The Insight of Chase ink plus car rental insurance You Must Read

Home » Home Insurance » The Insight of Chase ink plus car rental insurance You Must ReadYour Chase ink plus car rental insurance fire are obtainable. Chase ink plus car rental insurance are a smallbusiness that is most popular and liked by everyone today. You can Get the Chase ink plus car rental insurance files here. News all free logo.

If you’re looking for chase ink plus car rental insurance pictures information linked to the chase ink plus car rental insurance interest, you have come to the right site. Our site always gives you suggestions for refferencing the highest quality video and picture content, please kindly surf and locate more informative video articles and graphics that fit your interests.

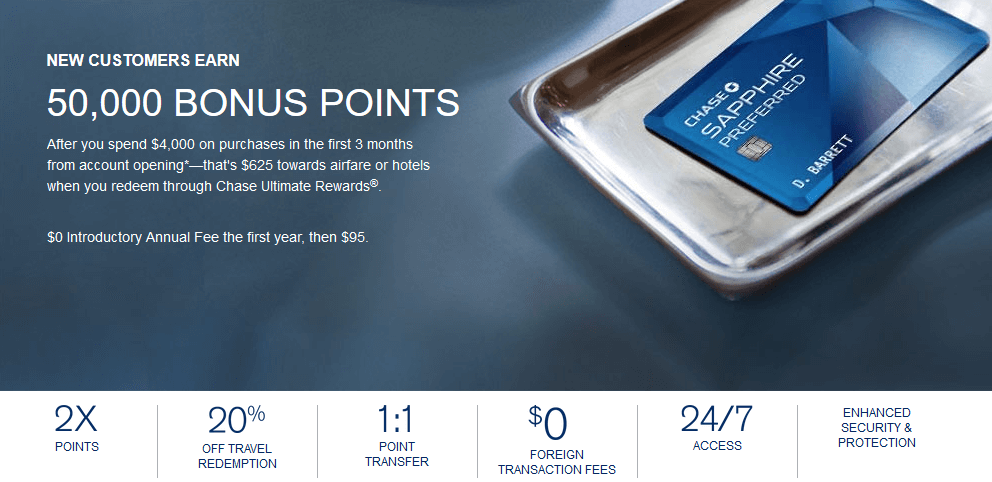

Chase Ink Plus Car Rental Insurance. Cost is 15% of the trip price when the trip price is more than $250 and 25% of the trip price when the trip rice is less than $250, with a minimum charge of $10 per day. However, if you select a yearly plan, no single car rental period can be more than 31 days. Like the chase sapphire preferred card and chase sapphire reserve, you’ll get primary rental insurance when you use your chase ink business preferred card to pay for your car rental (during a business trip!) and decline the rental agency’s. The chase ink business preferred card offers primary auto rental insurance (cdw) when renting a car for business purposes.

Best Credit Cards for Car Rentals The Points Guy From thepointsguy.com

Best Credit Cards for Car Rentals The Points Guy From thepointsguy.com

The cdw will help reimburse you for damages or a replacement if. It’s an awesome deal and the card has no annual fee. If you use the card to pay your phone bill, chase will cover theft and damage to your phone, as well as employee phones listed on your phone bill, up to three times per year (with a $100 deductible). In order to be eligible for the chase ink rental car benefit, you need to initiate and complete the entire rental transaction using your card that is eligible for the benefit, and you need to decline the rental company’s collision damage waiver or similar provision. Purchase protection — covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account. And international rentals for up to 31 consecutive days.

You will also find many nice perks for business travelers on this card, including primary car rental insurance and no foreign transaction fees.

I’ve been reading the new guide to benefits y’all sent recently, but i haven’t found an answer to my concern about renting a car using points. Coverage includes damages from collision or theft. Chase ink card rental car coverage eligibility. In addition to receiving excellent rental car coverage, you’ll be earning 2 ultimate rewards points per dollar spent on your car rental when using the chase sapphire preferred. Physical damage and/or theft of the covered rental vehicle. If you use the card to pay your phone bill, chase will cover theft and damage to your phone, as well as employee phones listed on your phone bill, up to three times per year (with a $100 deductible).

Source: oliverjean-alittlelovefromyou.blogspot.com

Source: oliverjean-alittlelovefromyou.blogspot.com

Physical damage and/or theft of the covered rental vehicle. If you use the card to pay your phone bill, chase will cover theft and damage to your phone, as well as employee phones listed on your phone bill, up to three times per year (with a $100 deductible). And international rentals for up to 31 consecutive days. Like the chase sapphire preferred card and chase sapphire reserve, you’ll get primary rental insurance when you use your chase ink business preferred card to pay for your car rental (during a business trip!) and decline the rental agency’s. I wrote a secure msg:

Source: thepointsguy.com

Source: thepointsguy.com

Coverage includes damages from collision or theft. It’s an awesome deal and the card has no annual fee. It offers primary rental car coverage among many other useful benefits, including great rewards and earning potential. Chase ink card rental car coverage eligibility. Having said all that, if you already have multiple credit cards and are wondering which of your cards is best for rental car insurance, our pick is the chase sapphire preferred® card.

