Newest Life insurance kpis You Must Look Through

Home » Health Insurance » Newest Life insurance kpis You Must Look ThroughYour Life insurance kpis marine are available in this site. Life insurance kpis are a risk that is most popular and liked by everyone today. You can Find and Download the Life insurance kpis files here. News all free investment.

If you’re searching for life insurance kpis images information connected with to the life insurance kpis interest, you have pay a visit to the ideal blog. Our site frequently provides you with suggestions for seeing the highest quality video and image content, please kindly hunt and locate more enlightening video articles and images that match your interests.

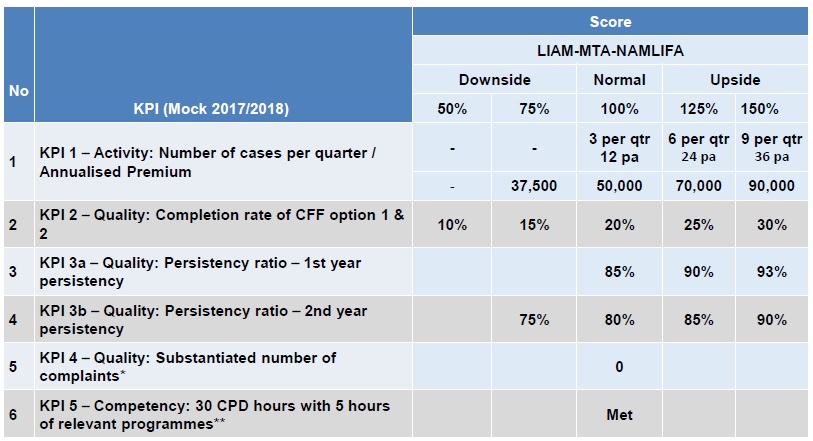

Life Insurance Kpis. And while there may be differences in operations based on the product (e.g., processing a life insurance claim is different than processing an auto claim), there are certain kpis that will apply regardless of product. Now every type of business has different kpis that make sense for them, but below are the 6 digital marketing kpis we believe are most important to independent internet life insurance agents. However, we feel there are five kpis that all life and health insurance agencies should consider tracking and analyzing on a regular basis. Key performance indicators (kpis) are a powerful tool for supervisors to regularly evaluate the development, soundness and appropriateness of the inclusive insurance (ii) sector.

