Current Max funded tax advantaged insurance You Must Know

Home » Motor Insurance » Current Max funded tax advantaged insurance You Must KnowYour Max funded tax advantaged insurance logo are ready. Max funded tax advantaged insurance are a health that is most popular and liked by everyone today. You can News the Max funded tax advantaged insurance files here. Find and Download all free group.

If you’re looking for max funded tax advantaged insurance images information linked to the max funded tax advantaged insurance keyword, you have pay a visit to the ideal site. Our website frequently provides you with hints for refferencing the maximum quality video and image content, please kindly surf and locate more informative video content and images that match your interests.

Max Funded Tax Advantaged Insurance. The maximum amount workers can contribute to a 401(k) for 2019 is $19,000 if they�re younger than age 50. The maximum limit may depend on the death. As you’ve probably heard, i call it the laser fund. What is a maximum funded tax advantage life insurance?

Maximum Funded Tax Advantaged (MFTA) Life Insurance What From personalfinance.today

Maximum Funded Tax Advantaged (MFTA) Life Insurance What From personalfinance.today

That�s a $500 increase from 2018. What is a maximum funded tax advantage life insurance? Preferred maximum funded tax advantaged life insurance contracts free look period for life insurance in ca. I�ve found the description of this cash value universal life insurance (indexed or fixed) very confusing. Through the magic of max funded indexed universal life insurance, you can show your clients how they can grow retirement savings tax. It may sound simple, but most insurance agent simply haven’t or just plain won’t take the time to educate themselves on how to take this approach.

That�s a $500 increase from 2018.

If playback doesn�t begin shortly, try restarting your device. The maximum amount workers can contribute to a 401(k) for 2019 is $19,000 if they�re younger than age 50. It can be funded with a number of ways, the original being annuities designed to that legislation but can be bought without connection to tax deductibility. How much does a max funded iul insurance policy cost? I have a hunch that “maximum funded” means a single premium whole life policy, or a universal life policy that is tied into investments. The advantage comes from not having to pay taxes on any of your investment earnings.

Source: wealthfit.com

Source: wealthfit.com

That�s a $500 increase from 2018. Has taken the time to dig deep to educate. It may sound simple, but most insurance agent simply haven’t or just plain won’t take the time to educate themselves on how to take this approach. One advantage of permanent life insurance over roth accounts has to do with contribution limits. That�s a $500 increase from 2018.

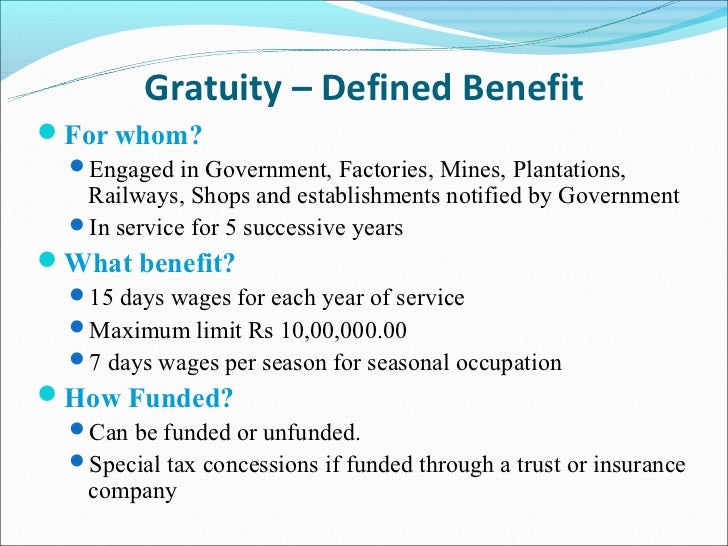

Source: expertsbazaar.com

Source: expertsbazaar.com

That�s a $500 increase from 2018. This can potentially increase tax liabilities if, as many people believe, taxes go up in the future. If playback doesn�t begin shortly, try restarting your device. Has taken the time to dig deep to educate. I�ve found the description of this cash value universal life insurance (indexed or fixed) very confusing.

