Recommended Average renters insurance cost bc Review

Home » Health Insurance » Recommended Average renters insurance cost bc ReviewYour Average renters insurance cost bc premium are available. Average renters insurance cost bc are a health that is most popular and liked by everyone this time. You can Get the Average renters insurance cost bc files here. Download all royalty-free fire.

If you’re searching for average renters insurance cost bc images information connected with to the average renters insurance cost bc topic, you have pay a visit to the right blog. Our website frequently provides you with hints for refferencing the highest quality video and picture content, please kindly hunt and find more enlightening video content and graphics that match your interests.

Average Renters Insurance Cost Bc. Plus, we’ve got you covered with the best roadside assistance. Get a free online tenant insurance quote in 5 minutes from square one. As for owned property, british columbia is clearly the priciest province, where home owners need to put down here the highest amount in canada: The average cost of renters insurance.

Notable News of the Week April 5, 2013 Ratehub.ca From ratehub.ca

Notable News of the Week April 5, 2013 Ratehub.ca From ratehub.ca

You can get tenant insurance from just about any insurance provider, so it’s a good idea to talk to one or more brokers about policy options, premiums, and more. Covered (while away from home temporarily) property in your vehicle opens in new window. (value penguin) why the difference? How much does tenants insurance cost in bc? Depending on the coverages you select and the number of possessions you own, a typical tenants insurance policy can start as low as $20/month. Liability coverage opens in new window.

Covered for up to 40% of contents coverage.

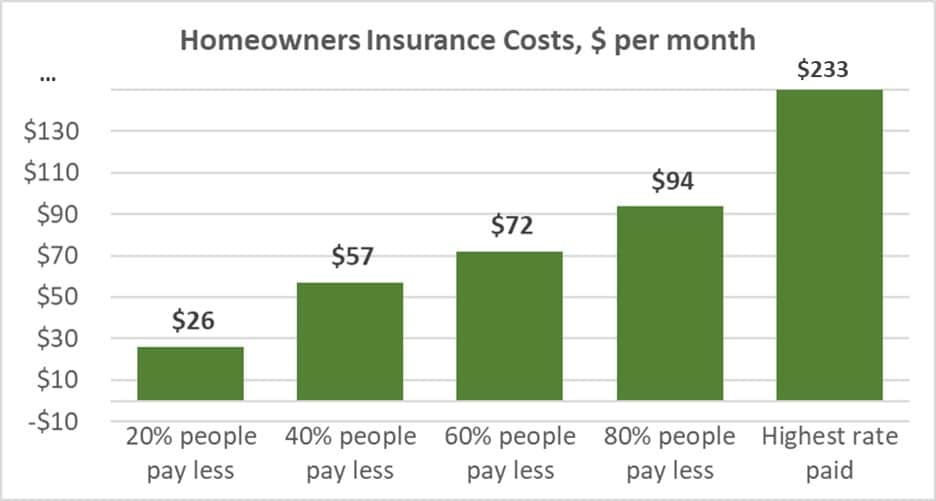

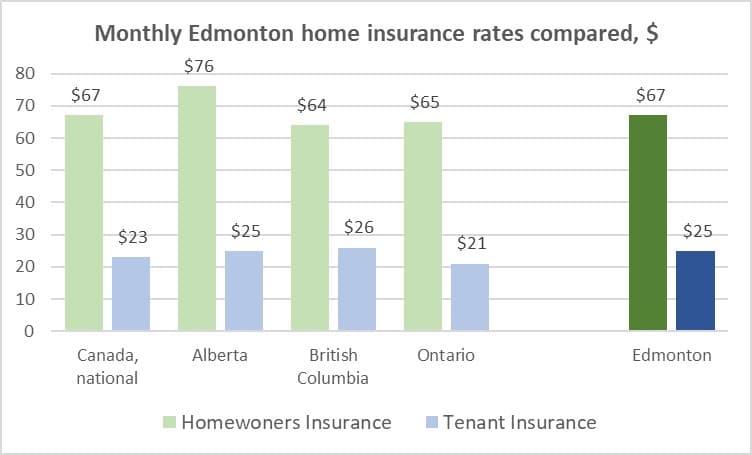

Tenant insurance rates will vary from one city or town to the next in british columbia. Plus, we’ve got you covered with the best roadside assistance. Bc tenant insurance come in on the higher end at $26 per month, while renters insurance in ontario is on the lower end at $21 per month. The average cost of renters insurance is $326 a year, or about $27 a month. No simple solutions to skyrocketing condo insurance costs, report finds. Liability coverage opens in new window.

