemental property insurance Review

Home » Motor Insurance » Up to Date Supplemental property insurance ReviewYour Supplemental property insurance premium are obtainable. Supplemental property insurance are a umbrella that is most popular and liked by everyone today. You can Get the Supplemental property insurance files here. Find and Download all royalty-free premium.

If you’re searching for supplemental property insurance pictures information connected with to the supplemental property insurance topic, you have pay a visit to the right blog. Our website always provides you with hints for viewing the maximum quality video and image content, please kindly search and locate more enlightening video content and images that match your interests.

Supplemental Property Insurance. You need to pay additional money aside from your regular premium, but you will be protected against. If a warehouse risk, please complete section 5. However, as set forth in section 45.02[4], such efforts are compensable if the property is in imminent danger of being damaged or destroyed, even though the property ultimately may not. But, if you do wish to do either of the two, you will be required to pay a supplemental property tax which will become a lien against your property as of the date of ownership change or the date of completion of new construction.

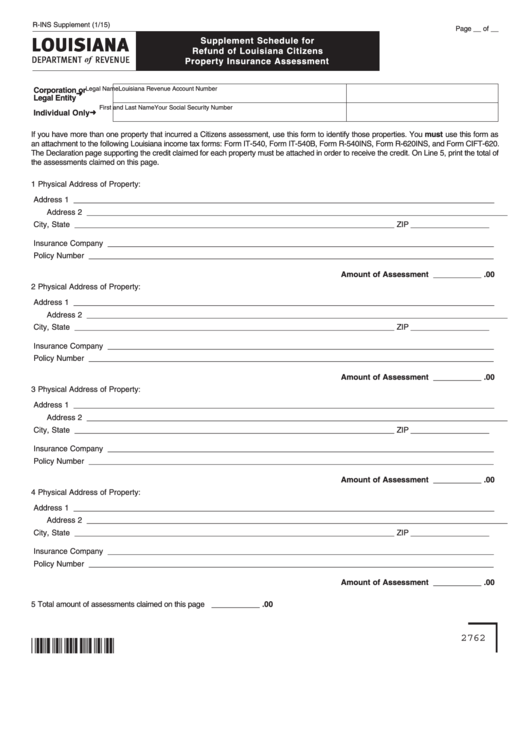

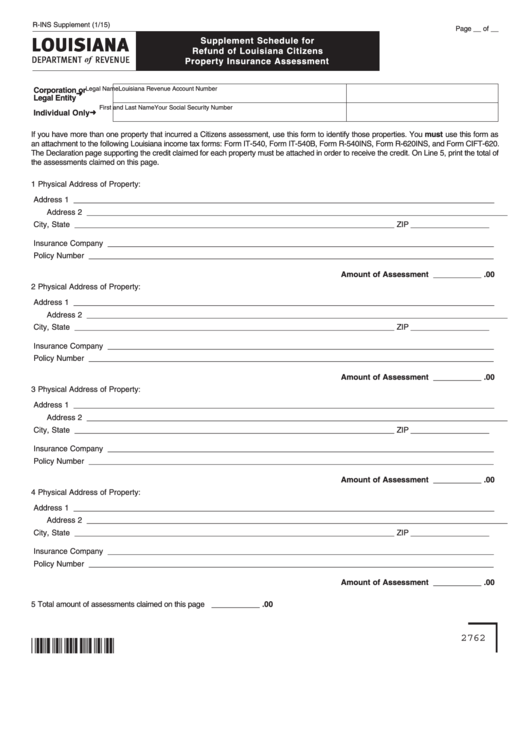

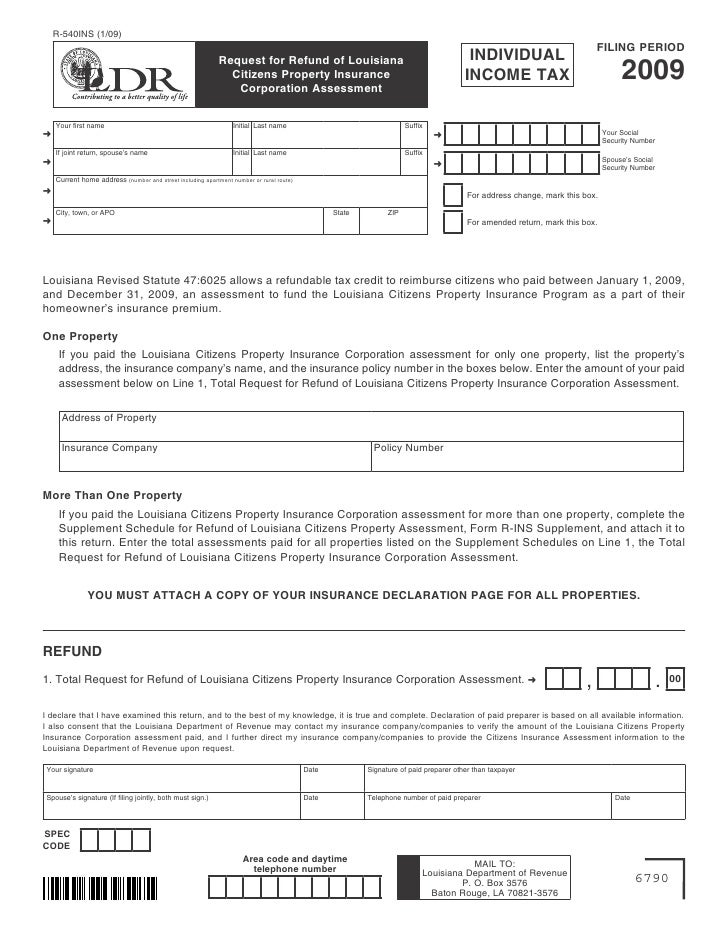

Fillable Supplement Schedule For Refund Of Louisiana From formsbank.com

Fillable Supplement Schedule For Refund Of Louisiana From formsbank.com

No additional deductible is assessed, since you already paid it once. The first thing you should do when you receive your supplemental property tax bill is contact your escrow company. Florida law states, “a claim, supplemental claim, or reopened claim under an insurance policy that provides property insurance, as defined in s.624.604 for loss or damage caused by the peril of windstorm or hurricane is barred unless notice of terms of the policy within three years after the hurricane first made landfall or the windstorm caused the covered damage.” An umbrella policy is an excellent way to supplement your homeowner’s insurance. If you have things like jewelry, antiques, electronics, or even a valuable baseball care collection, you need to make sure you’ll be compensated in the event of a loss. It may provide extra coverage.

If there is a reserve of funds these bills will be paid from your escrow account.

