Most Viewed Overfunded life insurance Review

Home » Motor Insurance » Most Viewed Overfunded life insurance ReviewYour Overfunded life insurance policy are available. Overfunded life insurance are a coverage that is most popular and liked by everyone now. You can News the Overfunded life insurance files here. News all royalty-free policy.

If you’re looking for overfunded life insurance pictures information related to the overfunded life insurance interest, you have pay a visit to the ideal blog. Our site frequently gives you suggestions for seeing the highest quality video and image content, please kindly surf and locate more informative video content and images that fit your interests.

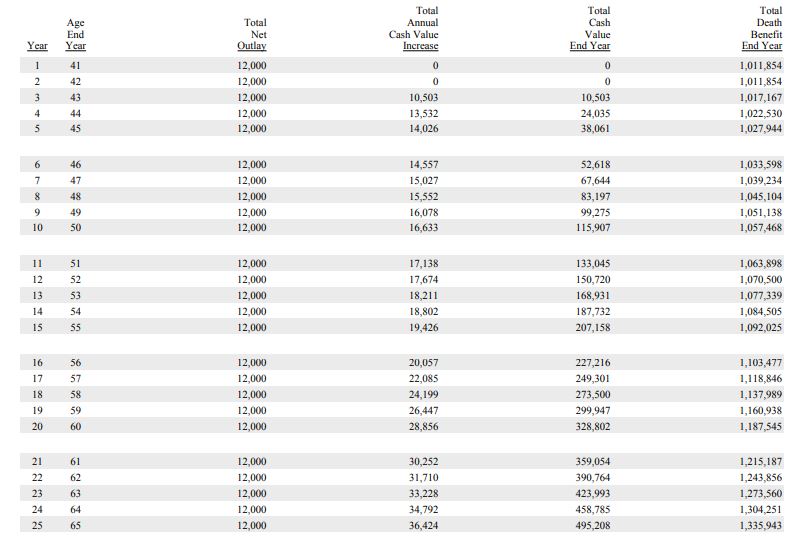

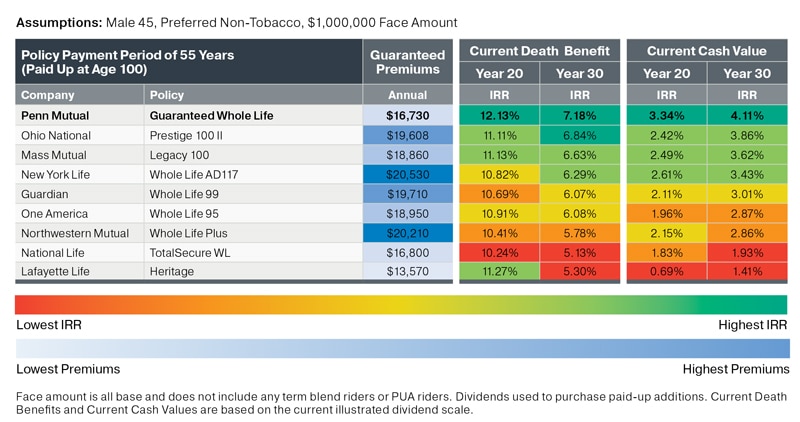

Overfunded Life Insurance. Overfunded life insurance refers to the act of paying more into your life insurance policy than is required. What is overfunded life insurance? The purpose of this article is to explain why universal life insurance (ul), and specifically indexed universal life (iul), has. The pros of overfunding a life insurance policy.

Overfunded Life Insurance Calculator Digitalflashnyc From huntergraphy.com

Overfunded Life Insurance Calculator Digitalflashnyc From huntergraphy.com

To put it simply, an overfunded life insurance (oli) is insurance that the holder pays a higher amount for than if they had regular insurance, and some even fund it to the maximum. Overfunded life insurance, or oli, is essentially a permanent life insurance policy, such as a whole or universal life plan, in which a policyholder has paid higher premiums than what is necessary to maintain the death benefit. Some might further define it as a life insurance policy where you fund it to the maximum (i.e., without creating a modified endowment contract ) amount you can. What are overfunded life insurance policies? Because this excess money isn’t needed to fund the death benefit or cover administrative costs, it immediately adds. This cash value grows predictably and safely.

Overfunded life insurance refers to the act of paying more into your life insurance policy than is required.

