The Most Popular Ho4 insurance You Must Read

Home » Travel Insurance » The Most Popular Ho4 insurance You Must ReadYour Ho4 insurance risk are available. Ho4 insurance are a protection that is most popular and liked by everyone today. You can Get the Ho4 insurance files here. News all free india.

If you’re looking for ho4 insurance images information related to the ho4 insurance interest, you have pay a visit to the right site. Our website frequently provides you with suggestions for seeing the highest quality video and picture content, please kindly hunt and locate more informative video content and graphics that match your interests.

Ho4 Insurance. Ho4 insurance is a named perils policy, which means the coverage steps in when the incidents listed in the policy damage your stuff. Ho4 insurance covers everyday household disasters, such as burglary, burst pipes, and fires. Anything that belongs to the tenant is covered under a renters insurance policy. Since you know what dangers trigger your ho4 coverage, this insurance plan is considered a “named perils” policy.

ePremium Renters Insurance Review for 2020 BLOGPAPI From blogpapi.com

ePremium Renters Insurance Review for 2020 BLOGPAPI From blogpapi.com

Ho4 insurance, or renters insurance, is financial coverage for 1) damages or losses to your stuff 2) legal fees if you’re sued 3) other’s medical bills if you’re at fault and 4) temp living expenses if your place becomes uninhabitable. The average condo insurance cost nationwide is $625, for $60,000 in personal property coverage, with a $1,000 deductible, and $300,000 in liability. There are two categories of insurance policies; The ho4 is a named perils policy. Personal property limits from $5,000 to $250,000. Ho4 insurance is a named perils policy, which means the coverage steps in when the incidents listed in the policy damage your stuff.

The largest difference between the two policies is going to be that an ho4 policy is specifically for a rental and an ho6 policy was created for a condo.

The sunshine state is prone to hurricanes and strong storms. Ho4 is one of eight types of homeowners insurance, and is the only type of policy meant for renters. Personal property limits from $5,000 to $250,000. What does an ho4 policy cover? The exact coverage amounts can usually be finessed a little, but ho3 insurance is what most people are talking about when it comes having home insurance. The ho6 is similar to the ho3 but designed specifically for condo owners.

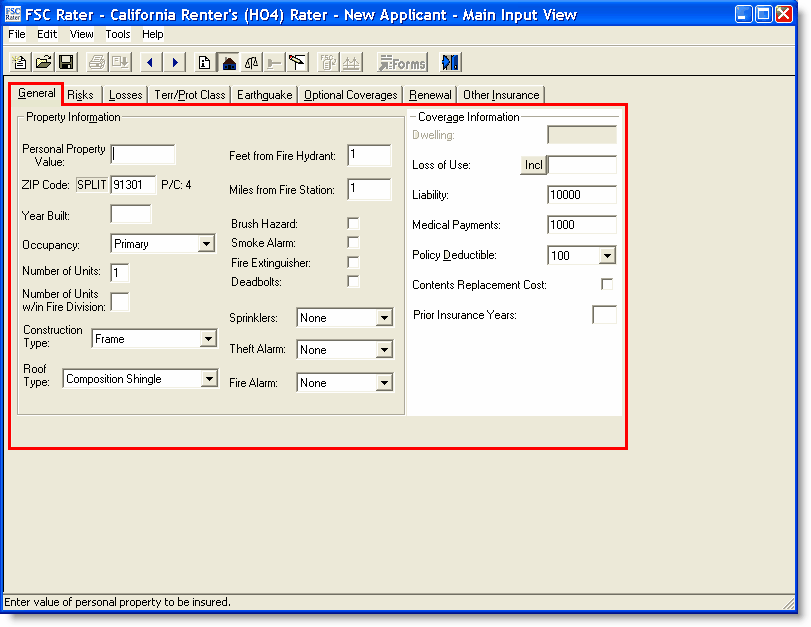

Source: help.vertafore.com

Source: help.vertafore.com

Ho4 vs ho6 homeowners policy. Since you know what dangers trigger your ho4 coverage, this insurance plan is considered a “named perils” policy. The term “perils” means a type of action or force that can cause a loss. But what happens when the driver does not only own a car, but also has their own car insurance? Florida has the highest condo insurance rate on average, $1,293.