Sigma hotel motel property supplement. Supplemental policy insured properties means, collectively, the properties commonly known as store 207, store 247, store 188, store 243, store 122 and store 231 as of. With a supplemental property insurance claim, an insured has to actually undertake repairs. An umbrella policy is an excellent way to supplement your homeowner’s insurance. The fha loan underwriting and transmittal. Right now, your policy may offer you.

Source: homeownersinsurancecover.net

Source: homeownersinsurancecover.net

Supplemental policy insured properties means, collectively, the properties commonly known as store 207, store 247, store 188, store 243, store 122 and store 231 as of. Florida law states, “a claim, supplemental claim, or reopened claim under an insurance policy that provides property insurance, as defined in s.624.604 for loss or damage caused by the peril of windstorm or hurricane is barred unless notice of terms of the policy within three years after the hurricane first made landfall or the windstorm caused the covered damage.” Sewer backup coverage while damage to a sewer line from an unexpected event (such as an explosion or damage from a fallen tree) may be covered by your homeowners insurance, other causes considered chronic or preventable events, such as. Real estate development property supplemental application (to be submitted with acord general liability application) important note: The property sells for $250,000.00.

Source: medicareonvideo.com

Source: medicareonvideo.com

The fha loan underwriting and transmittal. But, if you do wish to do either of the two, you will be required to pay a supplemental property tax which will become a lien against your property as of the date of ownership change or the date of completion of new construction. Supplemental policies offer coverage that extends beyond what is provided in a standard homeowners policy. Call us for free consultation. 5.claim information / all property & boiler and machinery _____ _____ _____ _____ 6.notice concerning personal information by purchasing insurance from beazley canada limited, a customer provides beazley with his or her consent to the collection, use and disclosure of personal inform ation, including that previously collected, for the following.

Source: slideshare.net

Source: slideshare.net

Real estate development property supplemental application (to be submitted with acord general liability application) important note: If a residential risk, please complete section 4. Provides a single limit of liability. You need to pay additional money aside from your regular premium, but you will be protected against. Sewer backup coverage while damage to a sewer line from an unexpected event (such as an explosion or damage from a fallen tree) may be covered by your homeowners insurance, other causes considered chronic or preventable events, such as.