What is overfunded life insurance? Permanent life insurance policies, such as whole life insurance or universal life insurance, have a cash value component. An overfunded policy will generate cash value faster, and can possibly increase the death benefit or dividends. Overfunded life insurance can help you quickly grow wealth, especially when utilized with whole life insurance as part of a wealth maximization account™. Overfunded life insurance offers many benefits, such as guaranteed death and level premiums. The pros of overfunding a life insurance policy.

Source: weqmra.com

Source: weqmra.com

Overfunded life insurance offers many benefits, such as guaranteed death and level premiums. What are overfunded life insurance policies? While the primary purpose of life insurance is providing a death benefit to the policyholder’s beneficiaries, paying more premium than necessary to drive up cash value can transform a life. I was recently on a call with one of my agents (and friends) in california helping him as he discussed iul with one of his clients. 2 based on current federal income tax law.

Source: kenyachambermines.com

Source: kenyachambermines.com

Overfunded life insurance isn�t necessarily anything special. What is overfunded life insurance? Here are some of the most important ones: For clients that have the means to invest more and who are focused on mitigating taxes in retirement, overfunded life insurance offers a valuable third option. Overfunded life insurance is, quite simply, when you pay more into a policy than is required.

Source: shirdihotelsaisahavas.com

Source: shirdihotelsaisahavas.com

Overfunded life insurance isn�t necessarily anything special. If you pass away, the. Overfunded life insurance is a policy that maximizes cash value and minimizes death benefits. Otherwise, you will be “overpaying” for the living benefit (cash value), and your death benefit would be smaller than it should. The notion of putting more premium into a life insurance policy than is necessary seems very counterintuitive to consumers.

Source: weqmra.com

Source: weqmra.com

For clients that have the means to invest more and who are focused on mitigating taxes in retirement, overfunded life insurance offers a valuable third option. You typically need to pay a certain premium each year or each month to ensure. 2 based on current federal income tax law. Also known as a lirp life insurance retirement plan , these oli policies are designed to offer maximum early high cash value along with the asset protection and tax benefits of life. Here are some of the most important ones:

Source: cladasia.com

Source: cladasia.com

The best way to know that your policy design is funded right to the minimum. Permanent life insurance policies, such as whole life insurance or universal life insurance, have a cash value component. What is overfunded life insurance? The notion of putting more premium into a life insurance policy than is necessary seems very counterintuitive to consumers. Overfunded life insurance refers to the act of paying more into your life insurance policy than is required.

Source: insuranceandestates.com

Source: insuranceandestates.com

This cash value grows predictably and safely. Before you purchase overfunded life insurance The purpose of this article is to explain why universal life insurance (ul), and specifically indexed universal life (iul), has. Permanent policies like whole life insurance or universal life insurance have cash value attached, so by overfunding, you contribute more to the cash value. Most life insurance policies require a specific premium monthly, quarterly, or annually to keep the policy active.

Source: weqmra.com

Source: weqmra.com

2 based on current federal income tax law. In this article, we’ll explain what overfunded life insurance is and how it works, why overfunded life insurance is used by the wealthy (and large corporations), and how to use your own overfunded life insurance policy for. The best way to know that your policy design is funded right to the minimum. Before you purchase overfunded life insurance An overfunded policy will generate cash value faster, and can possibly increase the death benefit or dividends.

Source: cladasia.com

Source: cladasia.com

The pros of overfunding a life insurance policy. In this article, we’ll explain what overfunded life insurance is and how it works, why overfunded life insurance is used by the wealthy (and large corporations), and how to use your own overfunded life insurance policy for. The purpose of this article is to explain why universal life insurance (ul), and specifically indexed universal life (iul), has. The pros of overfunding a life insurance policy. The benefits of overfunding a life insurance policy for supplemental retirement savings are many of the same benefits touted for life insurance policies in general:

Source: mbkinc.co

Source: mbkinc.co

If the policy is classified as a modified endowment contract Overfunded life insurance is a policy that maximizes cash value and minimizes death benefits. Allianz care is the leading provider of health and wellbeing insurance internationally. This cash value grows predictably and safely. Overfunded life insurance [15 pros and cons] updated april 19, 2021 in this article, we’re going to discuss a strategy whereby someone can take advantage of overfunding their cash value whole life insurance policy for the purpose of then using this cash accumulation to grow and preserve wealth.