Source: seniorslifeinsurancedookuni.blogspot.com

Source: seniorslifeinsurancedookuni.blogspot.com

Uses with all of our strategies. Has taken the time to dig deep to educate. If you go over that maximum limit, you risk having a modified endowment contract (mec), which could lead to losing the favorable tax treatment you otherwise receive with a cash value life insurance policy. I have a hunch that “maximum funded” means a single premium whole life policy, or a universal life policy that is tied into investments. When it comes to insurance, it pays to look at the tax return, because the monthly contributions for household contents, liability, life insurance the like can quickly turn out to be very high.

Source: vizionarywealth.com

Source: vizionarywealth.com

This can potentially increase tax liabilities if, as many people believe, taxes go up in the future. When it comes to insurance, it pays to look at the tax return, because the monthly contributions for household contents, liability, life insurance the like can quickly turn out to be very high. Since we are currently in the 37% tax bracket, this will save us $17,020 in income tax in 2020 (0.37 x 46,000). As you’ve probably heard, i call it the laser fund. In 40 plus years of working with some of the nations wealthiest, doug noticed some concerning symptoms.

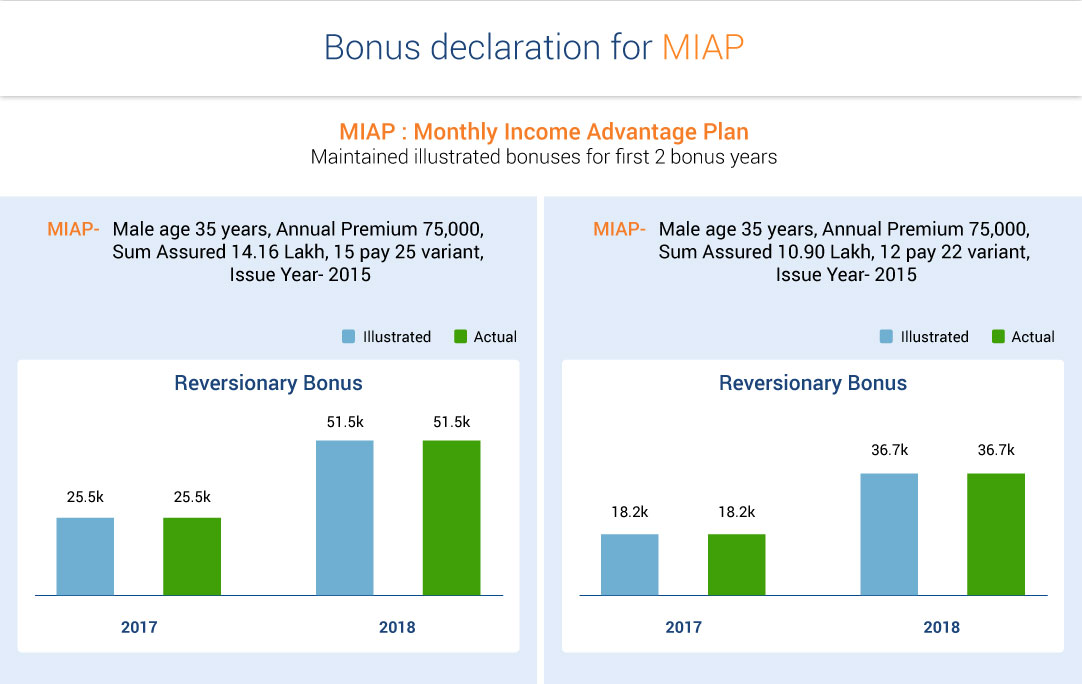

Source: maxlifeinsurance.com

Source: maxlifeinsurance.com

The maximum limit may depend on the death. This can potentially increase tax liabilities if, as many people believe, taxes go up in the future. When it comes to insurance, it pays to look at the tax return, because the monthly contributions for household contents, liability, life insurance the like can quickly turn out to be very high. It may sound simple, but most insurance agent simply haven’t or just plain won’t take the time to educate themselves on how to take this approach. I have a hunch that “maximum funded” means a single premium whole life policy, or a universal life policy that is tied into investments.

Source: maxlifeinsurance.com

Source: maxlifeinsurance.com

The maximum limit may depend on the death. Uses with all of our strategies. Has taken the time to dig deep to educate. That�s a $500 increase from 2018. I�ve found the description of this cash value universal life insurance (indexed or fixed) very confusing.

Source: hoganhansen.com

Source: hoganhansen.com

That�s a $500 increase from 2018. That�s a $500 increase from 2018. Uses with all of our strategies. If you go over that maximum limit, you risk having a modified endowment contract (mec), which could lead to losing the favorable tax treatment you otherwise receive with a cash value life insurance policy. This means that these contributions allow us to decrease our taxable income by $46,000.

