Current Economic impact on insurance industry You Must Look

Home » Home Insurance » Current Economic impact on insurance industry You Must LookYour Economic impact on insurance industry india are available. Economic impact on insurance industry are a india that is most popular and liked by everyone now. You can News the Economic impact on insurance industry files here. Get all royalty-free banner.

If you’re searching for economic impact on insurance industry pictures information linked to the economic impact on insurance industry keyword, you have come to the ideal site. Our site always gives you suggestions for refferencing the highest quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

Economic Impact On Insurance Industry. Insurance drives economic growth by expediting the recovery of claimants and beneficiaries. Have more than $1.4 trillion invested in the economy. In fact, the insurance industry relies on the economy for its survival. Insurers are buckled up to accelerate growth in 2022.

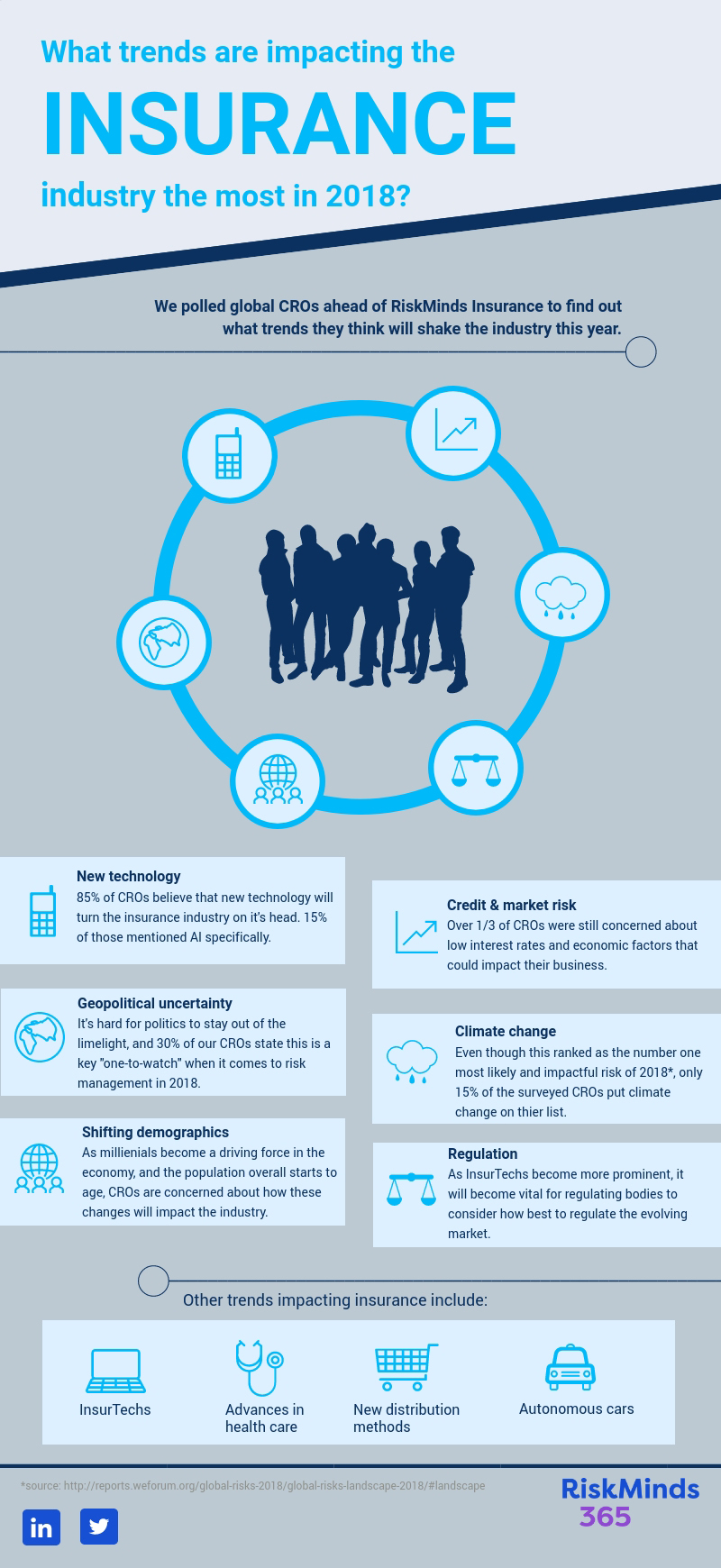

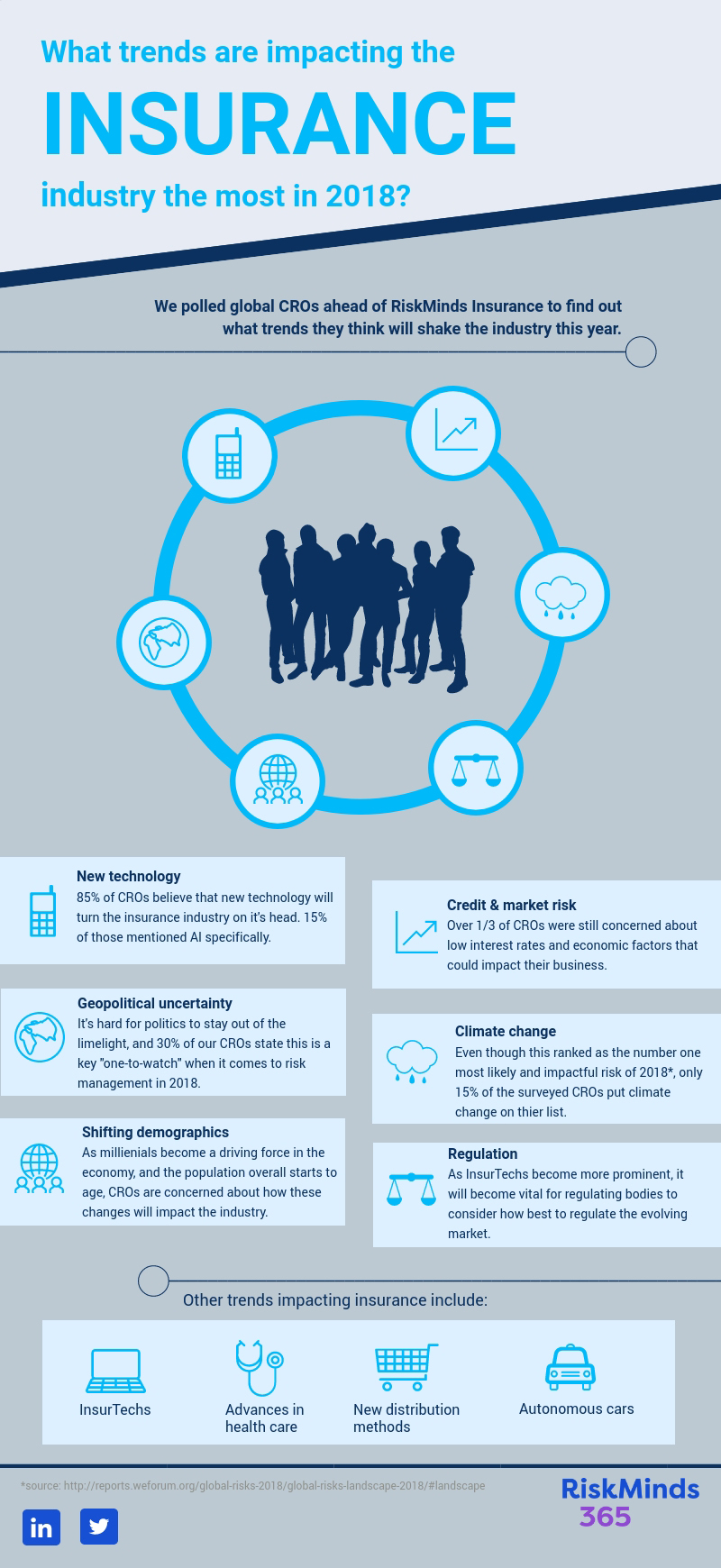

Top trends impacting the insurance industry in 2018 From informaconnect.com

Top trends impacting the insurance industry in 2018 From informaconnect.com

Presently, the trend is an economic recession with decreasing profits but increasing claims. Property/casualty includes auto, home, and commercial insurance, totaling $652.8 billion in the same year. The sharing economy has been around for nearly a decade and is still growing at a rapid pace. In 2017 the insurance industry paid roughly $1.5 trillion (an average of $125 billion per month) The ability of domestic and international (re)insurance markets to absorb losses from catastrophes can be effectively But the economic fallout from the crisis may act as a catalyst for positive change in the industry.