Source: gantins.com

Source: gantins.com

What is overfunded life insurance? Here is a quick story on this topic. Because this excess money isn’t needed to fund the death benefit or cover administrative costs, it immediately adds. Most life insurance policies require a specific premium monthly, quarterly, or annually to keep the policy active. Permanent policies like whole life insurance or universal life insurance have cash value attached, so by overfunding, you contribute more to the cash value.

Source: kenyachambermines.com

Source: kenyachambermines.com

Overfunded life insurance is when you pay more into a policy than is required. For clients that have the means to invest more and who are focused on mitigating taxes in retirement, overfunded life insurance offers a valuable third option. The benefits of overfunding a life insurance policy for supplemental retirement savings are many of the same benefits touted for life insurance policies in general: There are a couple of reasons and benefits to this procedure, as we’ll explain later in the article. 1 premiums paid into a life insurance policy may be limited by the testing associated with qualification of a life insurance policy for tax purposes.

Source: shirdihotelsaisahavas.com

Source: shirdihotelsaisahavas.com

You typically need to pay a certain premium each year or each month to ensure. Before you get into a strategy like the and asset you need to be aware of the cons of over funding life insurance. Because this excess money isn’t needed to fund the death benefit or cover administrative costs, it immediately adds. If the policy is classified as a modified endowment contract Allianz care is the leading provider of health and wellbeing insurance internationally.

Source: shirdihotelsaisahavas.com

Source: shirdihotelsaisahavas.com

Overfunded life insurance refers to the act of paying more into your life insurance policy than is required. What is overfunded life insurance? 1 premiums paid into a life insurance policy may be limited by the testing associated with qualification of a life insurance policy for tax purposes. An overfunded life insurance policy is a whole or universal life insurance policy (or variation of those, such as indexed universal life) in which more premium is paid in than required to secure the death benefit. In this article, we’ll explain what overfunded life insurance is and how it works, why overfunded life insurance is used by the wealthy (and large corporations), and how to use your own overfunded life insurance policy for.

Source: huntergraphy.com

Source: huntergraphy.com

Overfunded life insurance is when you pay more into a policy than is required. Overfunded life insurance refers to the act of paying more into your life insurance policy than is required. Otherwise, you will be “overpaying” for the living benefit (cash value), and your death benefit would be smaller than it should. While the primary purpose of life insurance is providing a death benefit to the policyholder’s beneficiaries, paying more premium than necessary to drive up cash value can transform a life. The cons of overfunded life insurance.

Source: insurancenewsnetmagazine.com

Source: insurancenewsnetmagazine.com

Each year and each month you will need to pay a certain premium to ensure the policy stays in. The cons of overfunded life insurance. The idea is to build cash value quickly that you can access for any reason during your lifetime. The benefits of overfunding a life insurance policy for supplemental retirement savings are many of the same benefits touted for life insurance policies in general: Because this excess money isn’t needed to fund the death benefit or cover administrative costs, it immediately adds.

Source: weqmra.com

Source: weqmra.com

Most life insurance policies require a specific premium monthly, quarterly, or annually to keep the policy active. The benefits of overfunding a life insurance policy for supplemental retirement savings are many of the same benefits touted for life insurance policies in general: Assumes the use of withdrawals to basis and/or policy loans. Because this excess money isn’t needed to fund the death benefit or cover administrative costs, it immediately adds. Here are some of the most important ones:

Source: oneweekfriends-stage.com

Source: oneweekfriends-stage.com

Each year and each month you will need to pay a certain premium to ensure the policy stays in. And almost all permanent life insurance policies have a cash value element to them. So, by overfunding your policy, you contribute more to the cash value. Most life insurance policies require a specific premium monthly, quarterly, or annually to keep the policy active. Here are some of the most important ones:

Source: weqmra.com

Source: weqmra.com

A level cost of insurance universal life insurance policy can also be overfunded. Overfunded life insurance refers to the act of paying more into your life insurance policy than is required. In this article, we’ll explain what overfunded life insurance is and how it works, why overfunded life insurance is used by the wealthy (and large corporations), and how to use your own overfunded life insurance policy for. The benefits of overfunding a life insurance policy for supplemental retirement savings are many of the same benefits touted for life insurance policies in general: If you pass away, the.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title overfunded life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.