Top Can you borrow against your term life insurance Review

Home » Health Insurance » Top Can you borrow against your term life insurance ReviewYour Can you borrow against your term life insurance infographic are available in this site. Can you borrow against your term life insurance are a property that is most popular and liked by everyone this time. You can Get the Can you borrow against your term life insurance files here. Get all free money.

If you’re looking for can you borrow against your term life insurance pictures information related to the can you borrow against your term life insurance topic, you have pay a visit to the right blog. Our site frequently provides you with suggestions for refferencing the maximum quality video and image content, please kindly hunt and find more informative video content and images that match your interests.

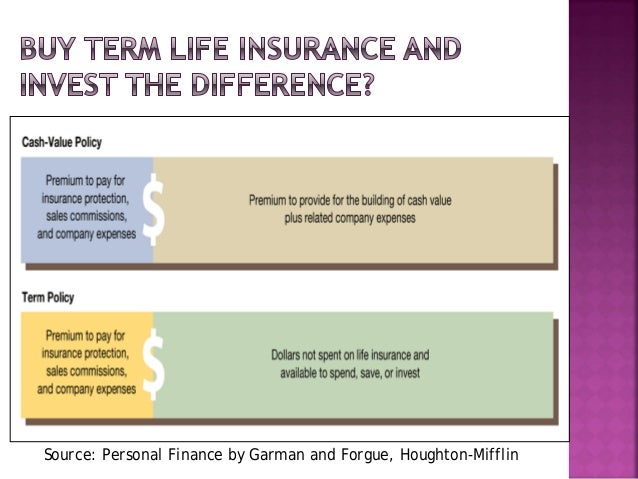

Can You Borrow Against Your Term Life Insurance. That means you can’t borrow against a term life policy or surrender it for cash. Borrowing against whole or permanent life insurance. For more, see the basics of term life insurance. Can you borrow money from term life policies?

How To Borrow Money Against Your Life Insurance Policy From entresuaspalavras.blogspot.com

How To Borrow Money Against Your Life Insurance Policy From entresuaspalavras.blogspot.com

Borrowing against whole or permanent life insurance. A life insurance loan is only available in cash value policies such as whole life insurance, universal life insurance or variable universal life insurance. You can�t borrow against them, and if you decide to surrender a term life insurance policy, you won�t receive money in return. Term life insurance, a cheaper and suitable option for many people, does not have a cash value and expires. But term life does not include a cash value account. How much you can borrow from a life insurance policy varies by insurer, but the maximum policy loan amount is typically at least 90% of the cash value, with no minimum.

You cannot take out a loan against a term life insurance policy because it does not accrue cash value of any kind.

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Most importantly, you can only borrow against a permanent or whole life insurance policy. Discuss what the impact will be on your policy, as well as any tax implications. And when you borrow against your insurance policy, you can design your own repayment schedule, modify it as needed, or even continue down the path of life without repaying it if your circumstances require. You cannot take out a loan against a term life insurance policy because it does not accrue cash value of any kind. During the discussion, first, a policy holder needs to ask his or her agent if borrowing is even a possibility.

Source: youtuberocks.com

Source: youtuberocks.com

During the discussion, first, a policy holder needs to ask his or her agent if borrowing is even a possibility. The irs has mandated that there are no. Can you borrow money from term life policies? The tax implications of borrowing against your life insurance. It is not possible to take out a loan against a term policy because it only offers pure death benefit protection and does not have any cash value.

Source: sbli.com

Source: sbli.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. You cannot borrow against term life insurance because no cash value is associated with it, and this kind of insurance is for a limited time only. Yes, you can borrow against your colonial life insurance policy by filling out a request for service form and mailing it to the address specified. That means you can’t borrow against a term life policy or surrender it for cash.

Source: sennexdesign.blogspot.com

Source: sennexdesign.blogspot.com

And when you borrow against your insurance policy, you can design your own repayment schedule, modify it as needed, or even continue down the path of life without repaying it if your circumstances require. Most of the time, you can take cash from your life insurance policy after you have built up the cash value. There is no cash value in a term life insurance policy to borrow against. For more, see the basics of term life insurance. You can even borrow against your own retirement with a 401(k) loan.

Source: thefinancesection.com

Source: thefinancesection.com

Most of the time, you can take cash from your life insurance policy after you have built up the cash value. The irs has mandated that there are no. X research source as for term life policies, these are not loan sources since they don’t have a cash value that can be borrowed. The period for which a term insurance policy remains in force can be anywhere between one to 30 years. That means you can’t borrow against a term life policy or surrender it for cash.

Source: wikihow.com

Source: wikihow.com

But what about a life insurance loan? Most importantly, you can only borrow against a permanent or whole life insurance policy. How much you can borrow from a life insurance policy varies by insurer, but the maximum policy loan amount is typically at least 90% of the cash value, with no minimum. You cannot take out a loan against a term life insurance policy because it does not accrue cash value of any kind. A life insurance loan is only available in cash value policies such as whole life insurance, universal life insurance or variable universal life insurance.