• both individual and commercial customers see greater need for insurance solutions.

Overall, global premiums are expected to rise by +5.1%. The insurance industry is a major player in the economy and this implies economic imbalances can as well be felt in the sector. In fact, the insurance industry relies on the economy for its survival. It is generally known that insurance fraud increases during periods of economic hardship and this is something insurers must be vigilant to in. Presently, the trend is an economic recession with decreasing profits but increasing claims. The ability of domestic and international (re)insurance markets to absorb losses from catastrophes can be effectively

Source: emea.exelatech.com

Source: emea.exelatech.com

Of these total premiums paid, 48.9% was on life insurance and 51.1% was on property/casualty insurance. Insurance drives economic growth by expediting the recovery of claimants and beneficiaries. The insurance sector plays an important role in the financial services industry, contributing to economic growth, efficient resource allocation, reduction of transaction costs, creation of liquidity, facilitation of economics of scale in investment, and • both individual and commercial customers see greater need for insurance solutions. This is driven by the inflation of labor and repairs costs.

Source: kinyeta.com

Source: kinyeta.com

The insurance industry is an integral component of the financial sector and plays an important role in the development of a nation (cristae et al., 2014). And they�re creating unique demands on the insurance industry. Insurance drives economic growth by expediting the recovery of claimants and beneficiaries. Presently, the trend is an economic recession with decreasing profits but increasing claims. Property/casualty includes auto, home, and commercial insurance, totaling $652.8 billion in the same year.

Source: kinyeta.com

Source: kinyeta.com

Total premiums have dropped by 17.01% while claims have increased by 38.4%. As the broader economy recovers and responds to the pandemic, insurers will face a number of challenges but also see. Insurance has a real effect on the global economy, of course, through the sheer Insurance on economic growth and analyzing the impact of insurance on economic growth mostly in global context. The insurance sector plays an important role in the financial services industry, contributing to economic growth, efficient resource allocation, reduction of transaction costs, creation of liquidity, facilitation of economics of scale in investment, and

Source: tomorrowmakers.com

Source: tomorrowmakers.com

Property/casualty includes auto, home, and commercial insurance, totaling $652.8 billion in the same year. • both individual and commercial customers see greater need for insurance solutions. The performance of an insurance industry has found to significantly relate to indicators of economic Unsurprisingly, the us (+5.3%) and china (+13.4%) are likely to be the two growth engines. Insurance drives economic growth by expediting the recovery of claimants and beneficiaries.

Source: sobah.newmoviesanytime.com

Source: sobah.newmoviesanytime.com

Insurers pay claims whenever there is a covered loss described in the insurance contract. Of these total premiums paid, 48.9% was on life insurance and 51.1% was on property/casualty insurance. The aggregate impact of insurance, therefore, is to level consumption patterns and contribute more widely to financialand social stability. The ability of domestic and international (re)insurance markets to absorb losses from catastrophes can be effectively Total premiums have dropped by 17.01% while claims have increased by 38.4%.

Source: anandmarket.in

Source: anandmarket.in

Strong growth is expected for the insurance industry in 2021, mirroring the expected global economic development. Developed markets, including the life insurance sector, are likely to shrink in real terms as a result of the economic slowdown—while developing markets will likely experience more declines in return on equity. Home insurance policyholders are affected by the rate of inflation in many ways. The aggregate impact of insurance, therefore, is to level consumption patterns and contribute more widely to financialand social stability. Thus, if the economy is not doing well, the insurance sector will.

Source: amateurearthling.org

Source: amateurearthling.org

Insurance on economic growth and analyzing the impact of insurance on economic growth mostly in global context. As it costs more to repair or replace a damaged home insurance companies must raise the rates they charge for coverage. But the economic fallout from the crisis may act as a catalyst for positive change in the industry. Rate trends for commercial lines are firming while. Due to the cancellation of travels, events and other economic losses, the ghanaian insurance industry witnessed a loss currently estimated at gh ȼ112 million.