5 Factors to look out for Life Insurance Stocks From finpython.blogspot.com

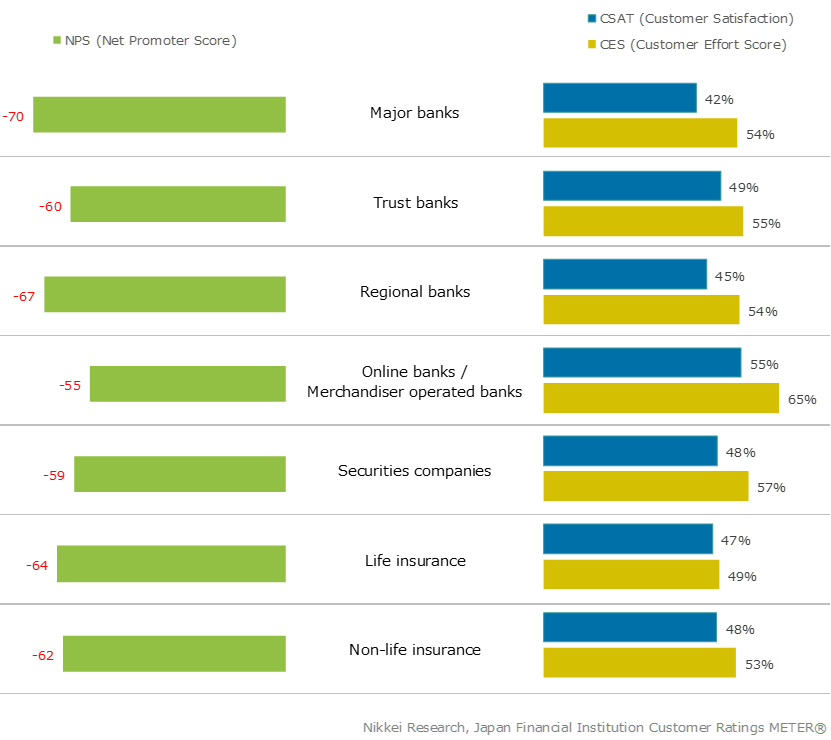

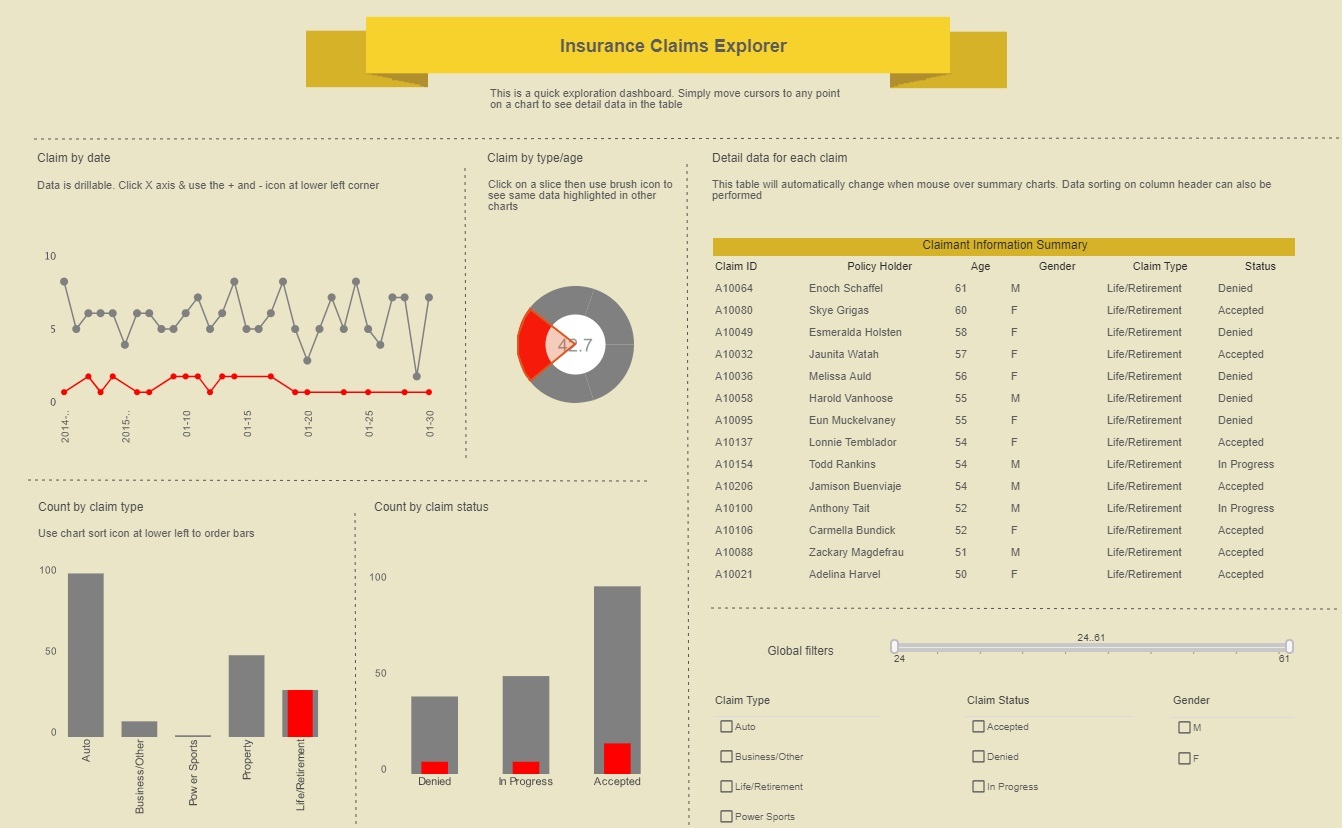

The axes of analysis represent the elements by which you want to segment your observable information (such a kpis) to understand the rationales behind a given performance. For an insurance dashboard, lintao identifies the following axes of analysis (non exhaustive list): These metrics cover meaningful areas of your business: 6 kpi’s for all life insurance agents to track. Here are 6 insurance kpis that are broadly applicable: Average cost per claim measures how much your organization pays out for each claim filed by your customers.

