Up to Date Kpi insurance You Must Know

Home » Home Insurance » Up to Date Kpi insurance You Must KnowYour Kpi insurance life are obtainable. Kpi insurance are a business that is most popular and liked by everyone this time. You can Download the Kpi insurance files here. Download all free group.

If you’re searching for kpi insurance images information connected with to the kpi insurance keyword, you have come to the right blog. Our site always provides you with hints for refferencing the highest quality video and image content, please kindly surf and find more informative video content and graphics that match your interests.

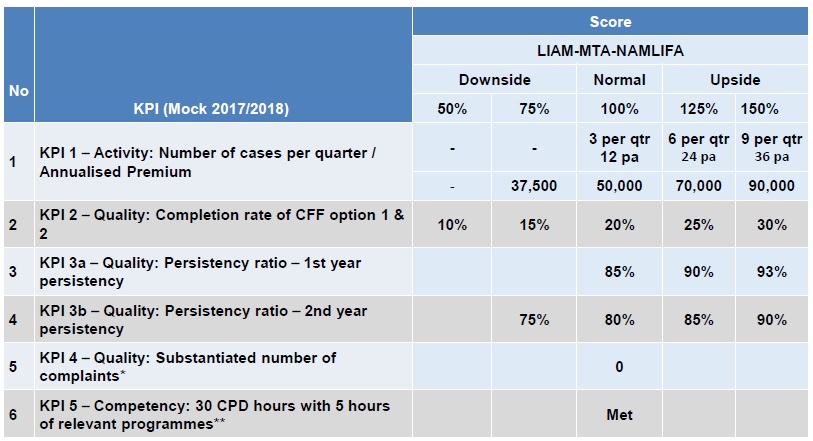

Kpi Insurance. Opsdog.com sells insurance kpi and benchmarking data in three different ways. According to verisk analytics, the average auto collision claim is $3,160, while the insurance research council found that the average homeowner’s insurance claim is $626. This insurance kpi measures the number of business days it takes an underwriter to process a property & casualty (p&c) insurance policy application, from the time the insurance application is submitted to the underwriter until the formal decision has been. Key performance indicators (kpis) are the most important business metrics for a particular industry.