Source: millionmilesecrets.com

Source: millionmilesecrets.com

Insure my rental car offers up to $100,000 of rental car coverage for damage or theft with no deductible. Coverage is primary when renting for business purposes and provides reimbursement up to the actual cash value of the vehicle for theft and collision damage for most cars in the u.s. Chase sapphire preferred ($95) chase sapphire reserve ($550) chase united explorer card ($95) chase united club card ($450) chase ink preferred business card ($95) only when you use the rental car primarily for business purpose j.p. Earn 10x total points and 1 year of lyft pink use your j.p. In addition to receiving excellent rental car coverage, you’ll be earning 2 ultimate rewards points per dollar spent on your car rental when using the chase sapphire preferred.

Source: oliverjean-alittlelovefromyou.blogspot.com

Source: oliverjean-alittlelovefromyou.blogspot.com

And international rentals for up to 31 consecutive days. I wrote a secure msg: It offers primary rental car coverage among many other useful benefits, including great rewards and earning potential. When you rent a car and pay for the rental with an eligible chase credit card, your rental car will be covered thanks to your credit card collision damage waiver (cdw). It’s an awesome deal and the card has no annual fee.

Source: thepointsguy.com

Source: thepointsguy.com

Chase ink card rental car coverage eligibility. In order to be eligible for the chase ink rental car benefit, you need to initiate and complete the entire rental transaction using your card that is eligible for the benefit, and you need to decline the rental company’s collision damage waiver or similar provision. What this means is, if you damage your rental car, you are covered (with exceptions including passenger vans and really expensive premium cars). If you use the card to pay your phone bill, chase will cover theft and damage to your phone, as well as employee phones listed on your phone bill, up to three times per year (with a $100 deductible). Morgan reserve card and earn 10x total points through march 2022, plus activate lyft pink for a.

Source: credit-o.com

Source: credit-o.com

The chase ink will be your primary if you are outside of your country of residence). Chase ink card rental car coverage eligibility. If you are traveling for business reasons, congrats! Coverage includes damages from collision or theft. I’ve been investigating the ur mall, planning to rent a car probably using ur points.

Source: oliverjean-alittlelovefromyou.blogspot.com

Source: oliverjean-alittlelovefromyou.blogspot.com

What this means is, if you damage your rental car, you are covered (with exceptions including passenger vans and really expensive premium cars). It offers primary rental car coverage among many other useful benefits, including great rewards and earning potential. Coverage is primary when renting for business purposes and provides reimbursement up to the actual cash value of the vehicle for theft and collision damage for most cars in the u.s. The chase freedom unlimited card’s rental car insurance coverage is secondary. The chase ink will be your primary if you are outside of your country of residence).

Source: uponarriving.com

Source: uponarriving.com

Earn 10x total points and 1 year of lyft pink use your j.p. When you rent a car and pay for the rental with an eligible chase credit card, your rental car will be covered thanks to your credit card collision damage waiver (cdw). Having said all that, if you already have multiple credit cards and are wondering which of your cards is best for rental car insurance, our pick is the chase sapphire preferred® card. The chase ink business preferred card offers primary auto rental insurance (cdw) when renting a car for business purposes. The car rentals purchased through ultimate rewards category includes prepaid car rental purchases made on ultimaterewards.com or by booking through the chase travel center via the number on the back of your card.

Source: correctsuccess.com

Source: correctsuccess.com

I’ve been investigating the ur mall, planning to rent a car probably using ur points. When you use a chase freedom flex℠ or chase freedom unlimited® to pay for a rental car, you are covered as the primary renter. Chase sapphire preferred ($95) chase sapphire reserve ($550) chase united explorer card ($95) chase united club card ($450) chase ink preferred business card ($95) only when you use the rental car primarily for business purpose j.p. I’ve been investigating the ur mall, planning to rent a car probably using ur points. If you are traveling for business reasons, congrats!

Source: oliverjean-alittlelovefromyou.blogspot.com

Cost is 15% of the trip price when the trip price is more than $250 and 25% of the trip price when the trip rice is less than $250, with a minimum charge of $10 per day. However, if you select a yearly plan, no single car rental period can be more than 31 days. Having said all that, if you already have multiple credit cards and are wondering which of your cards is best for rental car insurance, our pick is the chase sapphire preferred® card. Earn 10x total points and 1 year of lyft pink use your j.p. When you rent a car and pay for the rental with an eligible chase credit card, your rental car will be covered thanks to your credit card collision damage waiver (cdw).

