The Insight of Basic form insurance You Must Know

Home » Health Insurance » The Insight of Basic form insurance You Must KnowYour Basic form insurance india are available in this site. Basic form insurance are a policy that is most popular and liked by everyone today. You can Find and Download the Basic form insurance files here. Download all free house.

If you’re searching for basic form insurance pictures information related to the basic form insurance interest, you have pay a visit to the right blog. Our website always provides you with suggestions for seeking the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

Basic Form Insurance. You�re on your own for any losses that aren�t specifically named. A broad form policy that adds more coverage, such as damage from broken windows. Basic form ( cp1010 ), broad form ( cp1020 ), and special form ( cp1030 ). The basic, broad, and special causes of loss forms.

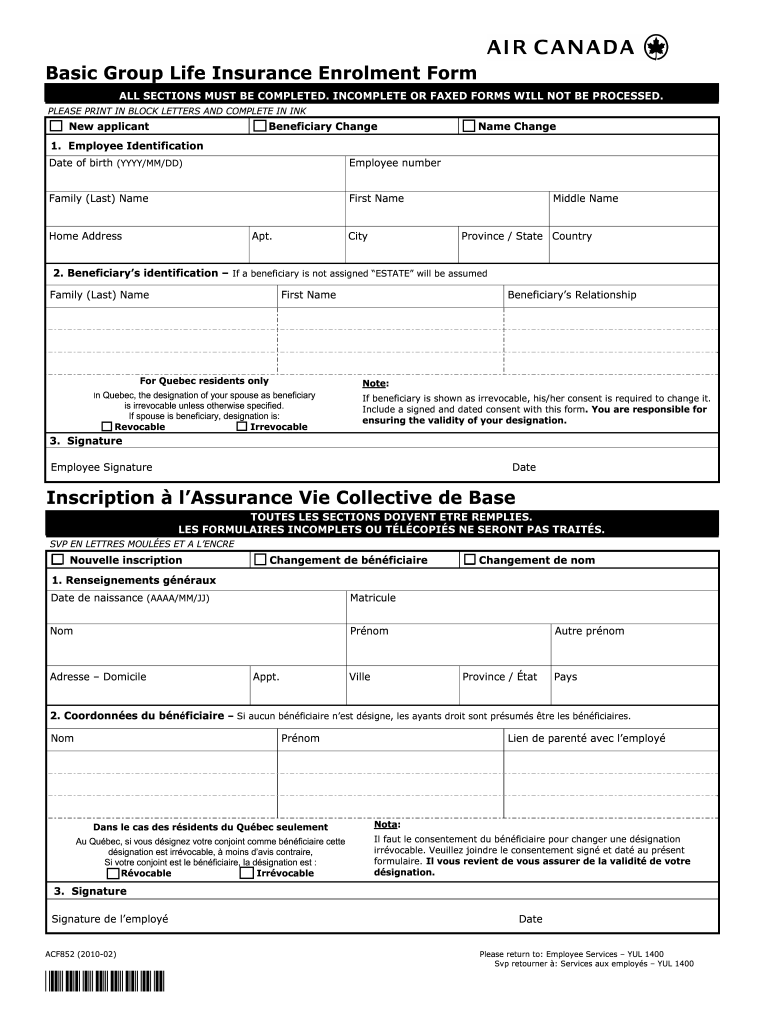

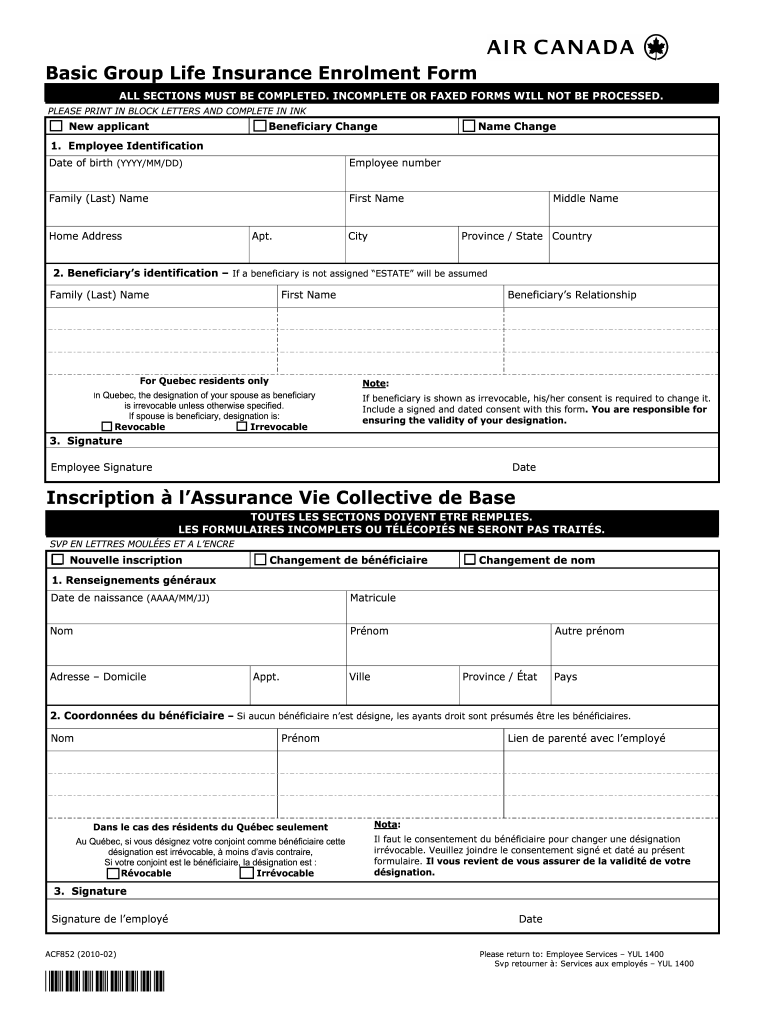

Basic Group Life Insurance Enrolment Form Fill Out and From signnow.com

Basic Group Life Insurance Enrolment Form Fill Out and From signnow.com

Basic form ( cp1010 ), broad form ( cp1020 ), and special form ( cp1030 ). They provide coverage for loss from only the particular causes that are listed in the policy as covered. Employers that offer basic life insurance generally provide policies with a specific death benefit amount, which is usually set as either a. In the world of insurance, there are six basic principles or forms of insurance coverage that must be fulfilled, including utmost good faith, insurable interest, indemnity, proximate cause (proximal cause), subrogation (transfer of rights or guardianship), and contribution. Broad form policies are more extensive in coverage as they include all the perils of the basic form plus: The right to insure arising out of a financial relationship, between the insured to the insured and legally recognized.

Covered causes of loss when basic is shown in the declarations, covered causes of loss means the following:

Starting with the basic form of insurance coverage, a policy that offers basic peril coverage is only going to cover the insured for named perils. So, if it’s not listed, it’s not covered. Basic form is the most restrictive, while special offers the greater level of protection. Employers that offer basic life insurance generally provide policies with a specific death benefit amount, which is usually set as either a. They provide coverage for loss from only the particular causes that are listed in the policy as covered. You�re on your own for any losses that aren�t specifically named.