Insurance KPIs Examples ABN Software From abnasia.org

Insurance KPIs Examples ABN Software From abnasia.org

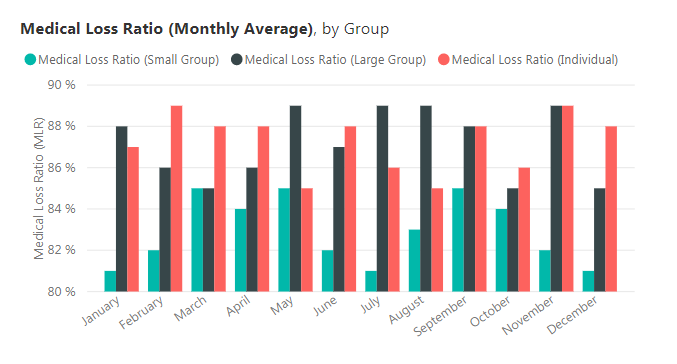

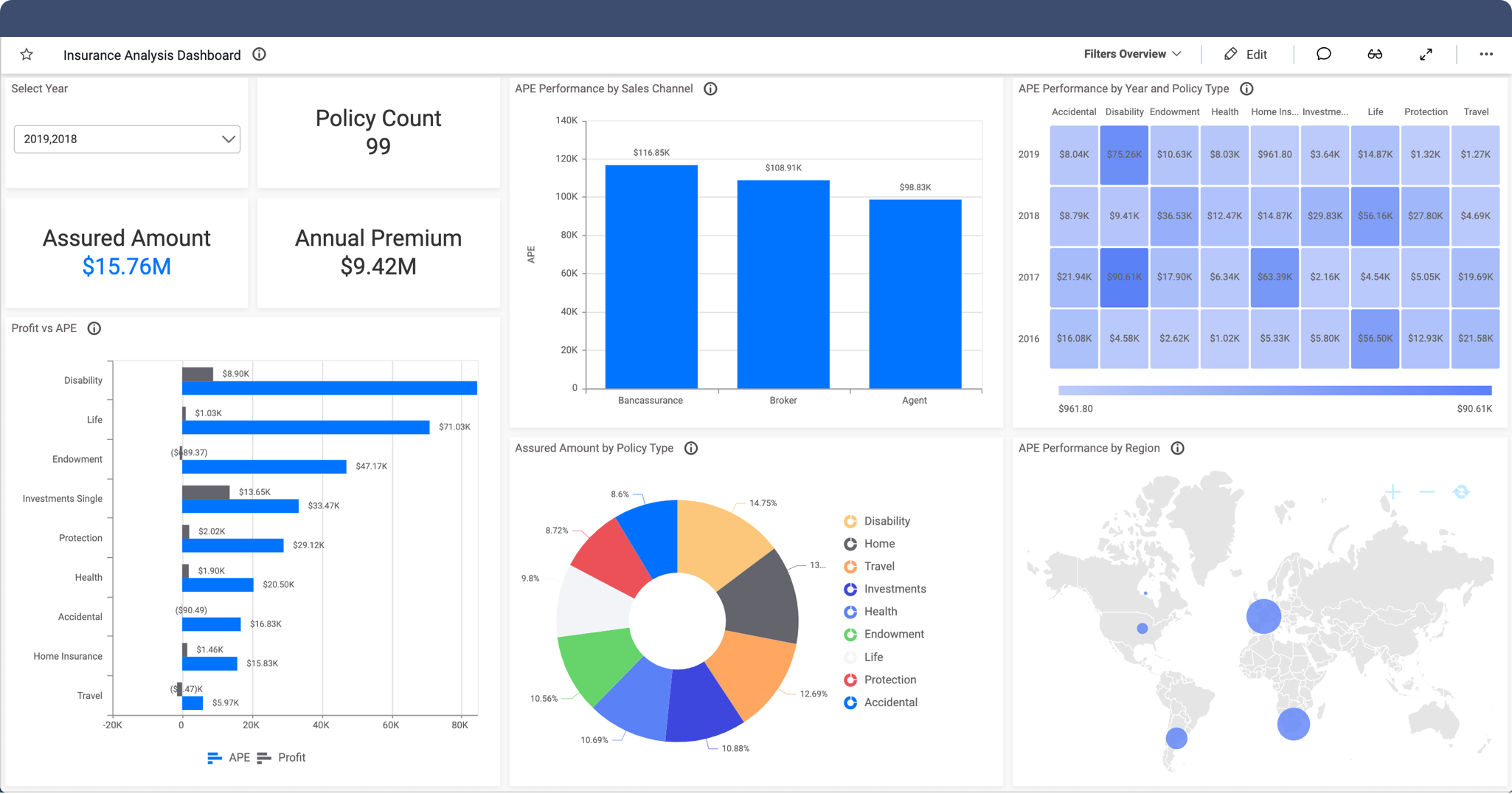

Dashboards eliminate data “clutter” by streamlining the time and energy it takes to collect, organize, and deploy important information. This kpi relates admitted assets and liabilities, and in order for the insurance program or institution to be technically solvent, the value of this kpi needs to be higher than 100%. When understanding market expectations for property and casualty insurance, whether at a company or industry level, here are some of the p&c insurance kpis to consider: Average value of past due loans. They help you understand the current business strategy and what you can do to reach your goals. Targets for % insurance solvency ratio may vary according to the strategy of covering liabilities, the assets management and insurance programs.

Insurance kpis and metrics ensure that your organization is selling the right policies, delivering quality service, and retaining the right customers.

This measures the percentage of policies pending approval when compared to the total number of policies established. When understanding market expectations for property and casualty insurance, whether at a company or industry level, here are some of the p&c insurance kpis to consider: It�s important to note that insurance is the business of managing risks and, to do that well, the insurer needs a thorough understanding of the incurred claims ratio. With this kpi (as with other insurance kpis), it’s important to categorize based on the type of claim, since each type of claim will differ in cost. Insurance kpis are measurements used by insurance companies to monitor key areas of the business to identify areas of operational success and areas that need attention to achieve your business goals. Opsdog.com sells insurance kpi and benchmarking data in three different ways.

Source: famperikelen.blogspot.com

Source: famperikelen.blogspot.com

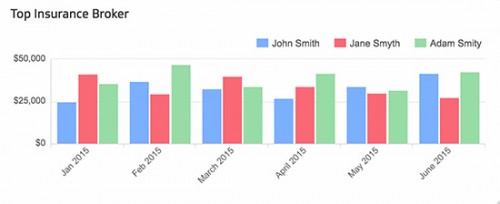

Our compliance kpis can act as important, leading indicators of potential risk. According to verisk analytics, the average auto collision claim is $3,160, while the insurance research council found that the average homeowner’s insurance claim is $626. This measures the percentage of policies pending approval when compared to the total number of policies established. An insurance kpi dashboard is to measure the performance and efficiency of insurance agents. Selecting the appropriate kpi is essential in evaluating the success of your agency.