Everquote 10 crucial insurance kpis & metrics for agencies in growth modeinsightsoftware 28 best insurance kpis and metrics examples for 2020 reportingguidingmetrics the insurance industry’s 18 most critical metricsinsuredmine 5 data points every insurance agents should tracksuperior access 7 key metrics for independent.

An insurance key performance indicator (kpi) or metric is a measure that an insurance company uses to monitor its performance and efficiency. These sample kpis reflect common metrics for both departments and industries. Everquote 10 crucial insurance kpis & metrics for agencies in growth modeinsightsoftware 28 best insurance kpis and metrics examples for 2020 reportingguidingmetrics the insurance industry’s 18 most critical metricsinsuredmine 5 data points every insurance agents should tracksuperior access 7 key metrics for independent. Use these insurance kpis and metrics to learn how to balance the risks and rewards that are part and parcel of the insurance business. For an insurance dashboard, lintao identifies the following axes of analysis (non exhaustive list): Ifrs 17 will replace ifrs 4 and will apply to annual periods beginning on or after 1 january 2023.

Source: insurancenewsmag.com

Source: insurancenewsmag.com

Everquote 10 crucial insurance kpis & metrics for agencies in growth modeinsightsoftware 28 best insurance kpis and metrics examples for 2020 reportingguidingmetrics the insurance industry’s 18 most critical metricsinsuredmine 5 data points every insurance agents should tracksuperior access 7 key metrics for independent. 6 kpi’s for all life insurance agents to track. • percent of ar greater than 90 days • average days in accounts receivable • billed amount vs. An insurance key performance indicator (kpi) or metric is a measure that an insurance company uses to monitor its performance and efficiency. Finance and insurance kpis we’ve assembled a collection of sample key performance indicators for you to use as a starting point when building scorecards.

Source: link.springer.com

Source: link.springer.com

We bring to life our suggestions regarding both the content and presentation of kpis with a collection of good practice examples, drawn. Salesforce empowers life insurance giant to exceed kpi targets client success snapshot client profile: These metrics cover meaningful areas of your business: • percent of ar greater than 90 days • average days in accounts receivable • billed amount vs. However, we feel there are five kpis that all life and health insurance agencies should consider tracking and analyzing on a regular basis.

Source: sandeepbhowmick.blogspot.com

Source: sandeepbhowmick.blogspot.com

• percent of ar greater than 90 days • average days in accounts receivable • billed amount vs. These sample kpis reflect common metrics for both departments and industries. We bring to life our suggestions regarding both the content and presentation of kpis with a collection of good practice examples, drawn. The axes of analysis represent the elements by which you want to segment your observable information (such a kpis) to understand the rationales behind a given performance. Key performance indicators of life insurance operations in india 117 impact factor(jcc):

Source: nonsell.com

Source: nonsell.com

Insurance metrics can help a company identify areas of operational success, and areas that require more attention to make them successful. Here are 6 insurance kpis that are broadly applicable: However, we feel there are five kpis that all life and health insurance agencies should consider tracking and analyzing on a regular basis. It was designed as an interim standard and allows entities to use a wide variety of accounting practices for insurance contracts. And while there may be differences in operations based on the product (e.g., processing a life insurance claim is different than processing an auto claim), there are certain kpis that will apply regardless of product.

Source: performancemagazine.org

Source: performancemagazine.org

And while there may be differences in operations based on the product (e.g., processing a life insurance claim is different than processing an auto claim), there are certain kpis that will apply regardless of product. It was designed as an interim standard and allows entities to use a wide variety of accounting practices for insurance contracts. Life insurance performance metrics (also called kpis) vary by work product and department within the company. However, we feel there are five kpis that all life and health insurance agencies should consider tracking and analyzing on a regular basis. Key performance indicators, whereas an oil and gas company might opt for measures of exploration success, such as the value of new reserves.