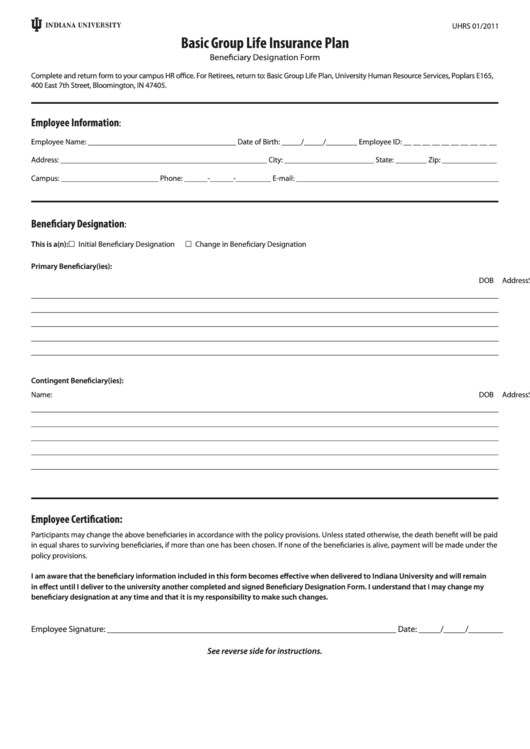

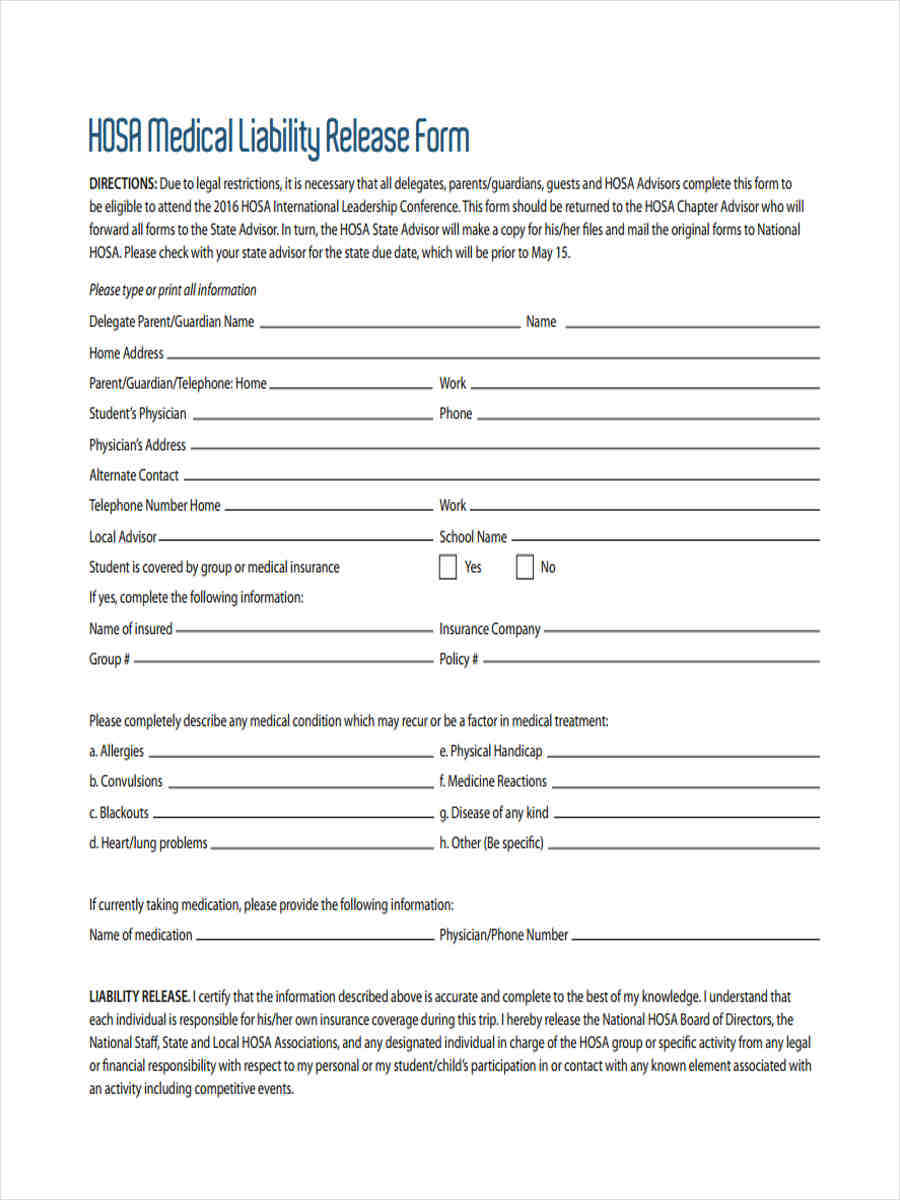

Source: sampletemplates.com

Source: sampletemplates.com

By paying money every month for it, you receive the peace of mind that if something goes wrong, the insurance company will pay for the things you need to make life like it was before your loss. Basic form is the most restrictive, while special offers the greater level of protection. We have several home insurance forms, and the form best suited to your needs will be offered by the agent at the time of submission. Employers that offer basic life insurance generally provide policies with a specific death benefit amount, which is usually set as either a. The following is an explanation of the basic principles for each:

Source: pinterest.com

Source: pinterest.com

Basic form ( cp1010 ), broad form ( cp1020 ), and special form ( cp1030 ). Explosion, including the explosion of gases or fuel within the furnace of any fired vessel or within the flues or passages through which the gases of combustion pass. The right to insure arising out of a financial relationship, between the insured to the insured and legally recognized. Starting with the basic form of insurance coverage, a policy that offers basic peril coverage is only going to cover the insured for named perils. In the world of insurance, there are six basic principles or forms of insurance coverage that must be fulfilled, including utmost good faith, insurable interest, indemnity, proximate cause (proximal cause), subrogation (transfer of rights or guardianship), and contribution.