Source: mymedigapplans.com

Source: mymedigapplans.com

Section 1 and the fraud statement must be completed on all submissions. The property sells for $250,000.00. 1 it all depends on the type of supplemental health plan you choose. No additional deductible is assessed, since you already paid it once. If a shopping center risk, please complete section 3.

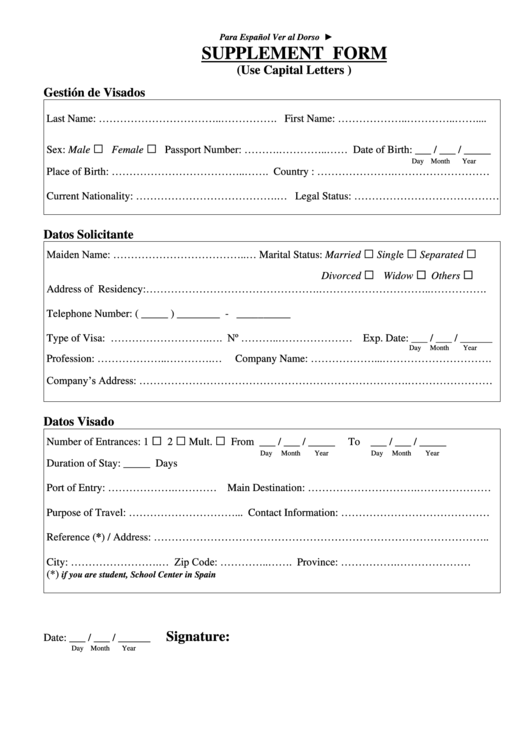

Source: formsbank.com

Source: formsbank.com

Call us for free consultation. Homeowners, renters or business insurance claims can find a need for a supplemental claim for some of the same reasons found in car insurance claims. Supplemental insurance is the best way to cover your expensive possessions. If a residential risk, please complete section 4. Section 1 and the fraud statement must be completed on all submissions.

Source: slideshare.net

Source: slideshare.net

With a supplemental property insurance claim, an insured has to actually undertake repairs. If a warehouse risk, please complete section 5. A supplemental assessment is levied for $50,000.00, bringing the tax rate in line with the current market value. A supplemental home insurance policy is coverage that goes above and beyond what your standard home insurance coverage provides. Real estate development property supplemental application (to be submitted with acord general liability application) important note:

Source: slideshare.net

Source: slideshare.net

Supplemental claims are becoming more common, especially on large projects where additional loss and damage may be discovered while completing the repairs or replacement. With a supplemental property insurance claim, an insured has to actually undertake repairs. As previously announced, if a value is sent to the new field “borrower 1 proposed supplemental property insurance” (field 131691), which prints in the “proposed monthly payment for the property” section of the redesigned 1008 and redesigned 1003, it will be included in the “other” monthly expense of the older 1003. A supplemental assessment is levied for $50,000.00, bringing the tax rate in line with the current market value. Right now, your policy may offer you.

Source: abiteofculture.com

Source: abiteofculture.com

Supplemental health insurance is a plan that covers costs above and beyond what standard health policies will pay. Simply document the damages and their cause and send the supplement to the insurance company. Real estate development property supplemental application (to be submitted with acord general liability application) important note: If the insured is acting as a general contractor or performing infrastructure & construction activities, then colony’s general casualty contractors application is the appropriate supplement to complete. Sewer backup coverage while damage to a sewer line from an unexpected event (such as an explosion or damage from a fallen tree) may be covered by your homeowners insurance, other causes considered chronic or preventable events, such as.

Source: ihsinsurance.net

Source: ihsinsurance.net

If you have things like jewelry, antiques, electronics, or even a valuable baseball care collection, you need to make sure you’ll be compensated in the event of a loss. Supplemental policy insured properties means, collectively, the properties commonly known as store 207, store 247, store 188, store 243, store 122 and store 231 as of. It may provide extra coverage. Earthquake because of the nature of earthquakes, coverage for earthquake damage is not typically standard in all homeowners insurance policies. But what happens when the insurance company places conditions or limitations not contained within the policy upon the submission of a supplemental claim for additional or.