Source: insuranceclaimszoekiya.blogspot.com

Source: insuranceclaimszoekiya.blogspot.com

You should be looking at these 10 kpis for insurance agencies at the very least. Example kpis for finance and insurance. An insurance kpi dashboard is to measure the performance and efficiency of insurance agents. Dashboards eliminate data “clutter” by streamlining the time and energy it takes to collect, organize, and deploy important information. Key performance indicators or kpis provide you with an overview of how well your organization is performing.

Source: klipfolio.com

Source: klipfolio.com

All insurance departments in every state require agencies to maintain a trust ratio of 1 or greater by law. Average value of past due loans. This measures the percentage of policies pending approval when compared to the total number of policies established. It is the trust ratio. Average sum deposited in new deposit accounts.

Source: abnasia.org

Source: abnasia.org

Key performance indicators (kpis) are the most important business metrics for a particular industry. This insurance kpi measures the number of business days it takes an underwriter to process a property & casualty (p&c) insurance policy application, from the time the insurance application is submitted to the underwriter until the formal decision has been. The claims ratio kpi measures the number of claims in a period and divides that by the earned premium for the same period. When understanding market expectations for property and casualty insurance, whether at a company or industry level, here are some of the p&c insurance kpis to consider: Dashboards eliminate data “clutter” by streamlining the time and energy it takes to collect, organize, and deploy important information.

Source: famperikelen.blogspot.com

Source: famperikelen.blogspot.com

Locations in chamberlain and kennebec serving south dakota & nebraska. This measures the percentage of policies pending approval when compared to the total number of policies established. By using these insurance kpis and metrics business leaders can learn how to balance the risks and rewards that direct the future insurance business. These kpis include contract rate, bind rate, retention rate, and so on. Their success is based on

Source: opsdog.com

Source: opsdog.com

It is the trust ratio. They help you understand the current business strategy and what you can do to reach your goals. 10 core must track insurance kpi�s core kpis to watch. Insurance metrics can help a company identify areas of operational success, and areas that require more attention to make them successful. One critically important kpi is a function of your balance sheet rather than your income statement.

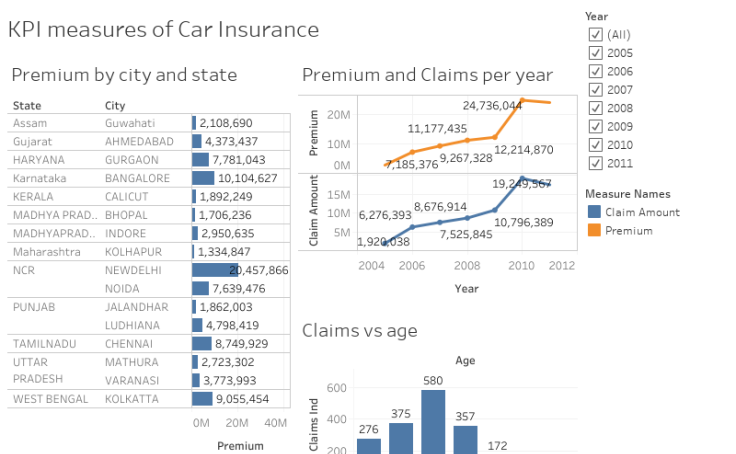

Source: insuranceanalytics.graymatter.co.in

Source: insuranceanalytics.graymatter.co.in

According to verisk analytics, the average auto collision claim is $3,160, while the insurance research council found that the average homeowner’s insurance claim is $626. Our compliance kpis can act as important, leading indicators of potential risk. Their success is based on Average value of past due loans. Opsdog.com sells insurance kpi and benchmarking data in three different ways.

Source: slideshare.net

Source: slideshare.net

Our compliance kpis can act as important, leading indicators of potential risk. All insurance departments in every state require agencies to maintain a trust ratio of 1 or greater by law. These kpis are often used to compare companies in the insurance. By using these insurance kpis and metrics business leaders can learn how to balance the risks and rewards that direct the future insurance business. With this kpi (as with other insurance kpis), it’s important to categorize based on the type of claim, since each type of claim will differ in cost.