Source: ratehub.ca

Source: ratehub.ca

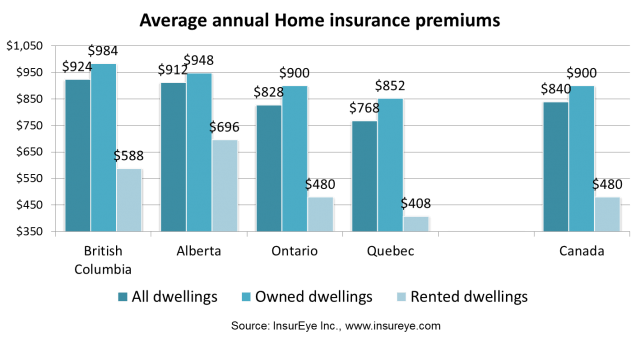

For renters insurance, the average cost is $564 per year or $47 per month. Why bc home insurance so expensive? The average price of homeowners insurance in british columbia is $1,020 per year or $85 per month. Pulling from our experience in bc, we’ve put together examples of monthly rental property insurance prices that we see most often. With $30,000 in contents, the average premium typically ranges between $300 and $400, or about $25 to $35 dollars a month.

Source: insureye.com

Source: insureye.com

Covered (while away from home temporarily) property in your vehicle opens in new window. On average, canadians pay $23 per month in tenant insurance. (value penguin) why the difference? Most of our companies have a minimum that they will insure, which is usually around $40,000. No simple solutions to skyrocketing condo insurance costs, report finds.

Source: cottonbitts.blogspot.com

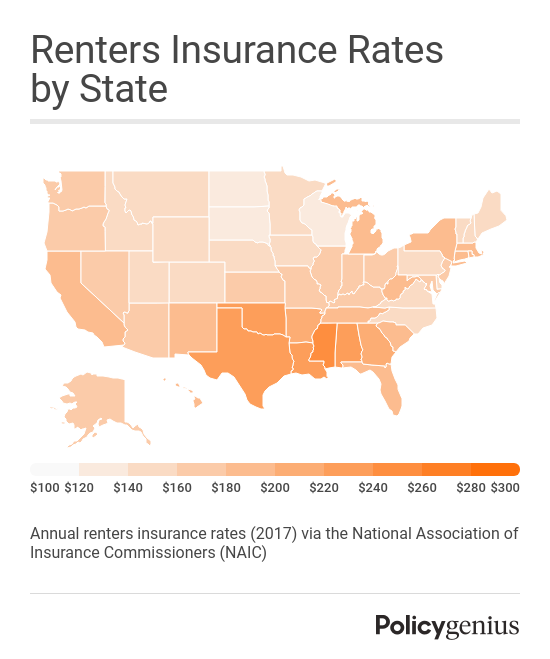

Additional living expenses opens in new window. Most of our companies have a minimum that they will insure, which is usually around $40,000. For example, the cheapest state for renters to buy insurance is north dakota, at only $9.58 per month. Get a free online tenant insurance quote in 5 minutes from square one. In general, tenant insurance is affordable but can go up if you have additional protection needs that require extended coverage.

Source: lovewordssss.blogspot.com

Source: lovewordssss.blogspot.com

In general, tenant insurance is affordable but can go up if you have additional protection needs that require extended coverage. With $30,000 in contents, the average premium typically ranges between $300 and $400, or about $25 to $35 dollars a month. For renters insurance, the average cost is $564 per year or $47 per month. Get a free online tenant insurance quote in 5 minutes from square one. As for owned property, british columbia is clearly the priciest province, where home owners need to put down here the highest amount in canada:

Source: economical.com

And there’s one other crucial difference: This led us to take a closer look at the states where renters. In british columbia, each insurance policy starts with a base premium. Plus, we’ve got you covered with the best roadside assistance. What is the average cost of renters insurance?

Source: pinterest.com

Source: pinterest.com

Why bc home insurance so expensive? Get a free online tenant insurance quote in 5 minutes from square one. How much does tenants insurance cost in bc? The cost of tenant insurance in canada will vary depending on the value of your belongings and where you live. Tenant insurance rates will vary from one city or town to the next in british columbia.