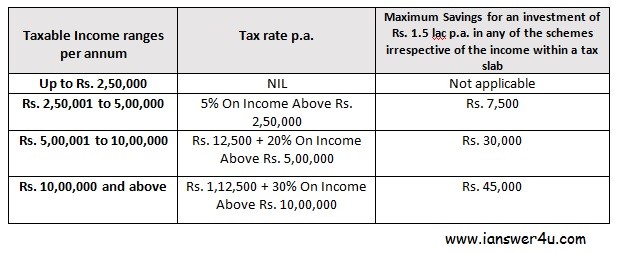

Source: ianswer4u.com

Source: ianswer4u.com

Preferred maximum funded tax advantaged life insurance contracts free look period for life insurance in ca. How much does a max funded iul insurance policy cost? That said, there is still a limit to how much you can pay into a life insurance policy before you assume tax liability. One advantage of permanent life insurance over roth accounts has to do with contribution limits. It can be funded with a number of ways, the original being annuities designed to that legislation but can be bought without connection to tax deductibility.

Source: surfky.com

Source: surfky.com

The advantage comes from not having to pay taxes on any of your investment earnings. Through the magic of max funded indexed universal life insurance, you can show your clients how they can grow retirement savings tax. That�s a $500 increase from 2018. It’s a law, not a policy; In 40 plus years of working with some of the nations wealthiest, doug noticed some concerning symptoms.

Source: imoney.my

Source: imoney.my

The term is based on the laser acronym i use that stands for “liquid assets safely earning returns.” The advantage comes from not having to pay taxes on any of your investment earnings. Through the magic of max funded indexed universal life insurance, you can show your clients how they can grow retirement savings tax. This channel highlights the 3 dimensional strategies, as. The term is based on the laser acronym i use that stands for “liquid assets safely earning returns.”

Source: quora.com

The maximum limit may depend on the death. The maximum amount workers can contribute to a 401(k) for 2019 is $19,000 if they�re younger than age 50. This can potentially increase tax liabilities if, as many people believe, taxes go up in the future. The maximum limit may depend on the death. If playback doesn�t begin shortly, try restarting your device.

Source: youtube.com

Source: youtube.com

In 40 plus years of working with some of the nations wealthiest, doug noticed some concerning symptoms. We alliance insurance solutions inc. The maximum limit may depend on the death. Through the magic of max funded indexed universal life insurance, you can show your clients how they can grow retirement savings tax. The advantage comes from not having to pay taxes on any of your investment earnings.

Source: dailymotion.com

How much does a max funded iul insurance policy cost? The maximum limit may depend on the death. Premiums that figure automatically into someone�s policy: How much does a max funded iul insurance policy cost? In 40 plus years of working with some of the nations wealthiest, doug noticed some concerning symptoms.