Source: kinyeta.com

Source: kinyeta.com

Presently, the trend is an economic recession with decreasing profits but increasing claims. Economic factors affecting insurance industry can either enhance or hinder the thriving of insurance firms. From its origins in ancient times, the insurance industry has evolved into an essential service in our society and a “key component for economic development” (liedtke 2007). The most obvious effect is the rise in the cost of the insurance itself. The ability of domestic and international (re)insurance markets to absorb losses from catastrophes can be effectively

Source: mahmoodhussain.net

Source: mahmoodhussain.net

Due to the cancellation of travels, events and other economic losses, the ghanaian insurance industry witnessed a loss currently estimated at gh ȼ112 million. • both individual and commercial customers see greater need for insurance solutions. Keeping this important industry operating is another way insurance positively contributes to the economy. And they�re creating unique demands on the insurance industry. Here are some of the key findings from deloitte’s 2022 insurance industry outlook.

Source: invisiscope.com

Source: invisiscope.com

The insurance industry is a major player in the economy and this implies economic imbalances can as well be felt in the sector. Economic factors affecting insurance industry can either enhance or hinder the thriving of insurance firms. Insurers pay claims whenever there is a covered loss described in the insurance contract. Insurance industry employed 2.9 million people in 2020 and was valued at $1.28 trillion. They�re causing new legal liability challenges.

Source: weqmra.com

Source: weqmra.com

In 2017 the insurance industry paid roughly $1.5 trillion (an average of $125 billion per month) The performance of an insurance industry has found to significantly relate to indicators of economic It is generally known that insurance fraud increases during periods of economic hardship and this is something insurers must be vigilant to in. Insurance on economic growth and analyzing the impact of insurance on economic growth mostly in global context. Insurers are buckled up to accelerate growth in 2022.

Source: vypir.com

Source: vypir.com

Total premiums have dropped by 17.01% while claims have increased by 38.4%. Rate trends for commercial lines are firming while. Insurance drives economic growth by expediting the recovery of claimants and beneficiaries. Its impacts are largely felt through asset risks, notably capital markets volatility, and weaker premium growth prospects. Due to the changing life style, work culture and high income structure, change in consumption

Source: norvanreports.com

Source: norvanreports.com

• the insurance industry suffered far less economic and They�re causing new legal liability challenges. The most obvious effect is the rise in the cost of the insurance itself. The performance of an insurance industry has found to significantly relate to indicators of economic Our comparison and forecast predicts a normalization of economic indicators from january 2021.

Source: globaldata.com

Source: globaldata.com

Insurance on economic growth and analyzing the impact of insurance on economic growth mostly in global context. Here are some of the key findings from deloitte’s 2022 insurance industry outlook. The ability of domestic and international (re)insurance markets to absorb losses from catastrophes can be effectively Unsurprisingly, the us (+5.3%) and china (+13.4%) are likely to be the two growth engines. But the economic fallout from the crisis may act as a catalyst for positive change in the industry.

Source: santaclaritatreeservice.org

Source: santaclaritatreeservice.org

Thus, if the economy is not doing well, the insurance sector will. Insurers pay claims whenever there is a covered loss described in the insurance contract. As it costs more to repair or replace a damaged home insurance companies must raise the rates they charge for coverage. The insurance industry has not escaped its impact but insurers have responded quickly to the crisis. The insurance industry is an integral component of the financial sector and plays an important role in the development of a nation (cristae et al., 2014).

Source: influencive.com

Source: influencive.com

Property/casualty includes auto, home, and commercial insurance, totaling $652.8 billion in the same year. In 2017 the insurance industry paid roughly $1.5 trillion (an average of $125 billion per month) Insurance has a real effect on the global economy, of course, through the sheer Our lives are progressing rapidly, there is a significant increase in the general population, technology and science is continuously maturing and the world is becoming smaller. Presently, the trend is an economic recession with decreasing profits but increasing claims.

Source: informaconnect.com

Source: informaconnect.com

The most obvious effect is the rise in the cost of the insurance itself. As the broader economy recovers and responds to the pandemic, insurers will face a number of challenges but also see. While health insurance is measured. Thus, if the economy is not doing well, the insurance sector will. Due to the cancellation of travels, events and other economic losses, the ghanaian insurance industry witnessed a loss currently estimated at gh ȼ112 million.

Source: researchgate.net

Source: researchgate.net

Property/casualty includes auto, home, and commercial insurance, totaling $652.8 billion in the same year. Insurers pay claims whenever there is a covered loss described in the insurance contract. Insurance industry employed 2.9 million people in 2020 and was valued at $1.28 trillion. The businesses operating in this economy are disrupting typical business models. Insurance has a real effect on the global economy, of course, through the sheer

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title economic impact on insurance industry by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.