Source: sampletemplates.com

Source: sampletemplates.com

Weight of snow, ice, or sleet; You�re on your own for any losses that aren�t specifically named. That is, special form policies include coverage for direct loss from all. Special form policies are the most inclusive and read differently than basic and broad form. Starting with the basic form of insurance coverage, a policy that offers basic peril coverage is only going to cover the insured for named perils.

Source: roberthempsall.co.uk

Source: roberthempsall.co.uk

What makes it a basic policy is that it is simple in the fact that you pay for a specific amount of coverage for a certain amount of time. Basic form policies only include coverage for the specifically named perils. What this equates to that if a coverage is not specifically listed, or named, in the insurance policy, there is no coverage. Employers that offer basic life insurance generally provide policies with a specific death benefit amount, which is usually set as either a. Typically, the insurer lists the perils on your policy.

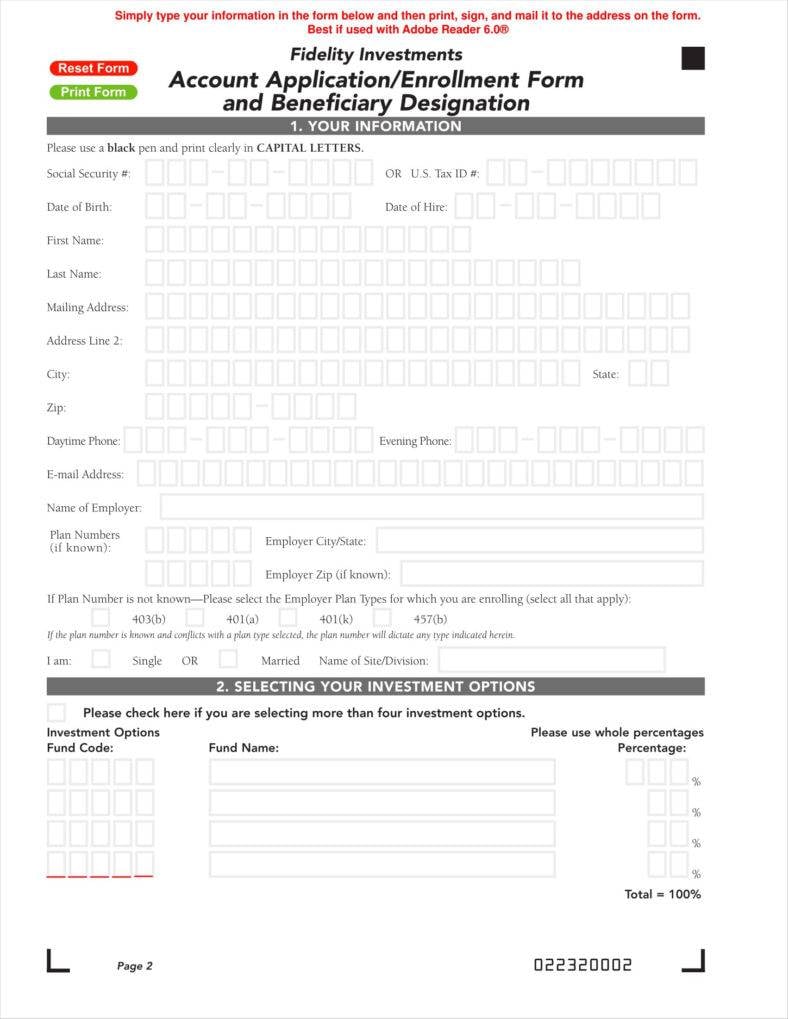

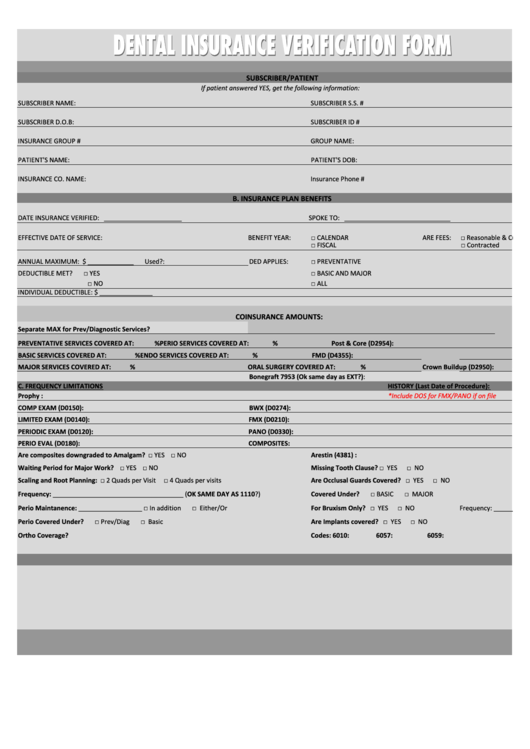

Source: formsbank.com

Source: formsbank.com

The basic form is a “named perils” policy (that is, the policy explicitly names what perils are covered) and covers losses due to: Starting with the basic form of insurance coverage, a policy that offers basic peril coverage is only going to cover the insured for named perils. The basic and broad causes of loss forms are named perils forms; That is, special form policies include coverage for direct loss from all. They provide coverage for loss from only the particular causes that are listed in the policy as covered.