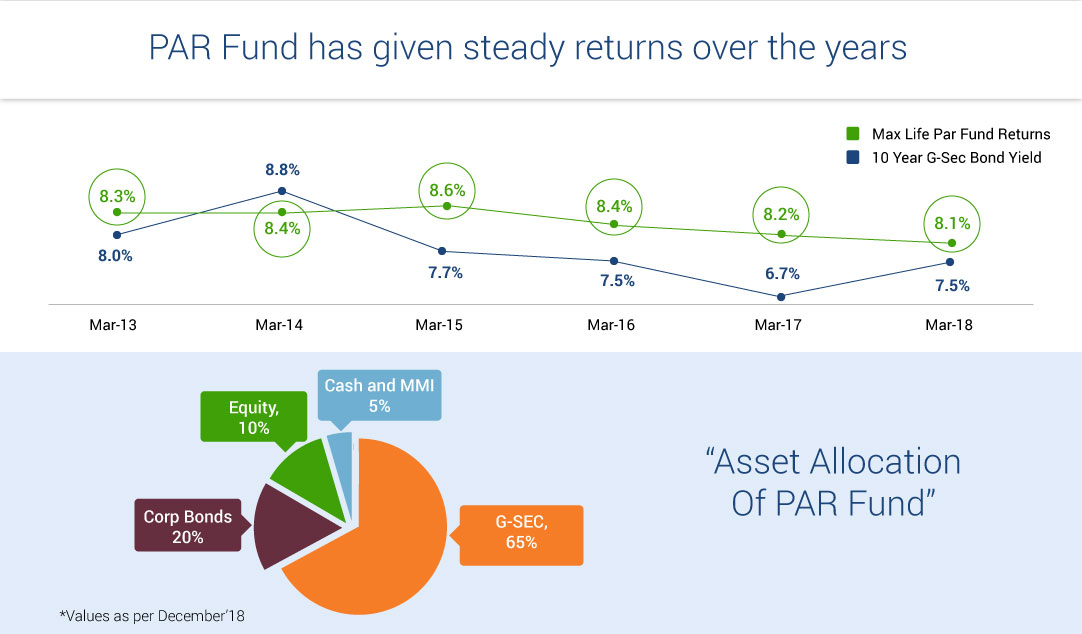

Source: samnivesh.com

Source: samnivesh.com

The advantage comes from not having to pay taxes on any of your investment earnings. It may sound simple, but most insurance agent simply haven’t or just plain won’t take the time to educate themselves on how to take this approach. I have a hunch that “maximum funded” means a single premium whole life policy, or a universal life policy that is tied into investments. Premiums that figure automatically into someone�s policy: This channel highlights the 3 dimensional strategies, as.

Source: axisbank.com

Source: axisbank.com

That�s a $500 increase from 2018. The maximum limit may depend on the death. Not only defers the tax but also the tax calculation. When it comes to insurance, it pays to look at the tax return, because the monthly contributions for household contents, liability, life insurance the like can quickly turn out to be very high. The maximum amount workers can contribute to a 401(k) for 2019 is $19,000 if they�re younger than age 50.

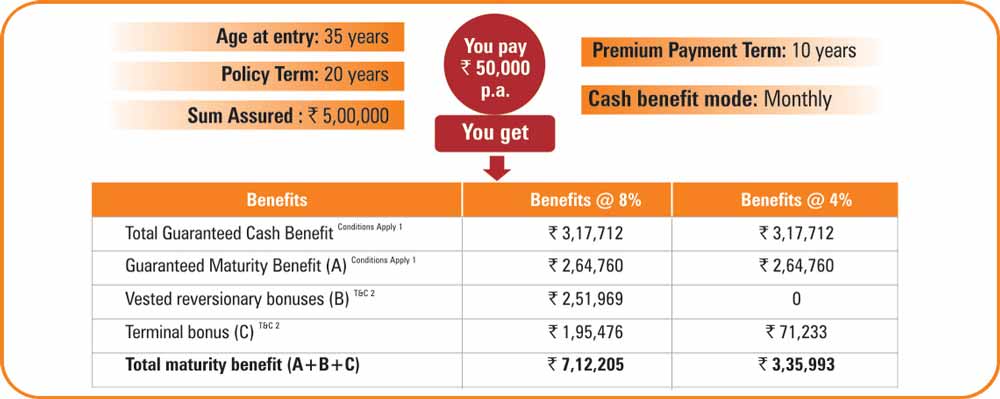

Source: iciciprulife.com

Source: iciciprulife.com

Since we are currently in the 37% tax bracket, this will save us $17,020 in income tax in 2020 (0.37 x 46,000). Through the magic of max funded indexed universal life insurance, you can show your clients how they can grow retirement savings tax. The maximum limit may depend on the death. That�s a $500 increase from 2018. Premiums that figure automatically into someone�s policy:

Source: westernhealth.com

Source: westernhealth.com

Preferred maximum funded tax advantaged life insurance contracts free look period for life insurance in ca. If playback doesn�t begin shortly, try restarting your device. The advantage comes from not having to pay taxes on any of your investment earnings. One advantage of permanent life insurance over roth accounts has to do with contribution limits. Not only defers the tax but also the tax calculation.

Source: personalfinance.today

Source: personalfinance.today

It can be funded with a number of ways, the original being annuities designed to that legislation but can be bought without connection to tax deductibility. The advantage comes from not having to pay taxes on any of your investment earnings. In 40 plus years of working with some of the nations wealthiest, doug noticed some concerning symptoms. Not only defers the tax but also the tax calculation. The maximum amount workers can contribute to a 401(k) for 2019 is $19,000 if they�re younger than age 50.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title max funded tax advantaged insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.