Source: avpinsurance.com

Source: avpinsurance.com

The ho4 insurance policy is most commonly referred to as renters insurance. Industry standard ho4 policy form. Ho4 is one of eight types of homeowners insurance, and is the only type of policy meant for renters. An ho4 policy, also called renters insurance, protects a renter’s personal property and addresses their personal liability. What is ho4 insurance, is when the is the on the other side of the car ?.

Source: aegiseasy.com

Source: aegiseasy.com

The ho4 insurance policy is most commonly referred to as renters insurance. These types start with the code ho followed by a number that designates the type of coverage you need, for example, ho7. if you just need basic coverage, you may get an ho1 home policy, which is the most expensive type of home. The average condo insurance cost nationwide is $625, for $60,000 in personal property coverage, with a $1,000 deductible, and $300,000 in liability. If you are a renter, you may need tenant’s insurance (ho4) to cover what your landlord’s home insurance will not. Ho4 vs ho6 homeowners policy.

Source: trustedchoice.com

Source: trustedchoice.com

Anything that belongs to the tenant is covered under a renters insurance policy. The largest difference between the two policies is going to be that an ho4 policy is specifically for a rental and an ho6 policy was created for a condo. This covers you, the tenants, your belongings, and potential liabilities that may occur while you live in the property. However, the ho6 policy will cover your interior walls that you own. Deductibles from $500 to $10,000.

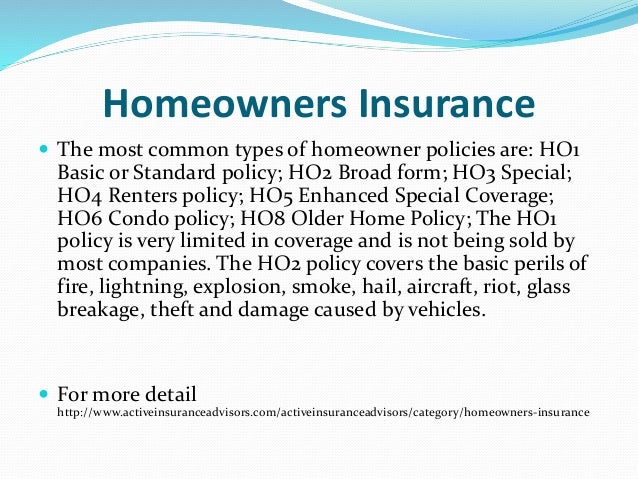

Source: slideshare.net

Source: slideshare.net

The exact coverage amounts can usually be finessed a little, but ho3 insurance is what most people are talking about when it comes having home insurance. An ho4 insurance policy has a list of risks it will cover and a few it won’t. Ho4 policies usually cover damage caused by these 16 named perils: However, the ho6 policy will cover your interior walls that you own. Renters insurance will cover damages or losses to your personal belongings and protect you from any liability if anyone is injuried while in your condo or home.

Source: univistainsurance.com

Source: univistainsurance.com

The average condo insurance cost nationwide is $625, for $60,000 in personal property coverage, with a $1,000 deductible, and $300,000 in liability. Ho4 insurance covers everyday household disasters, such as burglary, burst pipes, and fires. Below is a list of the typical events that cause renters, like yourself, to file a claim under their ho4 coverage. Deductibles from $500 to $10,000. The average condo insurance cost nationwide is $625, for $60,000 in personal property coverage, with a $1,000 deductible, and $300,000 in liability.

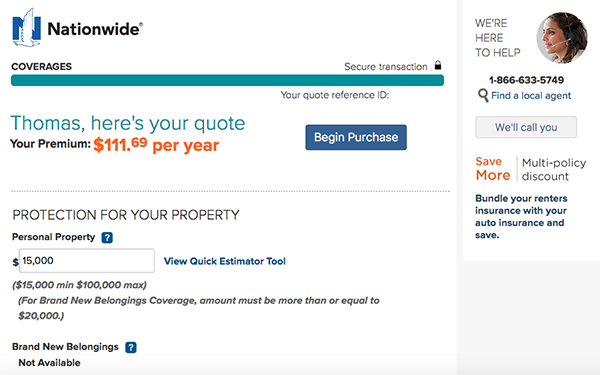

Source: blogpapi.com

Source: blogpapi.com

What does an ho4 policy cover? Below is a list of the typical events that cause renters, like yourself, to file a claim under their ho4 coverage. This covers you, the tenants, your belongings, and potential liabilities that may occur while you live in the property. Renters insurance will cover damages or losses to your personal belongings and protect you from any liability if anyone is injuried while in your condo or home. There are two categories of insurance policies;

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Since you know what dangers trigger your ho4 coverage, this insurance plan is considered a “named perils” policy. Medical payments when you’re responsible for a visitor’s injury. Ho4 insurance, or renters insurance, is financial coverage for 1) damages or losses to your stuff 2) legal fees if you’re sued 3) other’s medical bills if you’re at fault and 4) temp living expenses if your place becomes uninhabitable. Below is a list of the typical events that cause renters, like yourself, to file a claim under their ho4 coverage. Deductibles from $500 to $10,000.