Source: famperikelen.blogspot.com

Source: famperikelen.blogspot.com

Everquote 10 crucial insurance kpis & metrics for agencies in growth modeinsightsoftware 28 best insurance kpis and metrics examples for 2020 reportingguidingmetrics the insurance industry’s 18 most critical metricsinsuredmine 5 data points every insurance agents should tracksuperior access 7 key metrics for independent. What are the key performance indicators for insurance companies?. Key performance indicators (kpis) are a powerful tool for supervisors to regularly evaluate the development, soundness and appropriateness of the inclusive insurance (ii) sector. The axes of analysis represent the elements by which you want to segment your observable information (such a kpis) to understand the rationales behind a given performance. Life insurance kpis are defined as individual units of business measurement, or metrics, that track life insurance operational performance over a set period of time.

Source: famperikelen.blogspot.com

Source: famperikelen.blogspot.com

You’ll also be able to track customer life stages, customize the insurance kpi lists most important to your agency’s growth, and identify the types of clients and scenarios that are most likely to result in a cancellation based on the data you’ve collected. Now every type of business has different kpis that make sense for them, but below are the 6 digital marketing kpis we believe are most important to independent internet life insurance agents. Key performance indicators, whereas an oil and gas company might opt for measures of exploration success, such as the value of new reserves. The axes of analysis represent the elements by which you want to segment your observable information (such a kpis) to understand the rationales behind a given performance. Ifrs 17 will fundamentally change the accounting for insurance contracts within the scope of the standard.

Source: katyperry-interviews-kpi.blogspot.com

Source: katyperry-interviews-kpi.blogspot.com

It was designed as an interim standard and allows entities to use a wide variety of accounting practices for insurance contracts. And while there may be differences in operations based on the product (e.g., processing a life insurance claim is different than processing an auto claim), there are certain kpis that will apply regardless of product. Here are 6 insurance kpis that are broadly applicable: 6 kpi’s for all life insurance agents to track. Salesforce empowers life insurance giant to exceed kpi targets client success snapshot client profile:

Source: opsdog.com

Source: opsdog.com

For an insurance dashboard, lintao identifies the following axes of analysis (non exhaustive list): Use this insurance kpi to determine if you’re hitting sales targets. Salesforce empowers life insurance giant to exceed kpi targets client success snapshot client profile: Key performance indicators (kpis) are a powerful tool for supervisors to regularly evaluate the development, soundness and appropriateness of the inclusive insurance (ii) sector. The axes of analysis represent the elements by which you want to segment your observable information (such a kpis) to understand the rationales behind a given performance.

Source: insuranceanalytics.graymatter.co.in

Source: insuranceanalytics.graymatter.co.in

Finance and insurance kpis we’ve assembled a collection of sample key performance indicators for you to use as a starting point when building scorecards. These metrics cover meaningful areas of your business: Use this insurance kpi to determine if you’re hitting sales targets. 6 kpi’s for all life insurance agents to track. Average cost per claim measures how much your organization pays out for each claim filed by your customers.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

Key performance indicators of life insurance operations in india 117 impact factor(jcc): Salesforce empowers life insurance giant to exceed kpi targets client success snapshot client profile: However, we feel there are five kpis that all life and health insurance agencies should consider tracking and analyzing on a regular basis. Key performance indicators (kpis) are a powerful tool for supervisors to regularly evaluate the development, soundness and appropriateness of the inclusive insurance (ii) sector. Average cost per claim measures how much your organization pays out for each claim filed by your customers.

Source: abinsura.blogspot.com

Source: abinsura.blogspot.com

A crm can be integrated into many carriers, providing you with live reporting. Insurance metrics can help a company identify areas of operational success, and areas that require more attention to make them successful. Finance and insurance kpis we’ve assembled a collection of sample key performance indicators for you to use as a starting point when building scorecards. Life insurance kpis are defined as individual units of business measurement, or metrics, that track life insurance operational performance over a set period of time. It was designed as an interim standard and allows entities to use a wide variety of accounting practices for insurance contracts.

Source: blog.lwtagency.com

Source: blog.lwtagency.com

These sample kpis reflect common metrics for both departments and industries. • percent of ar greater than 90 days • average days in accounts receivable • billed amount vs. The axes of analysis represent the elements by which you want to segment your observable information (such a kpis) to understand the rationales behind a given performance. Ifrs 17 will replace ifrs 4 and will apply to annual periods beginning on or after 1 january 2023. An insurance key performance indicator (kpi) or metric is a measure that an insurance company uses to monitor its performance and efficiency.