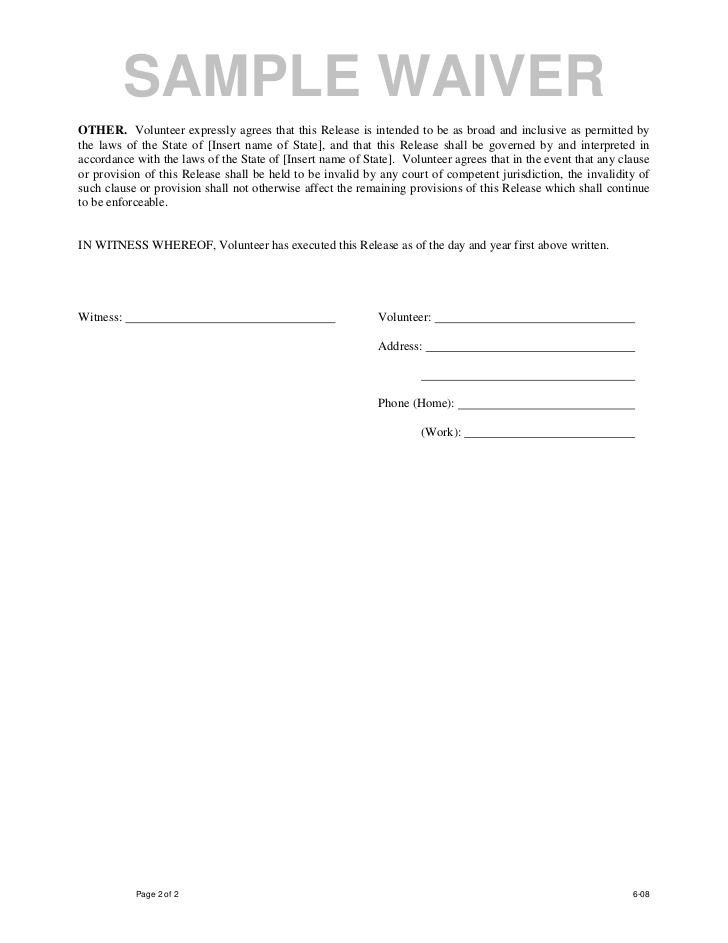

Source: printablelegaldoc.com

Source: printablelegaldoc.com

It is critical that a policyholder understands the property insurance cause of loss form attached to their policy and what coverage is provided. Starting with the basic form of insurance coverage, a policy that offers basic peril coverage is only going to cover the insured for named perils. These policies will also have a guaranteed level premium, and your coverage amounts. By paying money every month for it, you receive the peace of mind that if something goes wrong, the insurance company will pay for the things you need to make life like it was before your loss. Broad form incorporates basic form insurance and includes coverage for other perils.

Source: ibrizz.com

Source: ibrizz.com

That is, special form policies include coverage for direct loss from all. In the insurance world there are six basic principles that must be met, ie insurable interest, utmost good faith, proximate cause, indemnity, subrogation and contribution. The special causes of loss form is an all risks form; The basic form is a “named perils” policy (that is, the policy explicitly names what perils are covered) and covers losses due to: More of these term policies combined are sold than any other type of term life insurance.