Source: famperikelen.blogspot.com

Source: famperikelen.blogspot.com

This is true regardless of whether or not you�re required to maintain a trust account. Opening at 8:30 am on monday. Key performance indicators or kpis provide you with an overview of how well your organization is performing. Insurance kpis are measurements used by insurance companies to monitor key areas of the business to identify areas of operational success and areas that need attention to achieve your business goals. Our agency provides personal insurance, farmers insurance, business insurance and personal and life and health insurance.

Source: slideshare.net

Source: slideshare.net

These kpis include contract rate, bind rate, retention rate, and so on. Their success is based on An insurance kpi dashboard is to measure the performance and efficiency of insurance agents. These kpis include contract rate, bind rate, retention rate, and so on. Targets for % insurance solvency ratio may vary according to the strategy of covering liabilities, the assets management and insurance programs.

Source: klipfolio.com

Source: klipfolio.com

The metrics kpis track focus on areas of sales, costs, productivity, and claims. Average sum deposited in new deposit accounts. This insurance kpi measures the number of business days it takes an underwriter to process a property & casualty (p&c) insurance policy application, from the time the insurance application is submitted to the underwriter until the formal decision has been. These kpis are often used to compare companies in the insurance. The metrics kpis track focus on areas of sales, costs, productivity, and claims.

Source: pinterest.com

Source: pinterest.com

Opsdog.com sells insurance kpi and benchmarking data in three different ways. Opening at 8:30 am on monday. Our agency provides personal insurance, farmers insurance, business insurance and personal and life and health insurance. They help you understand the current business strategy and what you can do to reach your goals. An insurance key performance indicator (kpi) or metric is a measure that an insurance company uses to monitor its performance and efficiency.

Source: opsdog.com

Source: opsdog.com

This kpi relates admitted assets and liabilities, and in order for the insurance program or institution to be technically solvent, the value of this kpi needs to be higher than 100%. Targets for % insurance solvency ratio may vary according to the strategy of covering liabilities, the assets management and insurance programs. This is true regardless of whether or not you�re required to maintain a trust account. The metrics kpis track focus on areas of sales, costs, productivity, and claims. Opening at 8:30 am on monday.

Source: affordable-templates.blogspot.com

Source: affordable-templates.blogspot.com

Opening at 8:30 am on monday. What are the key performance indicators for insurance companies?. Targets for % insurance solvency ratio may vary according to the strategy of covering liabilities, the assets management and insurance programs. By using these insurance kpis and metrics business leaders can learn how to balance the risks and rewards that direct the future insurance business. Locations in chamberlain and kennebec serving south dakota & nebraska.

Source: abnasia.org

One critically important kpi is a function of your balance sheet rather than your income statement. With this kpi (as with other insurance kpis), it’s important to categorize based on the type of claim, since each type of claim will differ in cost. One critically important kpi is a function of your balance sheet rather than your income statement. This insurance kpi measures the number of business days it takes an underwriter to process a property & casualty (p&c) insurance policy application, from the time the insurance application is submitted to the underwriter until the formal decision has been. An insurance kpi dashboard is to measure the performance and efficiency of insurance agents.

Source: famperikelen.blogspot.com

Source: famperikelen.blogspot.com

Comprehensive insurance kpi benchmarking reports bundles that include 10 to 80+ measured kpis. This is true regardless of whether or not you�re required to maintain a trust account. Dashboards eliminate data “clutter” by streamlining the time and energy it takes to collect, organize, and deploy important information. Opening at 8:30 am on monday. What are the key performance indicators for insurance companies?.

Source: insightsoftware.com

Source: insightsoftware.com

When understanding market expectations for property and casualty insurance, whether at a company or industry level, here are some of the p&c insurance kpis to consider: They help you understand the current business strategy and what you can do to reach your goals. Insurance kpi dashboards help you identify areas of success and improvement, which means you can make educated decisions based on numbers instead of hunches. With this kpi (as with other insurance kpis), it’s important to categorize based on the type of claim, since each type of claim will differ in cost. Example kpis for finance and insurance.

Source: famperikelen.blogspot.com

Source: famperikelen.blogspot.com

The claims ratio kpi measures the number of claims in a period and divides that by the earned premium for the same period. All insurance departments in every state require agencies to maintain a trust ratio of 1 or greater by law. Insurance kpis are measurements used by insurance companies to monitor key areas of the business to identify areas of operational success and areas that need attention to achieve your business goals. Key performance indicators (kpis) are the most important business metrics for a particular industry. Key performance indicators for insurance companies # 2:

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title kpi insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.