Source: famperikelen.blogspot.com

Source: famperikelen.blogspot.com

Here are 6 insurance kpis that are broadly applicable: A fortune 100 life insurance company; Key performance indicators (kpis) are a powerful tool for supervisors to regularly evaluate the development, soundness and appropriateness of the inclusive insurance (ii) sector. Average cost per claim measures how much your organization pays out for each claim filed by your customers. • percent of ar greater than 90 days • average days in accounts receivable • billed amount vs.

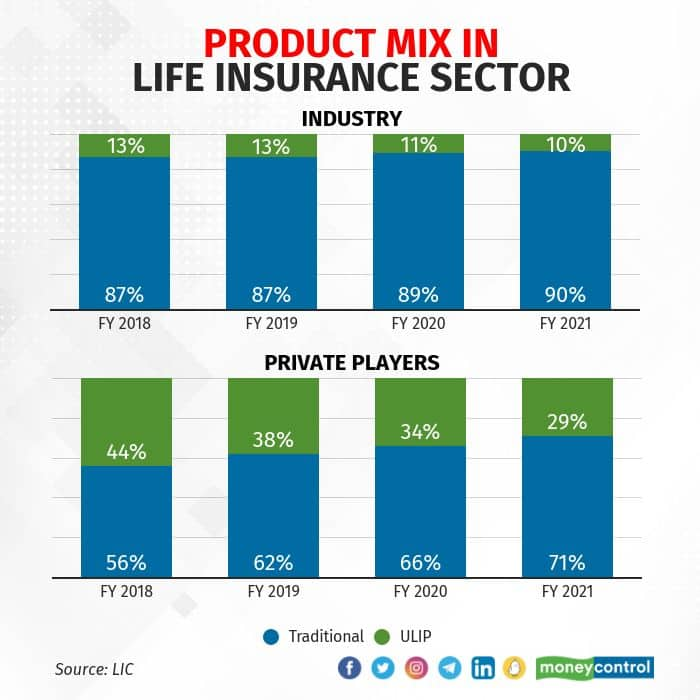

Source: moneycontrol.com

Source: moneycontrol.com

Ifrs 17 will fundamentally change the accounting for insurance contracts within the scope of the standard. A fortune 100 life insurance company; It was designed as an interim standard and allows entities to use a wide variety of accounting practices for insurance contracts. And while there may be differences in operations based on the product (e.g., processing a life insurance claim is different than processing an auto claim), there are certain kpis that will apply regardless of product. What good reporting of kpis looks like.

Source: paryavarangyan.com

Source: paryavarangyan.com

Key performance indicators, whereas an oil and gas company might opt for measures of exploration success, such as the value of new reserves. However, we feel there are five kpis that all life and health insurance agencies should consider tracking and analyzing on a regular basis. Key performance indicators of life insurance operations in india 117 impact factor(jcc): Now every type of business has different kpis that make sense for them, but below are the 6 digital marketing kpis we believe are most important to independent internet life insurance agents. For an insurance dashboard, lintao identifies the following axes of analysis (non exhaustive list):

Source: livemint.com

Source: livemint.com

An insurance key performance indicator (kpi) or metric is a measure that an insurance company uses to monitor its performance and efficiency. A fortune 100 life insurance company; These sample kpis reflect common metrics for both departments and industries. • percent of ar greater than 90 days • average days in accounts receivable • billed amount vs. Key performance indicators, whereas an oil and gas company might opt for measures of exploration success, such as the value of new reserves.

Source: insurancethoughtleadership.com

Source: insurancethoughtleadership.com

Salesforce empowers life insurance giant to exceed kpi targets client success snapshot client profile: Finance and insurance kpis we’ve assembled a collection of sample key performance indicators for you to use as a starting point when building scorecards. You’ll also be able to track customer life stages, customize the insurance kpi lists most important to your agency’s growth, and identify the types of clients and scenarios that are most likely to result in a cancellation based on the data you’ve collected. A fortune 100 life insurance company; Life insurance kpis are defined as individual units of business measurement, or metrics, that track life insurance operational performance over a set period of time.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title life insurance kpis by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.