Trending How much is 1 million in life insurance You Must Know

Home » Health Insurance » Trending How much is 1 million in life insurance You Must KnowYour How much is 1 million in life insurance marine are obtainable. How much is 1 million in life insurance are a icon that is most popular and liked by everyone this time. You can News the How much is 1 million in life insurance files here. Download all royalty-free investment.

If you’re looking for how much is 1 million in life insurance images information related to the how much is 1 million in life insurance topic, you have come to the ideal site. Our website always gives you suggestions for downloading the highest quality video and image content, please kindly surf and find more informative video articles and graphics that match your interests.

How Much Is 1 Million In Life Insurance. You may find the premium on a $1 million. The cost of a $1 million dollar term life insurance policy depends on age, health, term length, and other factors. A million dollar life insurance policy is a contract with a face value of a million dollars made between you and the insurance company. Increasing or decreasing the coverage amount), or even cancelled without any additional charges.

1 Million Life Insurance Policy Cost Canada CladAsia From cladasia.com

1 Million Life Insurance Policy Cost Canada CladAsia From cladasia.com

Depending on the underwriter you choose, you can get a million dollar insurance policy coverage for roughly $80 per month. A million dollars in no exam life insurance might seem like a ton of money. 5 healthy habits to help you qualify for a $1 million life insurance policy. Over half of americans overestimate the cost of term life policies by more than triple in many cases, and that perception remains true for a million dollar policy. Many wealthy people seeking between a 1 and a 10 million dollar life insurance policy often need coverage to protect their income, cover a large mortgage, (23). What makes term even better is that larger policies cost less on a per thousand basis than smaller policies do.

We�ve found that the average cost of life insurance is about $147 per month for a term life insurance policy lasting 20 years and providing a death benefit of $500,000.