Source: bestinsurancecenter.com

Source: bestinsurancecenter.com

You cannot take out a loan against a term life insurance policy because it does not accrue cash value of any kind. Term life insurance policies do not come with a cash value account, so policyholders can’t borrow money from their insurer against. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. It is not possible to take out a loan against a term policy because it only offers pure death benefit protection and does not have any cash value. Most of the time, you can take cash from your life insurance policy after you have built up the cash value.

Source: grouplifeinsurancedzumizuki.blogspot.com

Source: grouplifeinsurancedzumizuki.blogspot.com

But term life does not include a cash value account. You can even borrow against your own retirement with a 401(k) loan. There is no cash value in a term life insurance policy to borrow against. Term life insurance, a cheaper and suitable option for many people, does not have a cash value and expires. The tax implications of borrowing against your life insurance.

Source: protective.com

Source: protective.com

The irs has mandated that there are no. It’s easy to borrow against the cash value of a permanent life insurance policy. But what about a life insurance loan? Most of the time, you can take cash from your life insurance policy after you have built up the cash value. There is no cash value in a term life insurance policy to borrow against.

Source: globelifeworksiteadvantage.com

Source: globelifeworksiteadvantage.com

Borrowing against whole or permanent life insurance. However, some term life insurance has living benefits that allow the insured person to take part of the face amount in cash in case of critical or chronic illness. There is no cash value in a term life insurance policy to borrow against. The irs has mandated that there are no. But term life does not include a cash value account.

Source: entresuaspalavras.blogspot.com

Source: entresuaspalavras.blogspot.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. You cannot take out a loan against a term life insurance policy because it does not accrue cash value of any kind. Tap your insurance in the wrong way, though, and you could create as many financial problems as you solve. How much you can borrow from a life insurance policy varies by insurer, but the maximum policy loan amount is typically at least 90% of the cash value, with no minimum. For more, see the basics of term life insurance.

Source: wikihow.com

Source: wikihow.com

Most of the time, you can take cash from your life insurance policy after you have built up the cash value. You will have to contact your financial advisor or insurance agent to determine your policy�s cash value. Thus, borrowing money against a term life insurance policy is not possible most of the times, it is still recommended discussing it with the insurance company. It’s easy to borrow against the cash value of a permanent life insurance policy. But what about a life insurance loan?

Source: sennexdesign.blogspot.com

Source: sennexdesign.blogspot.com

If you have a term insurance policy in your name,. Can you borrow money from term life policies? For more, see the basics of term life insurance. You can borrow about 95% of the cash value amount of your whole life policy from most mutual insurance companies. However, some term life insurance has living benefits that allow the insured person to take part of the face amount in cash in case of critical or chronic illness.

Source: grouplifeinsurancedzumizuki.blogspot.com

Source: grouplifeinsurancedzumizuki.blogspot.com

During the discussion, first, a policy holder needs to ask his or her agent if borrowing is even a possibility. For the most part, you can borrow against a permanent life insurance policy, since it has a cash surrender value. For more, see the basics of term life insurance. Most of the time, you can take cash from your life insurance policy after you have built up the cash value. It’s easy to borrow against the cash value of a permanent life insurance policy.

Source: entresuaspalavras.blogspot.com

Source: entresuaspalavras.blogspot.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. You cannot borrow against term life insurance because no cash value is associated with it, and this kind of insurance is for a limited time only. You can even borrow against your own retirement with a 401(k) loan. During the discussion, first, a policy holder needs to ask his or her agent if borrowing is even a possibility. You can borrow against next week with a payday loan and against next month with a credit card.

Source: sennexdesign.blogspot.com

You cannot take out a loan against a term life insurance policy because it does not accrue cash value of any kind. Can you borrow money from term life policies? You cannot borrow against term life insurance because no cash value is associated with it, and this kind of insurance is for a limited time only. How much can you borrow from a life insurance policy? For the most part, you can borrow against a permanent life insurance policy, since it has a cash surrender value.

Source: grouplifeinsurancedzumizuki.blogspot.com

Source: grouplifeinsurancedzumizuki.blogspot.com

X research source as for term life policies, these are not loan sources since they don’t have a cash value that can be borrowed. You can even borrow against your own retirement with a 401(k) loan. You can�t borrow against them, and if you decide to surrender a term life insurance policy, you won�t receive money in return. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. How much can you borrow from a life insurance policy?

Source: plocba.blogspot.com

However, some term life insurance has living benefits that allow the insured person to take part of the face amount in cash in case of critical or chronic illness. Yes, you can borrow against your colonial life insurance policy by filling out a request for service form and mailing it to the address specified. Most importantly, you can only borrow against a permanent or whole life insurance policy. Can you borrow money from term life policies? Discuss what the impact will be on your policy, as well as any tax implications.

Source: grouplifeinsurancedzumizuki.blogspot.com

Source: grouplifeinsurancedzumizuki.blogspot.com

A life insurance loan is only available in cash value policies such as whole life insurance, universal life insurance or variable universal life insurance. However, some term life insurance has living benefits that allow the insured person to take part of the face amount in cash in case of critical or chronic illness. For more, see the basics of term life insurance. The period for which a term insurance policy remains in force can be anywhere between one to 30 years. But what about a life insurance loan?

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can you borrow against your term life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.