Source: roberthempsall.co.uk

Source: roberthempsall.co.uk

The following is an explanation of the basic principles for each: It provides coverage for loss from any cause except those that are. That is, special form policies include coverage for direct loss from all. So, if it’s not listed, it’s not covered. The right to insure arising out of a financial relationship, between the insured to the insured and legally recognized.

Source: sampleforms.com

Source: sampleforms.com

A basic form policy that typically covers fire, explosions, storms, smoke, riots, vandalism, and sprinkler leaks. So, if it’s not listed, it’s not covered. You�re on your own for any losses that aren�t specifically named. Basic form covers these 11 “perils” or causes of loss: It is critical that a policyholder understands the property insurance cause of loss form attached to their policy and what coverage is provided.

Source: formsbank.com

Source: formsbank.com

Broad form incorporates basic form insurance and includes coverage for other perils. What makes it a basic policy is that it is simple in the fact that you pay for a specific amount of coverage for a certain amount of time. Covered causes of loss when basic is shown in the declarations, covered causes of loss means the following: A broad form policy that adds more coverage, such as damage from broken windows. It provides coverage for loss from any cause except those that are.

Source: pinterest.com

Source: pinterest.com

Starting with the basic form of insurance coverage, a policy that offers basic peril coverage is only going to cover the insured for named perils. These policies will also have a guaranteed level premium, and your coverage amounts. Insurance companies are applying the principles of insurance. Basic form is the most restrictive, while special offers the greater level of protection. What makes it a basic policy is that it is simple in the fact that you pay for a specific amount of coverage for a certain amount of time.

Source: ibc.ca

By paying money every month for it, you receive the peace of mind that if something goes wrong, the insurance company will pay for the things you need to make life like it was before your loss. So, if it’s not listed, it’s not covered. They provide coverage for loss from only the particular causes that are listed in the policy as covered. The special causes of loss form is an all risks form; Basic life coverage can be seen as the purest form of a life policy, and that is a traditional term life insurance policy.

Source: sampletemplates.com

Source: sampletemplates.com

Explosion, including the explosion of gases or fuel within the furnace of any fired vessel or within the flues or passages through which the gases of combustion pass. You�re on your own for any losses that aren�t specifically named. Basic form is the most restrictive, while special offers the greater level of protection. This form may be changed during the term or at your renewal, depending on your changing needs and situation. In the insurance world there are six basic principles that must be met, ie insurable interest, utmost good faith, proximate cause, indemnity, subrogation and contribution.

Source: 4allcontracts.com

Fire or lightning, smoke, windstorm or hail, explosion, riot or civil commotion, aircraft (striking the property),. By paying money every month for it, you receive the peace of mind that if something goes wrong, the insurance company will pay for the things you need to make life like it was before your loss. This is not only limited to opening accounts as you might need to provide forms for applying for insurance, for which you can use insurance basic application form templates. Basic life coverage can be seen as the purest form of a life policy, and that is a traditional term life insurance policy. In the insurance world there are six basic principles that must be met, ie insurable interest, utmost good faith, proximate cause, indemnity, subrogation and contribution.

Source: signnow.com

Source: signnow.com

Broad form incorporates basic form insurance and includes coverage for other perils. Weight of snow, ice, or sleet; So, if it’s not listed, it’s not covered. Basic form ( cp1010 ), broad form ( cp1020 ), and special form ( cp1030 ). Fire or lightning, smoke, windstorm or hail, explosion, riot or civil commotion, aircraft (striking the property),.