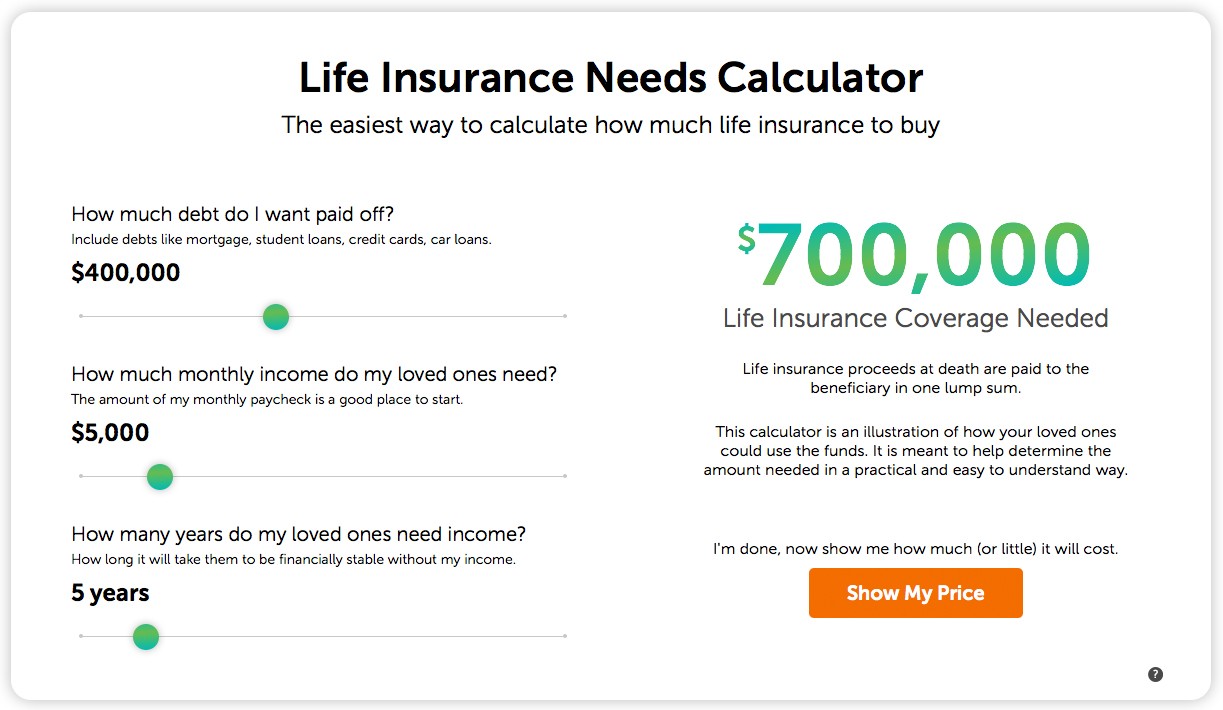

Below we take a look at all of the things you must consider when thinking about how much life insurance you may need. That means $1 million in life insurance until you are 65, covering all those years of buying a house, settling down, and having children. The outsurance life insurance calculator will help calculate how much life cover you would need to ensure you and your family are financially taken care of. The good news is term life insurance isn’t nearly as costly as most people think. The cost of a $1 million dollar term life insurance policy depends on age, health, term length, and other factors. Using the life insurance needs calculator on quotacy, here are some of the factors and costs that go into determining out how much life insurance coverage john and jane need.

Source: pinterest.com

Source: pinterest.com

The best companies include banner life, protective, and lincoln financial. You can also use the dime formula as a starting point in calculating your life insurance needs. However, we know of a company that will get your whole life insurance up to $400,000 without having to do a medical test. Debt + income + mortgage + education= total. Below we take a look at all of the things you must consider when thinking about how much life insurance you may need.

Source: lifeinsurancehelpdesk.com

Source: lifeinsurancehelpdesk.com

How much will a $1 million life insurance policy cost? We will use banner life for the life insurance company. $1 million in coverage can go a long way towards protecting your family should something unexpected happen to you. A $1 million term life insurance policy has lower premiums than a whole life insurance policy worth the same amount. However, suppose you have a mortgage, outstanding debt, and loved ones who rely on you for support.

Source: trustedchoice.com

Source: trustedchoice.com

How much does a $1 million life insurance policy cost? However, we know of a company that will get your whole life insurance up to $400,000 without having to do a medical test. Over half of americans overestimate the cost of term life policies by more than triple in many cases, and that perception remains true for a million dollar policy. A million dollar life insurance policy is a contract with a face value of a million dollars made between you and the insurance company. A $1 million term life insurance policy has lower premiums than a whole life insurance policy worth the same amount.

Source: cladasia.com

Source: cladasia.com

It helps you easily get covered at affordable rates. Depending on state and whether it’s public or private, the average total cost can range from $154,400 to $535,660. Increasing or decreasing the coverage amount), or even cancelled without any additional charges. $1 million in coverage can go a long way towards protecting your family should something unexpected happen to you. A 55 year old, on the other hand, will pay more because of.

Source: kenyachambermines.com

Source: kenyachambermines.com

Over half of americans overestimate the cost of term life policies by more than triple in many cases, and that perception remains true for a million dollar policy. Many wealthy people seeking between a 1 and a 10 million dollar life insurance policy often need coverage to protect their income, cover a large mortgage, (23). However, we know of a company that will get your whole life insurance up to $400,000 without having to do a medical test. A million dollar life insurance policy is a contract with a face value of a million dollars made between you and the insurance company. The cost of a $1 million dollar term life insurance policy depends on age, health, term length, and other factors.