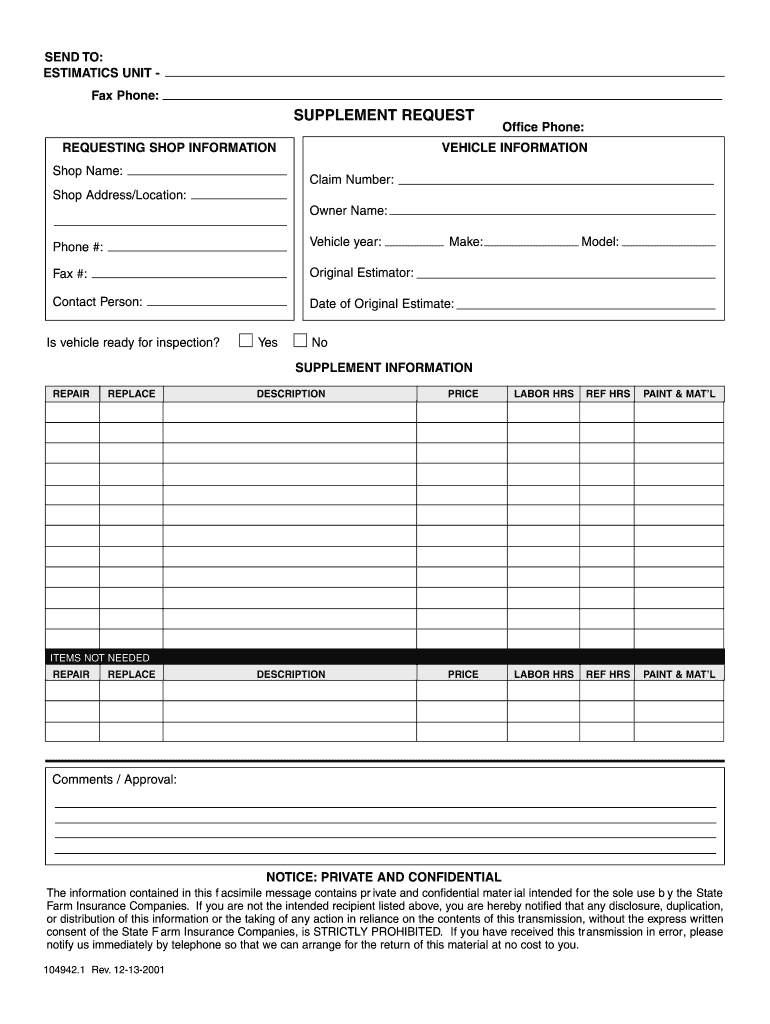

Source: formsbank.com

Source: formsbank.com

Many homeowners are unaware that home insurance provides limited coverage for valuable personal property and provides little or no coverage for loss caused by floods, water damage or earthquakes. If you have things like jewelry, antiques, electronics, or even a valuable baseball care collection, you need to make sure you’ll be compensated in the event of a loss. Earthquake because of the nature of earthquakes, coverage for earthquake damage is not typically standard in all homeowners insurance policies. With a supplemental property insurance claim, an insured has to actually undertake repairs. Supplemental insurance is the best way to cover your expensive possessions.