Source: weqmra.com

Source: weqmra.com

This led us to take a closer look at the states where renters. $984 per year, compared with $948 in alberta, $900 in ontario and $852 in quebec. (value penguin) why the difference? Covered for up to 100% of contents coverage. Check average bc home insurance rates.

Source: franciellysa.blogspot.com

In many situations, the cost of tenant insurance is far lower than people expect. Tenant insurance isn’t expensive, and for around $20 a month, you can have peace of mind knowing you and your possessions are safe from damage, theft, and lawsuits. (value penguin) why the difference? The average cost of renters insurance. Furthermore, if you choose to purchase additional coverage for high value items, this will also increase the cost of your policy.

Source: valuepenguin.com

Source: valuepenguin.com

Tenant insurance rates will vary from one city or town to the next in british columbia. Pulling from our experience in bc, we’ve put together examples of monthly tenant insurance prices that we see most often. What is the average cost of renters insurance? Plus, we’ve got you covered with the best roadside assistance. This led us to take a closer look at the states where renters.

Source: houseinforme.blogspot.com

By contrast, car insurance companies are allowed to base rates on this criteria in ontario and alberta. Get a home insurance quote from 15+ insurers. (value penguin) why the difference? Tenant insurance isn’t expensive, and for around $20 a month, you can have peace of mind knowing you and your possessions are safe from damage, theft, and lawsuits. The average across all of canada is about $74 per month for homeowners insurance and $41 per month for renters insurance.

Source: insureye.com

Source: insureye.com

How much does tenants insurance cost in bc? Many factors including the cost of your stuff and risks associated with where you live will determine your price. Furthermore, if you choose to purchase additional coverage for high value items, this will also increase the cost of your policy. For example, the cheapest state for renters to buy insurance is north dakota, at only $9.58 per month. Covered for up to 100% of contents coverage.

Source: imbillionaire.net

Source: imbillionaire.net

With $30,000 in contents, the average premium typically ranges between $300 and $400, or about $25 to $35 dollars a month. As for owned property, british columbia is clearly the priciest province, where home owners need to put down here the highest amount in canada: Furthermore, if you choose to purchase additional coverage for high value items, this will also increase the cost of your policy. $984 per year, compared with $948 in alberta, $900 in ontario and $852 in quebec. For renters insurance, the average cost is $564 per year or $47 per month.

Source: bridgeportbenedumfestival.com

Source: bridgeportbenedumfestival.com

Depending on your state, an average policy could cost twice what you would pay for the same coverage elsewhere. If your belongings are damaged due to an incident on your rental property, tenant insurance may help with repair or replacement costs. How much does tenants insurance cost in bc? Check average bc home insurance rates. Depending on your state, an average policy could cost twice what you would pay for the same coverage elsewhere.

Source: pinterest.com

Source: pinterest.com

The price of renters insurance can vary significantly, depending on your apartment’s location, condition of your building, deductible, and the amount of coverage you. Pulling from our experience in bc, we’ve put together examples of monthly rental property insurance prices that we see most often. Using our website, you can get a quote, purchase, and manage your policy online. You can get tenant insurance from just about any insurance provider, so it’s a good idea to talk to one or more brokers about policy options, premiums, and more. Tenant insurance rates will vary from one city or town to the next in british columbia.

Source: cladasia.com

Source: cladasia.com

What is the average cost of renters insurance? Tenants insurance is among the most affordable and simple insurance products in vancouver and the rest of the bc marketplace. Plus, we’ve got you covered with the best roadside assistance. Check average bc home insurance rates. Insurance companies will use rate tables to create the price for home insurance within territories based on experience ratings, exposure to risk, claims data, etc.

Source: insureye.com

Source: insureye.com

Our online landlord insurance product is one of the most competitive ones in the industry. How much does tenants insurance cost in bc? As for owned property, british columbia is clearly the priciest province, where home owners need to put down here the highest amount in canada: Bc tenant insurance come in on the higher end at $26 per month, while renters insurance in ontario is on the lower end at $21 per month. The base premium for basic insurance is $1,063 (as of april 2019).