Source: youtube.com

Source: youtube.com

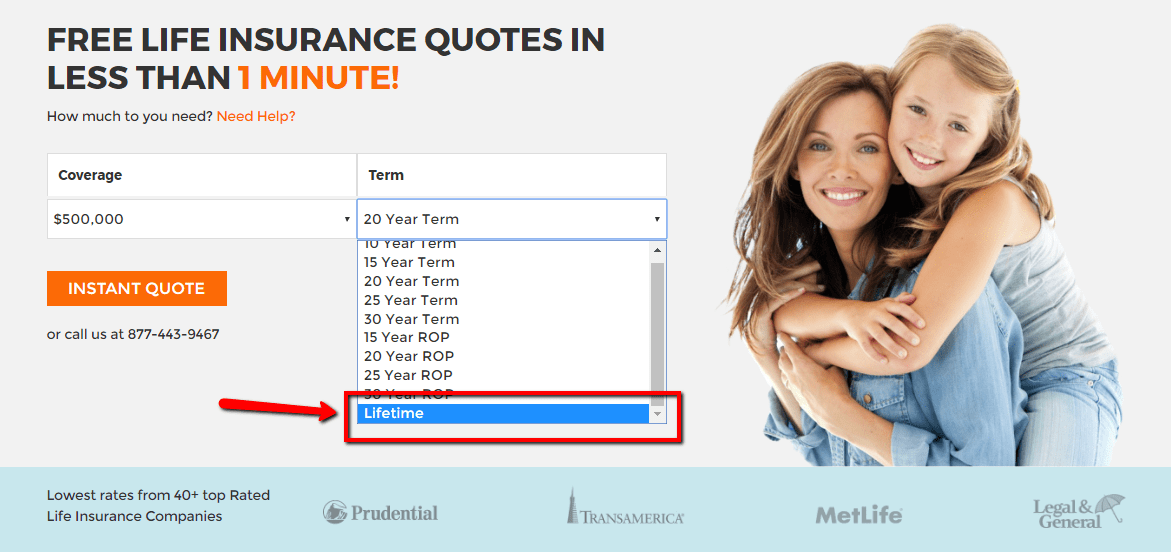

How much does a $1 million life insurance policy cost? Depending on the underwriter you choose, you can get a million dollar insurance policy coverage for roughly $80 per month. Debt + income + mortgage + education= total. Using the life insurance needs calculator on quotacy, here are some of the factors and costs that go into determining out how much life insurance coverage john and jane need. You may find the premium on a $1 million.

Source: topquotelifeinsurance.com

Source: topquotelifeinsurance.com

Many wealthy people seeking between a 1 and a 10 million dollar life insurance policy often need coverage to protect their income, cover a large mortgage, (23). However, we know of a company that will get your whole life insurance up to $400,000 without having to do a medical test. A million dollar life insurance policy is a contract with a face value of a million dollars made between you and the insurance company. It may sound expensive, but a million dollar life insurance policy is probably more affordable than you think. You can also use the dime formula as a starting point in calculating your life insurance needs.

Source: insurancenoon.com

Source: insurancenoon.com

107 rows since term life insurance provides protection for a limited time, it costs. Many experts recommend having at least 10x your annual salary in coverage. You can also use the dime formula as a starting point in calculating your life insurance needs. $1 million in coverage can go a long way towards protecting your family should something unexpected happen to you. You will still need to answer medical questions, but it will not require blood and urine.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

The outsurance life insurance calculator will help calculate how much life cover you would need to ensure you and your family are financially taken care of. Below we take a look at all of the things you must consider when thinking about how much life insurance you may need. Mary van keuren | jan 20, 2022. It helps you easily get covered at affordable rates. However, we know of a company that will get your whole life insurance up to $400,000 without having to do a medical test.

Source: enalgunlugardemioscuramente.blogspot.com

Source: enalgunlugardemioscuramente.blogspot.com

Depending on the underwriter you choose, you can get a million dollar insurance policy coverage for roughly $80 per month. You can also use the dime formula as a starting point in calculating your life insurance needs. However, we know of a company that will get your whole life insurance up to $400,000 without having to do a medical test. A million dollar life insurance policy is a contract with a face value of a million dollars made between you and the insurance company. We�ve found that the average cost of life insurance is about $147 per month for a term life insurance policy lasting 20 years and providing a death benefit of $500,000.

Source: youtube.com

Source: youtube.com

However, suppose you have a mortgage, outstanding debt, and loved ones who rely on you for support. The outsurance life insurance calculator will help calculate how much life cover you would need to ensure you and your family are financially taken care of. A million dollars in no exam life insurance might seem like a ton of money. However, suppose you have a mortgage, outstanding debt, and loved ones who rely on you for support. It offers term life insurance policies that can be adjusted at any time (i.e.

Source: quotacy.com

Source: quotacy.com

The cost of a $1 million dollar term life insurance policy depends on age, health, term length, and other factors. You may find the premium on a $1 million. We will use banner life for the life insurance company. You will still need to answer medical questions, but it will not require blood and urine. A $1 million term life insurance policy has lower premiums than a whole life insurance policy worth the same amount.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

The cost of a $1 million dollar term life insurance policy depends on age, health, term length, and other factors. Debt + income + mortgage + education= total. What makes term even better is that larger policies cost less on a per thousand basis than smaller policies do. A $1 million term life insurance policy has lower premiums than a whole life insurance policy worth the same amount. How much does a $1 million life insurance policy cost?

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how much is 1 million in life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.