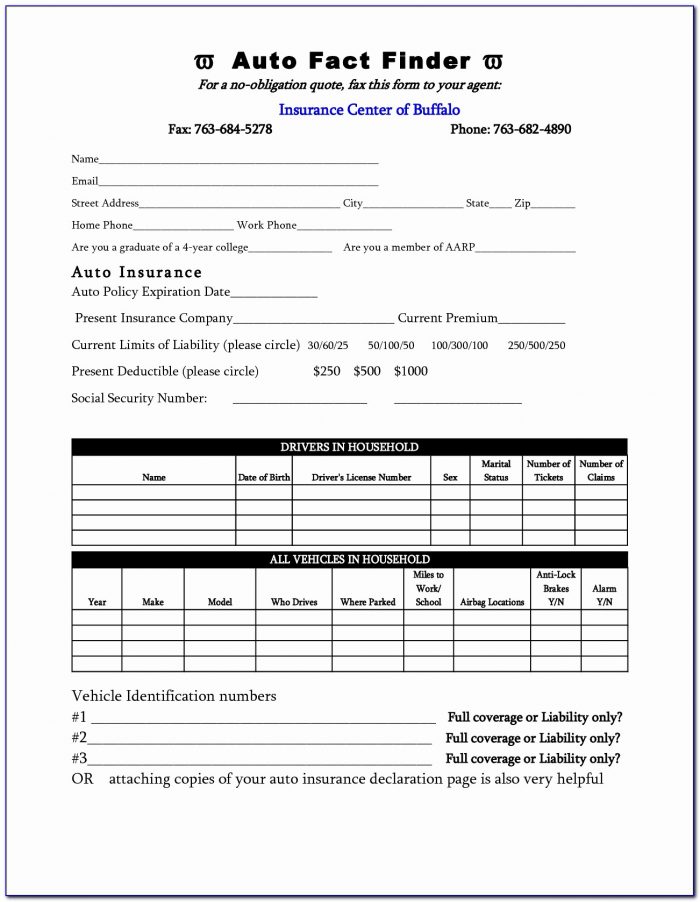

Source: sungateinsurance.com

Source: sungateinsurance.com

It may provide extra coverage. A supplemental assessment is levied for $50,000.00, bringing the tax rate in line with the current market value. A supplemental home insurance policy is coverage that goes above and beyond what your standard home insurance coverage provides. Section 1 and the fraud statement must be completed on all submissions. Supplemental policies offer coverage that extends beyond what is provided in a standard homeowners policy.

Source: vdocuments.mx

Source: vdocuments.mx

A supplemental home insurance policy is coverage that goes above and beyond what your standard home insurance coverage provides. The property sells for $250,000.00. Simply document the damages and their cause and send the supplement to the insurance company. If the insured is acting as a general contractor or performing infrastructure & construction activities, then colony’s general casualty contractors application is the appropriate supplement to complete. Supplemental policies offer coverage that extends beyond what is provided in a standard homeowners policy.

Source: iloveretirement.com

Source: iloveretirement.com

1 it all depends on the type of supplemental health plan you choose. Homeowners, renters or business insurance claims can find a need for a supplemental claim for some of the same reasons found in car insurance claims. It may even pay for costs not covered by a traditional health plan, such as coinsurance, copays, and deductibles. Simply document the damages and their cause and send the supplement to the insurance company. Examples of new construction might include room additions, pools, spas, and patio covers.

Source: signnow.com

Source: signnow.com

Supplemental health insurance is a plan that covers costs above and beyond what standard health policies will pay. Supplemental claims are becoming more common, especially on large projects where additional loss and damage may be discovered while completing the repairs or replacement. 1 it all depends on the type of supplemental health plan you choose. Many homeowners are unaware that home insurance provides limited coverage for valuable personal property and provides little or no coverage for loss caused by floods, water damage or earthquakes. Provides a single limit of liability.

Source: viralcovert.com

Source: viralcovert.com

Provides a single limit of liability. A personal property supplemental policy can cover the full value of items that are lost from theft, vandalism, damage, or disappearance. A supplemental assessment is levied for $50,000.00, bringing the tax rate in line with the current market value. But, if you do wish to do either of the two, you will be required to pay a supplemental property tax which will become a lien against your property as of the date of ownership change or the date of completion of new construction. Supplemental health insurance is a plan that covers costs above and beyond what standard health policies will pay.

Source: kofpc.org

Source: kofpc.org

Earthquake because of the nature of earthquakes, coverage for earthquake damage is not typically standard in all homeowners insurance policies. Unfortunately, if there is not a reserve of funds the homeowner will be directly responsible for the supplemental property taxes. Real estate development property supplemental application (to be submitted with acord general liability application) important note: If you don�t plan on buying new property or undertaking new construction, this new tax will not affect you at all. But what happens when the insurance company places conditions or limitations not contained within the policy upon the submission of a supplemental claim for additional or.

Source: vdocuments.mx

Source: vdocuments.mx

Supplemental policy insured properties means, collectively, the properties commonly known as store 207, store 247, store 188, store 243, store 122 and store 231 as of. Unfortunately, if there is not a reserve of funds the homeowner will be directly responsible for the supplemental property taxes. Section 1 and the fraud statement must be completed on all submissions. If a warehouse risk, please complete section 5. Right now, your policy may offer you.

Source: meritagemed.com

Source: meritagemed.com

Many homeowners are unaware that home insurance provides limited coverage for valuable personal property and provides little or no coverage for loss caused by floods, water damage or earthquakes. If the insured is acting as a general contractor or performing infrastructure & construction activities, then colony’s general casualty contractors application is the appropriate supplement to complete. Supplemental insurance is the best way to cover your expensive possessions. As previously announced, if a value is sent to the new field “borrower 1 proposed supplemental property insurance” (field 131691), which prints in the “proposed monthly payment for the property” section of the redesigned 1008 and redesigned 1003, it will be included in the “other” monthly expense of the older 1003. You need to pay additional money aside from your regular premium, but you will be protected against.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title supplemental property insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.