Source: millionmilesecrets.com

Source: millionmilesecrets.com

The car rentals purchased through ultimate rewards category includes prepaid car rental purchases made on ultimaterewards.com or by booking through the chase travel center via the number on the back of your card. Coverage is primary when renting for business purposes and provides reimbursement up to the actual cash value of the vehicle for theft and collision damage for most cars in the u.s. Earn 10x total points and 1 year of lyft pink use your j.p. When you use a chase freedom flex℠ or chase freedom unlimited® to pay for a rental car, you are covered as the primary renter. In order to be eligible for the chase ink rental car benefit, you need to initiate and complete the entire rental transaction using your card that is eligible for the benefit, and you need to decline the rental company’s collision damage waiver or similar provision.

Source: thepointsguy.com

Source: thepointsguy.com

It offers primary rental car coverage among many other useful benefits, including great rewards and earning potential. The chase ink will be your primary if you are outside of your country of residence). If your primary auto insurance policy covers rental cars, you’ll have to file a claim through that first. Chase sapphire preferred ($95) chase sapphire reserve ($550) chase united explorer card ($95) chase united club card ($450) chase ink preferred business card ($95) only when you use the rental car primarily for business purpose j.p. In addition to receiving excellent rental car coverage, you’ll be earning 2 ultimate rewards points per dollar spent on your car rental when using the chase sapphire preferred.

Source: millionmilesecrets.com

Source: millionmilesecrets.com

If you use the card to pay your phone bill, chase will cover theft and damage to your phone, as well as employee phones listed on your phone bill, up to three times per year (with a $100 deductible). If you use the card to pay your phone bill, chase will cover theft and damage to your phone, as well as employee phones listed on your phone bill, up to three times per year (with a $100 deductible). Bank altitude reserve ($400) the following cards have been discontinued for new. Merchant services chase merchant services provides you with a more secure and convenient way to do business by giving your customers the flexibility to make purchases however they choose with added security that protects their accounts. The chase freedom unlimited card’s rental car insurance coverage is secondary.

Source: oliverjean-alittlelovefromyou.blogspot.com

Source: oliverjean-alittlelovefromyou.blogspot.com

I’ve been investigating the ur mall, planning to rent a car probably using ur points. Chase sapphire preferred ($95) chase sapphire reserve ($550) chase united explorer card ($95) chase united club card ($450) chase ink preferred business card ($95) only when you use the rental car primarily for business purpose j.p. Physical damage and/or theft of the covered rental vehicle. However, if you select a yearly plan, no single car rental period can be more than 31 days. Morgan reserve card and earn 10x total points through march 2022, plus activate lyft pink for a.

Source: thepointsguy.com

Source: thepointsguy.com

The car rentals purchased through ultimate rewards category includes prepaid car rental purchases made on ultimaterewards.com or by booking through the chase travel center via the number on the back of your card. The chase ink business preferred card offers primary auto rental insurance (cdw) when renting a car for business purposes. I’ve been reading the new guide to benefits y’all sent recently, but i haven’t found an answer to my concern about renting a car using points. Earn 10x total points and 1 year of lyft pink use your j.p. You will also incur no foreign transaction fees on international car rentals.

Source: oliverjean-alittlelovefromyou.blogspot.com

Source: oliverjean-alittlelovefromyou.blogspot.com

What this means is, if you damage your rental car, you are covered (with exceptions including passenger vans and really expensive premium cars). When you rent a car and pay for the rental with an eligible chase credit card, your rental car will be covered thanks to your credit card collision damage waiver (cdw). Coverage includes damages from collision or theft. If you are traveling for business reasons, congrats! Bank altitude reserve ($400) the following cards have been discontinued for new.

Source: oliverjean-alittlelovefromyou.blogspot.com

Source: oliverjean-alittlelovefromyou.blogspot.com

I heard back from chase (i have the ink bold) the following. When you use a chase freedom flex℠ or chase freedom unlimited® to pay for a rental car, you are covered as the primary renter. It offers primary rental car coverage among many other useful benefits, including great rewards and earning potential. If you are traveling for business reasons, congrats! The cdw will help reimburse you for damages or a replacement if.

Source: oliverjean-alittlelovefromyou.blogspot.com

You will also incur no foreign transaction fees on international car rentals. What this means is, if you damage your rental car, you are covered (with exceptions including passenger vans and really expensive premium cars). I heard back from chase (i have the ink bold) the following. You will also find many nice perks for business travelers on this card, including primary car rental insurance and no foreign transaction fees. If your primary auto insurance policy covers rental cars, you’ll have to file a claim through that first.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title chase ink plus car rental insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.