Source: kenyachambermines.com

Source: kenyachambermines.com

Many factors including the cost of your stuff and risks associated with where you live will determine your price. The average cost of renters insurance is $326 a year, or about $27 a month. Always compare renters insurance quotes before you purchase to make sure you get the best rate. By contrast, car insurance companies are allowed to base rates on this criteria in ontario and alberta. How much does tenants insurance cost in bc?

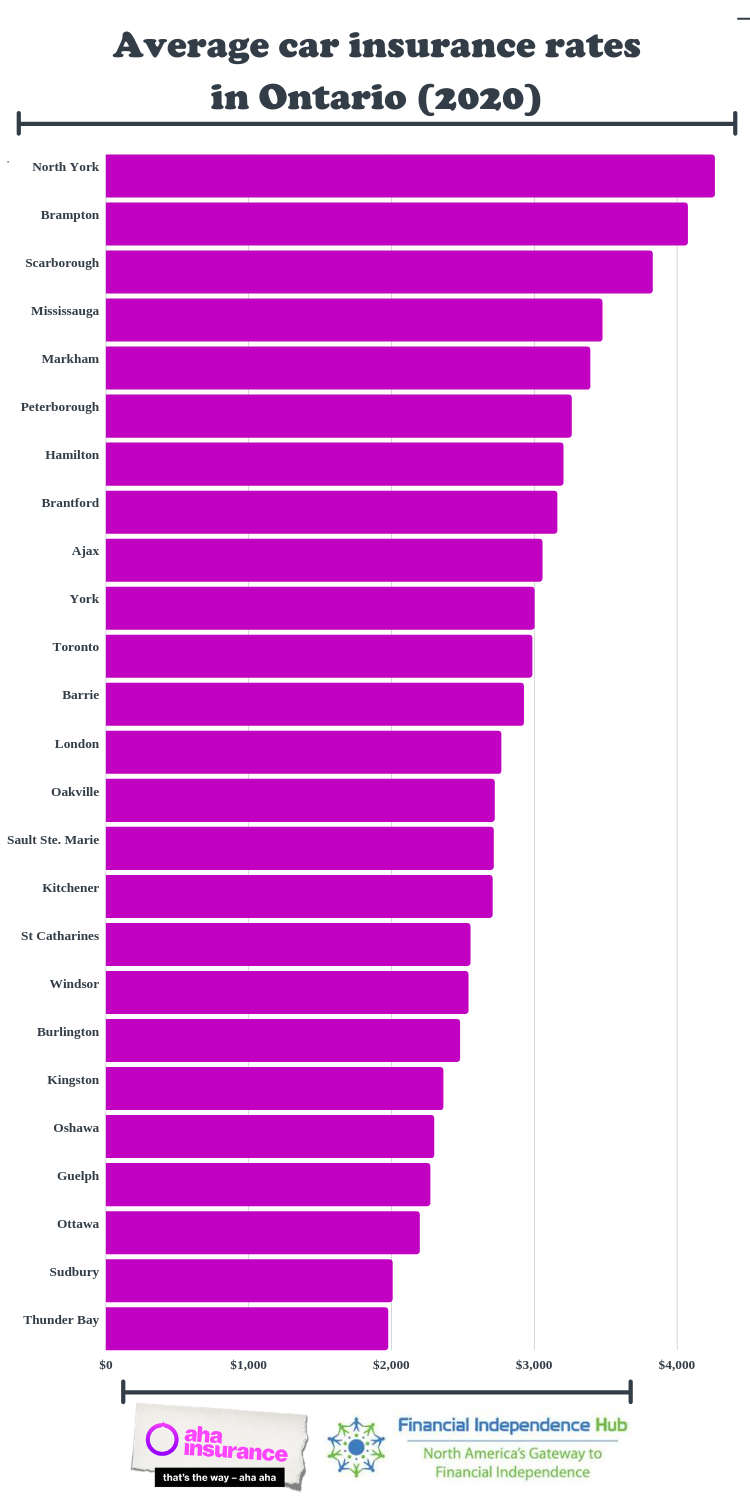

Source: findependencehub.com

Source: findependencehub.com

One person’s 800 sq ft. Insurance companies will use rate tables to create the price for home insurance within territories based on experience ratings, exposure to risk, claims data, etc. Insurance companies will use rate tables to create the price for home insurance within territories based on experience ratings, exposure to risk, claims data, etc. What is the average cost of renters insurance? There is no average for contents coverage.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title average renters insurance cost bc by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.