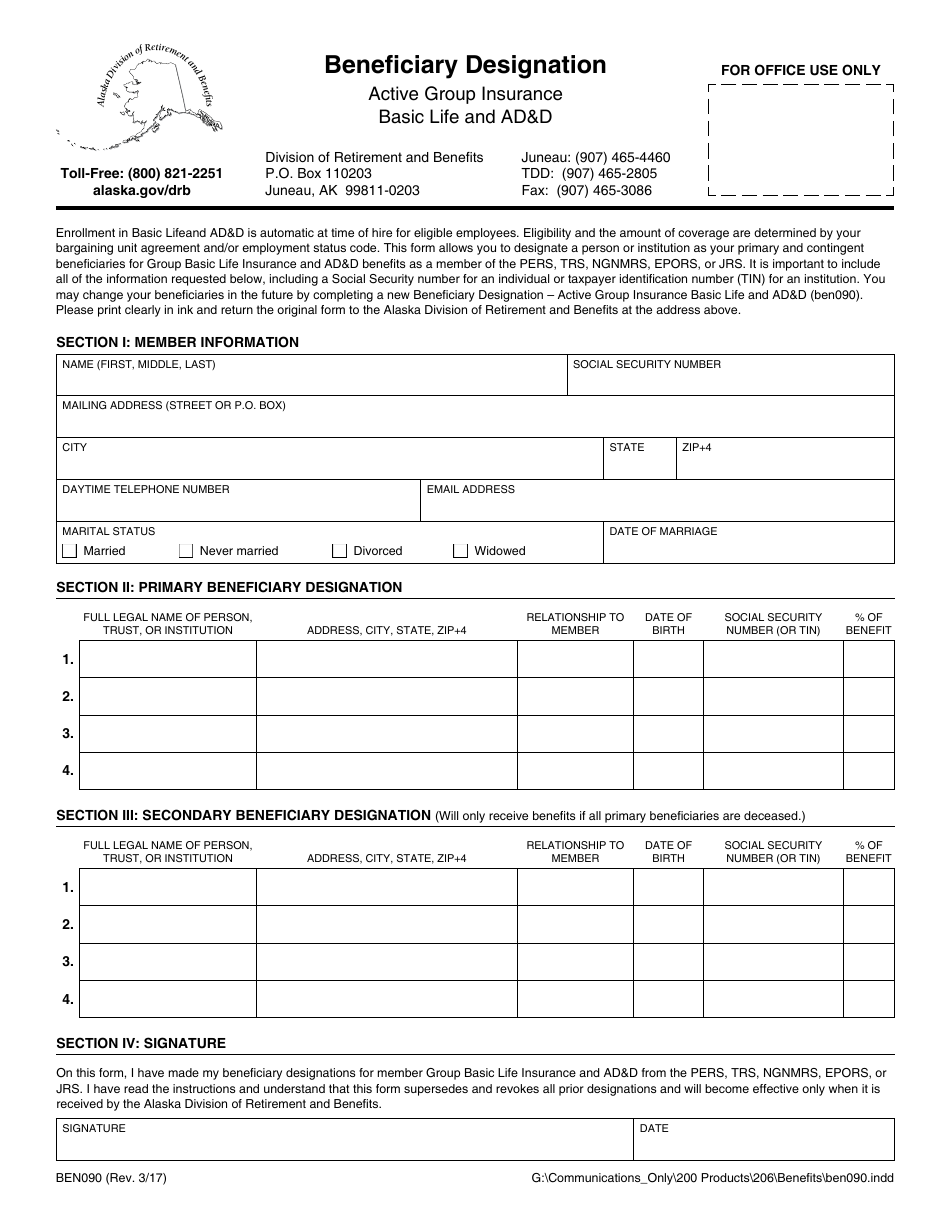

Source: templateroller.com

Source: templateroller.com

What this equates to that if a coverage is not specifically listed, or named, in the insurance policy, there is no coverage. A basic form policy that typically covers fire, explosions, storms, smoke, riots, vandalism, and sprinkler leaks. More of these term policies combined are sold than any other type of term life insurance. Basic life coverage can be seen as the purest form of a life policy, and that is a traditional term life insurance policy. In the insurance world there are six basic principles that must be met, ie insurable interest, utmost good faith, proximate cause, indemnity, subrogation and contribution.

Source: pinterest.ca

Source: pinterest.ca

Fire or lightning, smoke, windstorm or hail, explosion, riot or civil commotion, aircraft (striking the property),. We have several home insurance forms, and the form best suited to your needs will be offered by the agent at the time of submission. The following is an explanation of the basic principles for each: There are 3 forms in common use: At its core, the concept of insurance is very basic.

Source: newyorkmotorinsurance.com

Source: newyorkmotorinsurance.com

What this equates to that if a coverage is not specifically listed, or named, in the insurance policy, there is no coverage. Basic form is the most restrictive, while special offers the greater level of protection. In the world of insurance, there are six basic principles or forms of insurance coverage that must be fulfilled, including utmost good faith, insurable interest, indemnity, proximate cause (proximal cause), subrogation (transfer of rights or guardianship), and contribution. Employers that offer basic life insurance generally provide policies with a specific death benefit amount, which is usually set as either a. That is, special form policies include coverage for direct loss from all.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title basic form insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.