Source: fapriansyah.blogspot.com

Source: fapriansyah.blogspot.com

Named perils and open perils. However, the ho6 policy will cover your interior walls that you own. An ho4 insurance policy has a list of risks it will cover and a few it won’t. Types of home insurance policies (2020 expert guide) there are many different types of homeowners� insurance. The term “perils” means a type of action or force that can cause a loss.

Source: tempestadealmaletraseimagens.blogspot.com

Source: tempestadealmaletraseimagens.blogspot.com

Ho4 insurance, or renters insurance, is financial coverage for 1) damages or losses to your stuff 2) legal fees if you’re sued 3) other’s medical bills if you’re at fault and 4) temp living expenses if your place becomes uninhabitable. An ho4 insurance policy has a list of risks it will cover and a few it won’t. Named perils and open perils. The sunshine state is prone to hurricanes and strong storms. Medical payments when you’re responsible for a visitor’s injury.

Source: youtube.com

Source: youtube.com

The ho4 is a named perils policy. The ho4 insurance policy is most commonly referred to as renters insurance. $50,000 personal liability coverage included, with limits up to $500,000 available. What is ho4 insurance, is when the is the on the other side of the car ?. There are two categories of insurance policies;

Source: lemonade.com

Source: lemonade.com

But what happens when the driver does not only own a car, but also has their own car insurance? An ho4 does not cover the building structure itself. Each one covers a different range of perils. What is ho4 insurance, is when the is the on the other side of the car ?. Florida has the highest condo insurance rate on average, $1,293.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

In order to have a car covered while it is being driven, it must be owned. Ho4 vs ho6 homeowners policy. Ho4 insurance is more commonly known as renters insurance.renters insurance is important for the very same reason why homeowners insurance is important. The term “perils” means a type of action or force that can cause a loss. Named perils and open perils.

Source: youtube.com

Source: youtube.com

Each one covers a different range of perils. An ho4 does not cover the building structure itself. Named perils and open perils. Anything that belongs to the tenant is covered under a renters insurance policy. Ho4 insurance covers everyday household disasters, such as burglary, burst pipes, and fires.

Source: kin.com

Source: kin.com

Ho4 policies cost roughly $15 per month, but costs vary based on your coverage needs and policy choices. Florida has the highest condo insurance rate on average, $1,293. Ho4 vs ho6 homeowners policy. An ho4 will offer coverage for your belongings as well as some personal liability coverage. These types start with the code ho followed by a number that designates the type of coverage you need, for example, ho7. if you just need basic coverage, you may get an ho1 home policy, which is the most expensive type of home.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Florida has the highest condo insurance rate on average, $1,293. The ho6 is similar to the ho3 but designed specifically for condo owners. Renters insurance will cover damages or losses to your personal belongings and protect you from any liability if anyone is injuried while in your condo or home. $50,000 personal liability coverage included, with limits up to $500,000 available. Each one covers a different range of perils.

Source: reviews.com

Source: reviews.com

Renters insurance will cover damages or losses to your personal belongings and protect you from any liability if anyone is injuried while in your condo or home. The average condo insurance cost nationwide is $625, for $60,000 in personal property coverage, with a $1,000 deductible, and $300,000 in liability. Medical payments when you’re responsible for a visitor’s injury. However, the ho6 policy will cover your interior walls that you own. An ho4 policy, also called renters insurance, protects a renter’s personal property and addresses their personal liability.

Source: form—-0.blogspot.com

This covers you, the tenants, your belongings, and potential liabilities that may occur while you live in the property. But what happens when the driver does not only own a car, but also has their own car insurance? If you rent a house or an apartment, the landlord’s insurance policy only provides coverage for the structure or property. What is ho4 insurance, is when the is the on the other side of the car ?. If you are a renter, you may need tenant’s insurance (ho4) to cover what your landlord’s home insurance will not.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title ho4 insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.